Volvo 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Trucks

– signifi cant weakening in

all markets

The global market for heavy trucks continued

to grow during most of the year. In the fi rst

half of the year, demand remained strong in

Europe, parts of Asia and South America, but

the market weakened very sharply during

second half in the wake of a global recession

that was deepened by the crisis on fi nancial

markets. The North American market weak-

ened further from the already low level in

2007. The same trend was noted on the Jap-

anese market.

Total market

The total market for heavy trucks in 2008 in

the EU’s 27 countries plus Norway and Switzer-

land amounted to about 318,700 vehicles, a

decline of 3%. All truck manufacturers imple-

mented measures to adapt production to a

newer, much lower demand level. The total

European market for heavy trucks is projected

at 180,000 to 220,000 vehicles in 2009.

In the medium-heavy segment (10–15.9

tons) in Western Europe, the market decreased

by 18% to 29,200 trucks compared to 2007.

The continued weak development in the

North American economy affected the mar-

ket adversely. The total market declined 11%

to 184,900 trucks, compared with 208,000

trucks a year earlier. The North American mar-

ket in 2009 is expected to be characterized by

continued weak demand during the fi rst half of

the year and amount to 165,000-185,000

vehicles for the full year.

Although showing growth for the full year,

demand weakened sharply also in other mar-

kets during the second half of the year. In Bra-

zil, the total market rose 35% to 78,600 heavy

trucks. Among the major markets in Asia,

China rose the most with 11% to a record level

of about 550,000 trucks (>14 tons), compared

with 490,000 a year earlier. The market for

heavy trucks in India amounted to 159,600

vehicles in 2008 (193,000). The total market

for heavy trucks in Japan declined 18% to

34,900 vehicles (43,000). The Japanese mar-

ket for heavy and medium-heavy trucks is

expected to decline by 10–15% in 2009.

Market shares

During 2008, Volvo Trucks’ market share in

Europe for heavy trucks rose to 14.8% (14.6).

Renault Trucks’ market share in Europe

increased to 10.8% for heavy trucks (9.7). In

the medium-heavy truck segment (10–15.9

tons), Renault Trucks market share in Western

Europe was 15.1% (12.5) and Volvo Trucks’

6.7% (5.7).

Key ratios

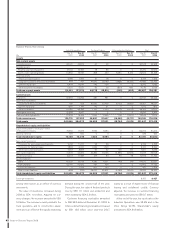

Trucks 2007 2008

Net sales as percentage

of Volvo Group's sales 66 67

Net sales, SEK bn 187.9 203.2

Operating income, SEK bn 15.2 12.2

Operating margin, % 8.1 6.0

Net sales by market

Trucks, SEK M 2007 2008

Europe 108,651 109,914

North America 27,255 26,588

South America 11,483 14,680

Asia 26,593 37,515

Other markets 13,910 14,538

Total 187,892 203,235

Deliveries by market

Trucks 2007 2008

Western Europe 100,106 95,969

Eastern Europe 27,964 25,878

North America 33,280 30,146

South America 15,264 18,092

Asia 39,916 60,725

Other markets 19,826 20,341

Total 236,356 251,151

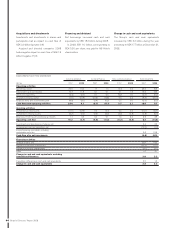

Market shares in Europe,

heavy trucks

Market shares in Europe,

medium-duty trucks

Market shares in North America,

heavy trucks

Market shares in Japan,

heavy trucks

08070807

10.8%9.7%14.8%14.6%

Volvo Trucks Renault Trucks

08070807

15.1%12.5%6.7%5.7%

Volvo Trucks Renault Trucks

08070807

7.3%7.3%8.9%9.3%

Mack Trucks Volvo Trucks

0807

22.6%21.6%

Nissan Diesel

Volvo Trucks’ market share in North America in

2008 declined to 8.9% (9.3), while Mack Trucks’

market share was unchanged at 7.3% (7.3).

In Japan, Nissan Diesel’s market share for

heavy trucks rose to 22.6% (21.6). Volvo’s

share of heavy trucks on the Brazilian market

declined to 12.9% (13.6).

In total, the Volvo Group is the world’s second

largest manufacturer of heavy trucks.

Business areas 2008

52