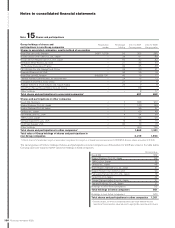

Volvo 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated fi nancial statements

104

THE VOLVO GROUP

Financial information 2008

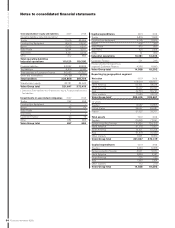

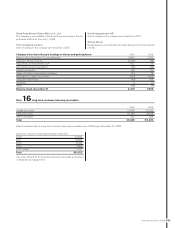

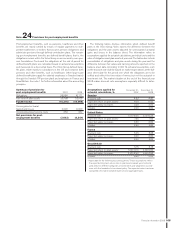

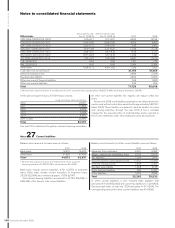

Information regarding shares 2007 2008

Own Series A shares 20,728,135 20,728,135

Own Series B shares 82,054,652 80,310,082

Total own shares 102,782,787 101,038,217

Own shares in % of total registered shares 4.80 4.75

Outstanding Series A shares 656,873,495 656,873,495

Outstanding Series B shares 1,368,763,938 1,370,508,508

Total outstanding shares 2,025,637,433 2,027,382,003

Total registered Series A shares 677,601,630 677,601,630

Total registered Series B shares 1,450,818,590 1,450,818,590

Total registered shares 2,128,420,220 2,128,420,220

Average number of outstanding shares 2,025,279,790 2,026,977,937

Changes in outstanding Volvo shares

Balance December 31, 2007 2,025,637,433

Share-based incentive program 1,744,570

2,027,382,003

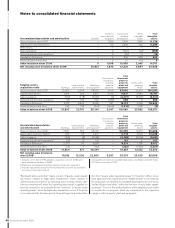

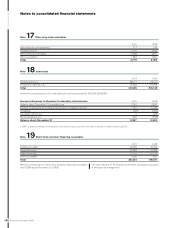

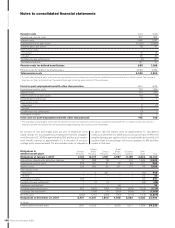

Change in other reserves Hedge reserve

Available for

sale-reserve Total

Balance at January 1, 2008 182 253 435

Fair value gains in year (3,671) – (3,671)

Tax on fair value gains 967 – 967

Transfers to income 792 – 792

Tax on transfers to income statement (222) – (222)

Change in fair value of commodity contracts (105) – (105)

Fair value adjustments regarding holding in Deutz – (324) (324)

Fair value adjustments regarding shares held by Nissan Diesel – (110) (110)

Fair value adjustments regarding holding in Vindic AB – (25) (25)

Other –– -

Balance at December 31, 2008 (2,057) (206) (2,263)

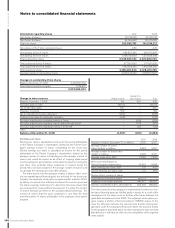

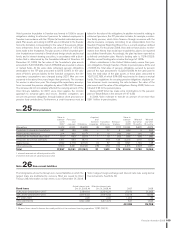

Earnings per share

Earnings per share is calculated as income for the period, attributable

to the Parent Company’s shareholders, divided by the Parent Com-

pany’s average number of shares outstanding for the fi scal year.

Diluted earnings per share is calculated as income for the period

attributable to the Parent Company’s shareholders divided by the

average number of shares outstanding plus the average number of

shares that would be issued as an effect of ongoing share-based

incentive programs and employee stock option programs. If during the

year there were potential shares redeemed or expired during the

period, these are also included in the average number of shares used

to calculate the earnings per share after dilution.

The share-based incentive program creates a dilution effect when

the non-market-based fi nancial goals are achieved for the fi scal year.

Similarly, the employee stock option program creates a dilution effect

by taking into account the difference between the exercise price and

the share’s average market price to determine how many shares that

are assumed to be issued without any payment. It is solely this number

of shares that have an effect on the calculated diluted earnings. The

number of shares that this value symbolizes is less than the total

potential number of shares attributable to the employee stock option

program.

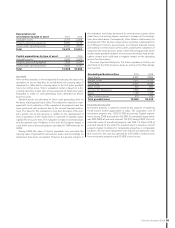

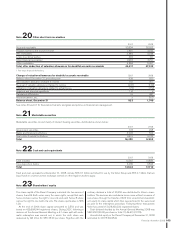

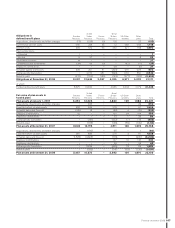

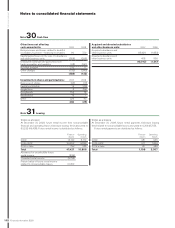

2007 2008

Number of shares, December 31, in millions 2,026 2,027

Average number of shares

before dilution in millions 2,025 2,027

Average number of shares after

dilution in millions 2,026 2,027

Average share price, SEK 118.39 73.80

Net income attributable to

Parent Company shareholders 14,932 9,942

Basic earnings per share, SEK 7.37 4.90

Diluted earnings per share, SEK 7.37 4.90

Dilution effect, number of shares

Share-based incentive program 143,073 –

Employee stock option program 462,477 188,822

Number of potential shares, December 31 605,550 188,822

The share-based incentive program is implemented if certain non-mar-

ket based fi nancial goals are fulfi lled partly or wholly. As a result of the

development of the share price no dilution effect arise between the

grant date and year-end close 2008. The employee stock option pro-

gram creates a dilution effect amounting to 188,822 shares. In this

case, the difference between the exercise price and the share’s aver-

age value under the actual period has been taken into account. Except

for the programs described above no other transactions have occurred

that affected, or will have an effect on, the compilation of the reported

share capital.