Volvo 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lower earnings

Over the short term, rapid implementation of

production cutbacks has a negative impact on

operating income, due to a time-lag for adjust-

ment of the cost structure. This strongly

impacted earnings during the second half of

the year in general and the fourth quarter in

particular. We will also continue to feel the

effects during the fi rst half of 2009.

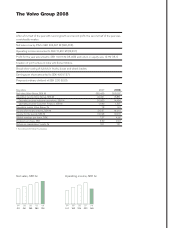

Driven by the market’s strong growth during

the fi rst half of the year, sales increased 6%

during 2008 to SEK 304 billion. Operating

income declined nearly 30%, but we were still

able to report earnings of nearly SEK 16 bil-

lion. Underutilization in the production plants

and reduced deliveries during the second half

of 2008, combined with continued high costs

for raw materials and parts, had a negative

impact on earnings.

Investments in the future

We also continued our investments in future

products, as refl ected by the fact that we

invested SEK 14 billion in research and devel-

opment, an increase by slightly more than SEK

3 billion compared with the preceding year.

Investments in R&D are planned to remain at a

relatively high level. We invest substantial

amounts of money in the development of

hybrids within trucks and buses as well as con-

struction equipment and new, competitive

trucks, buses and construction equipment with

new, cleaner engines that meet new emission

regulations that will become effective through-

out the world during the next few years.

We have also invested approximately SEK

10 billion in our factories in order to raise

capacity but above all to increase productivity

so that we can manufacture our products as

effi ciently as possible when we have come

through the current recession.

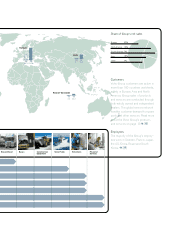

Diffi cult conditions in many markets

The truck market, which started the year at

record levels in most parts of the world outside

of North America and Japan, declined sharply

during the second half of the year in the

Group’s main markets in Europe, North Amer-

ica and Japan. Toward year-end, it was obvious

that all of our truck markets had been impacted

by the decline. I have been pleased to note,

however, that we increased our market share

in nearly all markets during 2008.

Under present market conditions, it is diffi -

cult to forecast development in the truck mar-

ket during 2009. We do not expect any recov-

ery in demand during the fi rst half of the year,

but with the approved and already imple-

mented internal actions that will gradually gen-

erate favorable effects during the fi rst half of

2009, we are prepared to cope with the diffi -

cult conditions.

Construction Equipment was impacted the

most by the rapid decline in the global econ-

omy, and the business area reported a sub-

stantial loss during the fourth quarter. The loss

was attributed to sharply lower sales combined

with underutilization in our production plants

and signifi cantly higher raw material costs.

The Construction Equipment business area is

now implementing measures that will gradually

adjust costs during the fi rst half of 2009 to the

lower level of demand.

For Buses, the coach market was weak, but

the city bus market continued to show stable

development supported by growing interest in

environmentally adapted vehicles, with particular

emphasis on hybrids. In October, we received

our fi rst order for city buses equipped with

hybrid drivelines.

For Volvo Penta, the market for marine

engines has declined sharply, while the market

for industrial engines remains relatively stable.

Volvo Penta has also implemented adjust-

ments in business operations and continues to

expand its industrial engine operations as part

of efforts to achieve better balance between

its segments.

Volvo Aero reached several important

engine agreements during the year that will

start to generate substantial long-term rev-

enues within the next few years. Sales and

profi tability declined during 2008, however,

and Volvo Aero has already started to prepare

for lower demand due to the general decline in

air travel throughout the world.

As expected, write-offs and credit provi-

sions for doubtful receivables in the customer

fi nancing portfolio of Volvo Financial Services

(VFS) increased in parallel with the weakening

economy, but they remain, nevertheless, at

relatively low levels. For full-year 2008, VFS

generated a 12.6% return on equity.

The Group has worked during recent years

to expand its aftermarket business consisting

of spare parts, used trucks, workshop services

and other supplementary services. We have

become better at supporting the business

activities of our customers throughout the

entire lifecycle of the products. During 2008,

this part of our operations accounted for about

26% of total sales. This provides several

advantages. The aftermarket business is much

more stable in its development than sales of

new vehicles and equipment. As long as our

customers’ trucks, buses, construction equip-

ment, boats and aircraft remain in operation,

they will continue to need service, spare parts

and many of the other services that we offer in

this area. Profi tability is also higher, and there-

fore the aftermarket is a prioritized area in

order to improve the Group’s profi tability over

the course of the business cycle.

Long-term growth and development

with focus on the environment

It is impossible to predict how long the present

level of weak demand will continue. I am con-

A global group 2008

4