Volvo 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

emission regulations in Europe, USA and

Japan in 2009 and 2010 as well as spending

on projects for the launch of diesel-electric

hybrids the next few years. The net of research

and development expense capitalization and

amortization had a negative impact of SEK

800 M compared with a negative impact of

SEK 400 M in 2007.

Impact of exchange rates on operating

income

The combined effect of changed exchange

rates, particularly for the USD, had an adverse

effect on operating income of approximately

SEK 900 M in 2008, compared with 2007.

The main reason is that the USD was weak

during most of 2008.

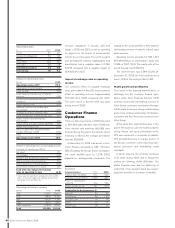

Customer Finance

Operations

Total new fi nancing volume in 2008 amounted

to SEK 44.5 billion (41.4). In total, 47,986 new

Volvo vehicles and machines (46,686) were

fi nanced during the year. In the markets where

fi nancing is offered, the average penetration

rate was 25% (24).

At December 31, 2008 total assets in Cus-

tomer Finance amounted to SEK 118 billion

(95). Excluding the Nissan diesel receivables,

the credit portfolio grew by 12.7% (12.6),

adjusted for exchange-rate movements. The

funding of the credit portfolio is fully matched

with lending in terms of maturity, interest rates

and currencies.

Operating income amounted to SEK 1,397

M (1,649). Return on shareholders’ equity was

12.6% in 2007 (15.9). The equity ratio at the

end of the year was 8.2% (8.1).

The write-off ratio was 0.54% (0.29). On

December 31, 2008, the total credit reserves

were 1.37% of the credit portfolio (1.59).

Stable growth and profi tability

The turmoil in the fi nancial markets poses a

challenge, but the customer fi nance oper-

ations within Volvo Financial Services (VFS)

continues to provide vital fi nancial services to

Volvo Group customers and dealers through-

out the world, focusing on strong credit discipline

and a close working relationship with dealers,

customers and the other business areas in the

Volvo Group.

At the same time, opportunities arise in this

part of the business cycle. As evidenced by the

strong volume and good penetration levels,

VFS was successful in a number of markets.

VFS provided fi nancing to a larger portion of

the Group’s customers while improving oper-

ational processes and maintaining credit

standards.

In North America, the economy continued

to be weak during 2008, and in Europe the

markes are showing similar diffi culties. The

global fi nancial crisis and the tightening of

credit that it has brought about has exacer-

bated the downturn in a number of markets.

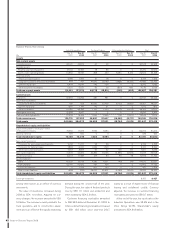

Operating margin

% 2007 2008

Trucks 8.1 6.0

Construction Equipment 7.9 3.2

Buses 1.4 (0.4)

Volvo Penta 10.0 8.1

Volvo Aero 6.9 4.8

Industrial operations 7.4 4.9

Volvo Group 7.8 5.2

Operating net fl ow per currency

SEK M 2007 2008

USD 19,000 23,600

EUR 17,800 15,700

GBP 8,700 7,700

CAD 2,000 1,900

Other currencies 15,800 12,200

Total 63,300 61,100

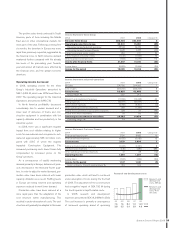

Change in operating income

SEK bn 2008

Operating income 2007 22.2

Improvement of gross margins 4.5

Lower volumes (0.6)

Lower capacity utilization, lay-off related

costs etc. (3.9)

Income from acquired and divested

operations (0.4)

Higher warranty costs (0.6)

Additional provisions for residual value

commitments (0.6)

Changes in currency exchange rates (0.9)

Lower capitalization of development costs (0.1)

Higher research and development

expenditures (2.0)

Higher selling and administrative expenses (0.2)

Higher restructuring costs (0.5)

Gain on sale of Petro Stopping Centers

and Sörred Energi in 2007 (0.5)

Other (0.5)

Operating income 2008 15.9

Impact of exchange rates on operating income

Compared with preceding year, SEK bn

Net sales12.5

Cost of sales (2.4)

Research and development expenses 0.0

Selling and administrative expenses (0.1)

Other operating income and expenses (0.9)

Income from investments in shares 0.0

Total effect of changes in exchange

rates on operating income (0.9)

1 Group sales are reported at average spot rates and the

effects of currency hedges are reported among “Other

operating income and expenses”.

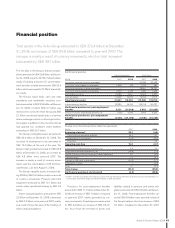

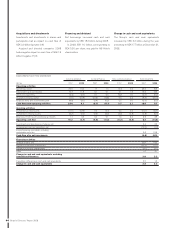

Key ratios

Financial Services 2007 2008

Credit portfolio net, SEK bn 91.1 112.3

Operating income, SEK M 1,649 1,397

Return on shareholders’

equity, % 15.9 12.6

Market penetration, % 24.1 24.9

Penetration by business area, %

Volvo CE 34 36

Volvo Trucks 29 29

Renualt Trucks 16 18

Buses 13 14

Mack Trucks 18 16

40 Board of Directors’ Report 2008