Volvo 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

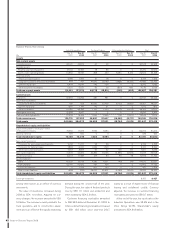

Cash-fl ow statement

Operating cash fl ow in the Industrial Operations decreased to a negative SEK

2.7 billion (positive 15.2). The decreased cash fl ow was mainly due to higher

working capital and lower earnings.

Cash fl ow

During 2008, the Industrial operations’ oper-

ating cash fl ow amounted to negative SEK 2.7

billion compared to positive SEK 15.2 billion

2007. The negative development during 2008

was mainly related to the lower operating

income, increased investments in fi xed assets

and an increase of the working capital. The

increase is mainly an effect of lower pace in

production and higher levels of inventories. In

order to reduce the capital tied-up in inventory,

a number of shutdown days in production were

carried out during the end of year. Measures

aimed at selling primarily trucks and construc-

tion equipment in inventory were prioritized.

These measures have continued during the

beginning of 2009.

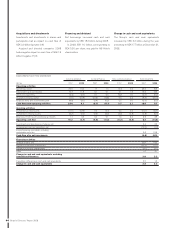

Investments

The industrial operations’ investments in fi xed

assets including capitalized development

costs during 2008 amounted to SEK 12.6 bil-

lion (10.1).

Capital expenditures in Trucks amounted to

SEK 8.3 billion (5.3). The capital expenditures

within Trucks consist of investments in cab

plants, assembly in Umeå, Sweden, as well

assembly and painting in Blainville, France,

aiming for increased capacity, productivity and

fl exibility. There are also signifi cant invest-

ments in manufacturing of engines and gear-

boxes, mainly in Köping and Skövde, Sweden,

in order to meet long term capacity needs. The

new assembly facility for trucks in Russia has

been completed during the year and the

expansion of dealer network and workshops,

mainly in Europe, has continued during 2008.

Product related investments refer to Euro V

and US10 emission standards as well as the

introduction of the new range of Volvo trucks

and other renewals in the product program.

Capital investments for Construction Equip-

ment decreased to SEK 2.0 billion from SEK

2.6 billion previous year. The main part of the

investments refers to productivity and capacity

increases in manufacturing for the articulated

haulers and excavator business as well as

within the axle and transmission production. It

also includes a new paint shop for the cab pro-

duction in Hallsberg, Sweden. Product related

investments during the year refer mainly to the

new L45F and L50F wheel loaders as well as

the expansion of the C-series and short swing

excavator range.

The investments made within Volvo Aero

was reduced to SEK 0.9 billion from SEK 1.0

billion last year. The main part of the invest-

ments refers to phase two of the new GEnx

engine in cooperation with General Electric

together with investments in production facili-

ties in order to secure the capacity required for

the GEnx program.

The investments in Buses were SEK 0.2 bil-

lion (0.3) and relate mainly to various product

related investments as US07 engine installation

in the Volvo 9700 Coach for the US market.

The level of investments in Volvo Penta

remained at a level of SEK 0.4 billion and con-

sist mainly of capacity increasing investments

in the Vara plant in Sweden and product

project related investments in tooling and

other development activities.

For 2009 the forecast for investments in

property, plant and equipment amount to SEK

7–8 billion, which is a decrease compared to

2008. However, in the process of planning the

investments for the coming years the Group is,

due to the current market situation, also re-

prioritizing and reviewing already approved

investments.

Investments in leasing assets amounted to

SEK 0.4 billion (0.2).

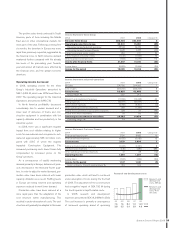

Capital expenditures, Industrial operations Self-fi nancing ratio, Industrial operations, %

Capitalized development costs, SEK bn

Capital expenditures, % of net sales

08070605

2.12.12.93.01.7

4.33.63.94.33.6

10.58.06.86.95.5

Property, plant and equipment,

SEK bn

04

Cash-flow from

operating activities

divided by net

investments in fixed

assets and leasing

assets.

0807060504

78265235173268

43

Board of Directors’ Report 2008