Volvo 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The positive sales trend continued In South

America, parts of Asia including the Middle

East and on other international markets for

most part of the year. Following a strong fi rst

six months, the downturn in Europe was more

rapid than previously expected, aggravated by

the fi nancial crisis. In North America demand

weakened further compared with the already

low levels of the preceeding year. Towards

year-end almost all markets were affected by

the fi nancial crisis and the global economic

downturn.

Operating income decreased

In 2008, operating income for the Volvo

Group’s Industrial Operations amounted to

SEK 14,454 M, which was 30% lower than in

2007. The operating margin for the Industrial

Operations amounted to 4.9% (7.4).

In North America profi tability decreased

considerably due to weaker demand and a

lower level of deliveries of trucks and con-

struction equipment in combination with low

capacity utilization and low productivity in the

industrial system.

In 2008, there was a signifi cant negative

impact from cost infl ation relating to higher

costs for raw materials and components, esti-

mated at approximately SEK 2.2 billion com-

pared with 2007, of which the majority

impacted Construction Equipment. The

increased purchasing costs haven’t been fully

compensated by increased prices on the

Group’s products.

As a consequence of rapidly weakening

demand primarily in Europe, deliveries of prod-

ucts decreased in the third and fourth quar-

ters. In order to adjust to market demand, pro-

duction rates have been reduced with lower

capacity utilization as a result. Staffi ng levels

in Europe are being lowered and operating

expenses reduced to meet lower demand.

Production rates have been reduced at a

more rapid pace than the adaptation of the

cost structure within manufacturing. This

resulted in under-absorption of costs. The cost

structure will gradually be adapted to the lower

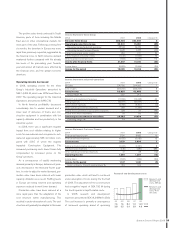

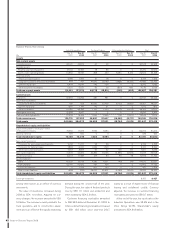

Income Statement Volvo Group

SEK M 2007 2008 Change in %

Net sales Volvo Group 285,405 303,667 6

Operating Income Volvo Group 22,231 15,851 (29)

Operating income Industrial operations 20,583 14,454 (30)

Operating income Customer Finance 1,649 1,397 (15)

Interest income and similar credits 952 1,171 23

Interest expense and similar credits (1,122) (1,935) 72

Other fi nancial income and costs (504) (1,077) 114

Income after fi nancial items 21,557 14,010 (35)

Income taxes (6,529) (3,994) (39)

Income for the period 15,028 10,016 (33)

Income Statement Industrial operations

SEK M 2007 2008 Change in %

Net sales 276,795 294,932 7

Cost of sales (214,160) (232,247) 8

Gross income 62,635 62,685 0

Gross margin, % 22.6 21.3

Research and development expenses (11,059) (14,348) 30

Selling expenses (24,671) (25,597) 4

Administrative expenses (7,092) (6,921) (2)

Other operating income and expenses 249 (1,457) –

Income from investments in associated companies 428 23 (95)

Income from other investments 93 69 (26)

Operating income Industrial operations 20,583 14,454 (30)

Operating margin, % 7.4 4.9

Income Statement Customer Finance

SEK M 2007 2008 Change in %

Finance and lease income 7,705 8,485 10

Finance and lease expenses (4,535) (5,082) 12

Gross income 3,170 3,403 7

Selling and administrative expenses (1,437) (1,551) 8

Credit provision expenses (125) (483) 286

Other operating income and expenses 41 28 (32)

Operating income 1,649 1,397 (15)

Income taxes (502) (356) (29)

Income for the period 1,147 1,041 (9)

Return on Equity, 12 month moving values, % 15.9 12.6

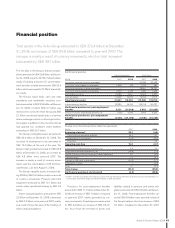

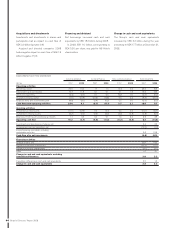

Research and development costs

0807060504

14.311.18.47.67.6

4.93.93.43.33.8

Research and

development

costs, SEK bn

Research and

development

costs, % of

net sales

production rates which will lead to continued

under absorption of costs during the fi rst half

of 2009. The adjustment of the cost structure

had a negative impact of SEK 750 M during

the fourth quarter in layoff-related costs.

In 2008, research and development

expenses amounted to SEK 14,348 M (11,059).

The cost increase is primarily a consequence

of increased spending ahead of upcoming

39

Board of Directors’ Report 2008