Volvo 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

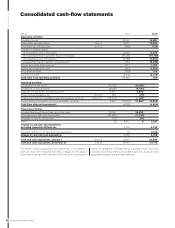

Financial information 2008

Notes to consolidated fi nancial statements

Note 1 Accounting principles

The consolidated fi nancial statements for AB Volvo and its subsidiaries have

been prepared in accordance with International Financial Reporting Standards

(IFRS) issued by the International Accounting Standards Board (IASB), as

adopted by the EU. The portions of IFRS not adopted by the EU have no mate-

rial effect on this report. This annual report is prepared in accordance with

IAS 1 Presentation of Financial Statements and in accordance with the Swed-

ish Companies Act. In addition, RFR 1.1 Supplementary Rules for Groups, has

been applied, issued by the Swedish Financial Reporting Board.

In the preparation of these fi nancial statements, the company man-

agement has made certain estimates and assumptions that affect the

value of assets and liabilities as well as contingent liabilities at the

balance sheet date. Reported amounts for income and expenses in

the reporting period are also affected. The actual future outcome of

certain transactions may differ from the estimated outcome when

these fi nancial statements were issued. Any such differences will

affect the fi nancial statements for future accounting periods. The key

sources of estimation uncertainty are set out in note 2.

Changes of accounting principles

Effective in 2005 Volvo has applied International Financial Reporting

Standards (IFRS) in its fi nancial reporting. In accordance with the

IFRS transition rules in IFRS 1, Volvo applies retroactive application

from the IFRS transition date at January 1, 2004. The details of the

transition from Swedish GAAP to IFRS are set out in Note 3 in the

annual reports of 2005 and 2006. Refer to the 2004 Annual Report

for a description of the previous Swedish accounting principles applied

by Volvo.

New accounting principles in 2008

Two new interpretations from IFRIC take effect as of 1 January 2008:

IFRIC 11 ’IFRS 2 Group and Treasury Share Transactions’ and IFRIC

14 ‘IAS 19 The limit on a defi ned benefi t asset, minimum funding

requirements and their interaction’. Their implementation have not had

any signifi cant impact on the Group’s fi nancial statements.

The amendments to IAS 39 and IFRS 7 effective from 1 July 2008,

published and endorsed in October 2008, have not had a signifi cant

effect on the Group’s fi nancial statements.

New accounting principles 2009 and 2010

When preparing the consolidated accounts as of December 31, 2008,

a number of standards and interpretations have been published, but

have not yet become effective. The following is a preliminary assess-

ment of the effect that the implementation of these standards and

statements could have on the Volvo Group’s fi nancial statements.

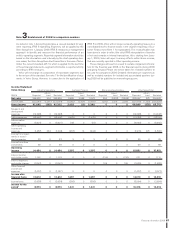

IFRS 8 Operating segments

The standard becomes effective on January 1, 2009 and applies for the

fi scal years beginning on that date. The standard addresses the distribution

of the company’s operations in different segments. In accordance with the

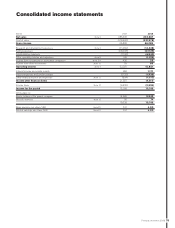

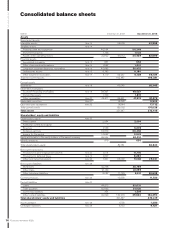

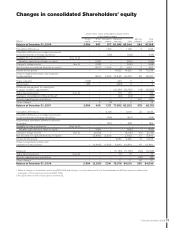

Amounts in SEK M unless otherwise specifi ed. The amounts within parentheses refer to the preceding year, 2007.

standard, the company shall adopt an approach based on the internal

reporting structure and determine the reportable segments based on this

structure. Volvo does not expect the adoption of IFRS 8 to result in any

change in the identifi cation of segments. Volvo will however, in connection

to the implementation of IFRS 8, remove the reclassifi cation of leases from

operating to fi nance leases within the Customer Finance segment. Volvo

will also reclassify currency exchange effects that are now reported in

operating income to be reported in gross income from 1 January 2009.

See note 3 for further details.

IAS 23 amendment Borrowing costs

The amendment becomes effective on January 1, 2009 and applies

to fi scal years beginning on or after that date. The amendment states

that borrowing costs that are directly attributable to the acquisition,

construction or production of an asset that necessarily takes a sub-

stantial period of time to get ready for its intended use or sale, should

form part of the cost of that asset. The Group will apply the amend-

ment as of January 1, 2009. According to the current accounting prin-

ciple applied by Volvo, borrowing costs are expensed. The amendment

will result in a change of accounting principle for the Volvo group, but

is not expected to have a signifi cant impact on the Group’s fi nancial

statements.

IAS 1 amendment Presentation of fi nancial statements

The amendment becomes effective on January 1, 2009 and applies

to fi scal years beginning on or after that date. The amendment con-

cerns the form for presentation of fi nancial position, comprehensive

income and cash fl ow and contains a requirement for statement of

comprehensive income. The Group will apply the amendment as of

January 1, 2009, which will not have a signifi cant impact on the

Group’s fi nancial statements, but only to a limited extent affect the

form of presentation for the Group fi nancial statements.

Revised IFRS 3 Business combinations*

The standard becomes effective on July 1, 2009 and applies to fi scal

years beginning on or after that date. The standard entails changes to

the reporting of future acquisitions regarding for example the account-

ing of transaction costs, any contingent considerations and step

acquisitions. The Group will apply the amendment as of January 1,

2010. The application will prospectively affect the accounting for busi-

ness combinations made from the application date.

IAS 27 amendment Consolidated and separate fi nancial statements*

The standard becomes effective on July 1, 2009, as a consequence

of the revised IFRS 3, and applies to fi scal years beginning on or after that

date. The amendment brings about changes in IAS 27 regarding for

example how to report changes to the ownership in cases where the

parent company retains or loses the control of the owned entity. The