Volvo 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Joint venture within trucks and buses with Eicher Motors in India

2007 Acquisition of Ingersoll Rand’s road construction operations

2007 Acquisition of Chinese wheel loader manufacturer Lingong

2006 Acquisition of Nissan Diesel of Japan, completed in 2007.

2005 Sale of the service company Celero Support

2004 Acquisition of remaining 50% of the Canadian bus manufacturer

Prevost

2004 Sale of axle-manufacturing operations to ArvinMeritor

2003 Acquisition of the truck and construction equipment operations of Bilia

2001 Sale of the insurance operations in Volvia to If

2001 Acquisition of the truck manufacturers Mack and Renault VI

1999 Sale of Volvo Cars to Ford

1998 Acquisition of the excavator operations of Samsung Heavy Industries

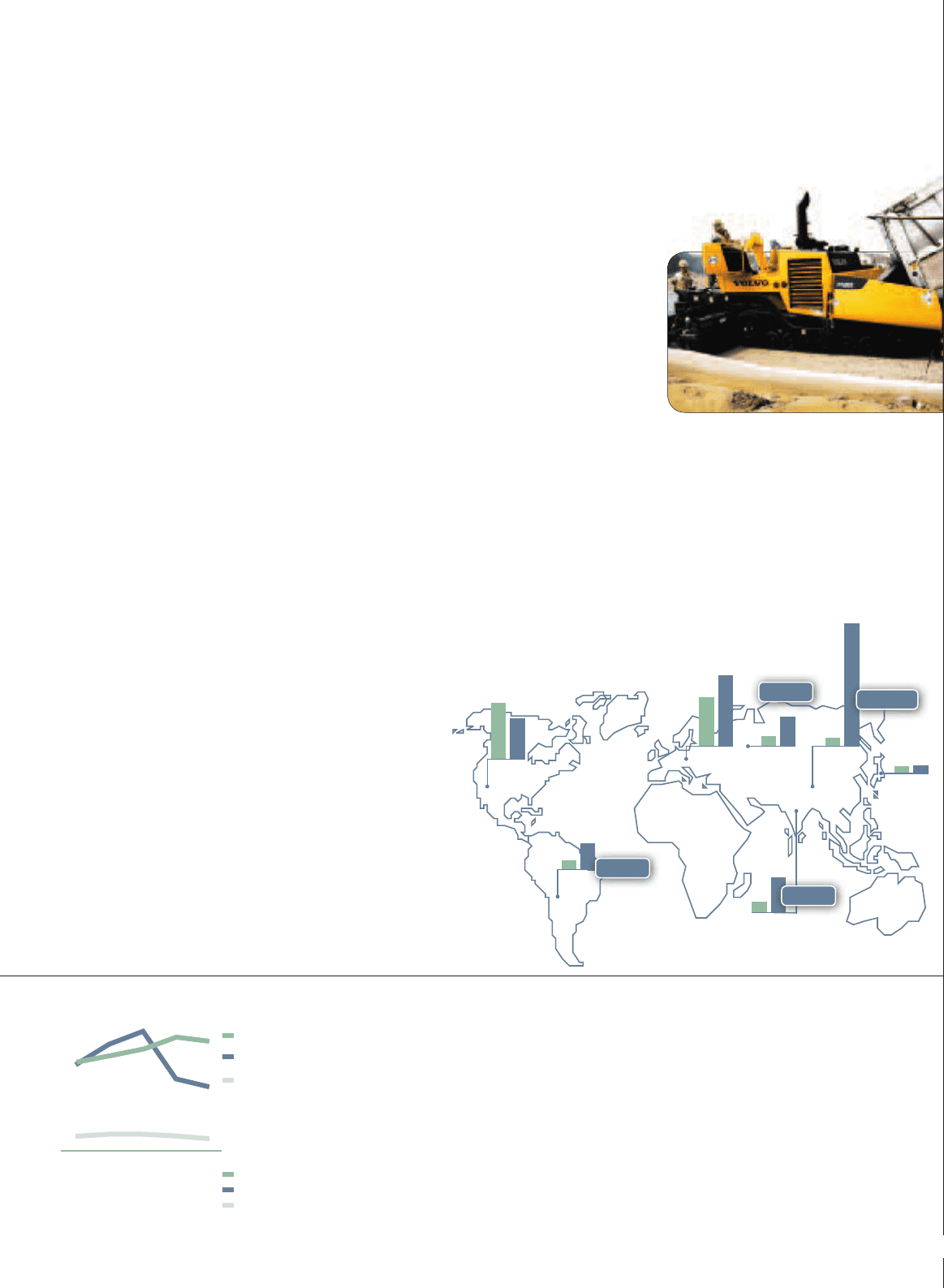

Heavy truck registrations, >16 tons Volvo Group – Acqusitions and Divestments

Europe

North America

Vehicles, thousands

0807060504

319329295277255

185

208349308249

35

43484842

Japan

Total heavy-duty truck market

Thousands

98

255

08

185

98

220

08

319

98

50

08

160

98

39

08

550

98

44

08

133

98

32

08

35

98

42

08

118

Europe Russia China

Japan

India

South America

North America

133

133

133

08

08

08

08

h Am

h Am

eric

eric

a

a

h Am

h Am

erica

+202%

+140%

+220%

+1,310%

Fluctuating raw materials prices

The boom in recent years, with higher production and increased transports has resulted in upward pressure

on raw materials prices. In particular, the price of oil continued to climb during the fi rst half of 2008. At the

beginning of 2008, North Sea oil, so-called Brent, cost USD 100 per barrel, later peaking at about USD 150

in July. In pace with the increasingly weaker trend in the world economy, the price of oil dropped sharply

during the second half of the year. In December, a Brent barrel cost about USD 36. The price of other impor-

tant input goods, such as metals and rubber, retreated during the second half of 2008 after the sharp rises

in recent years.

Fuel represents a large part of the operating costs for many of the Volvo Group’s customers. Fuel accounts for

as much as one third of total costs for a transport company. Accordingly, fuel economy is an important factor when

they choose new vehicles and machinery. This places demands on manufacturers to develop, new, more fuel-

effi cient products. Combined with increasingly stringent environmental demands, this means that substantial

investments must be made in research and development related to new technologies that reduce emissions and

with regard to complementary fuels and alternative drivelines with better environmental performance.

The Volvo Group is well in the forefront in the development of more fuel-effi cient engines and alternative

drivelines, such as hybrids for example.

Strengthened position in important markets

Since long, the Volvo Group has an established, strong position in Western Europe and North America. Since

the fastest growth is occurring outside these regions, in markets in which as recently as 10 years ago the

Group had limited operations, the Volvo Group has for some time also focused on these ‘new’ markets. Through

the acquisitions of Japanese truck manufacturer Nissan Diesel, Chinese wheel-loader manufac-

turer Lingong, the Ingersoll Rand division for road construction equipment,

and through the formation of a joint-venture for the production of trucks

and buses with India-based Eicher Motors, also now Asia is an home

market for the Volvo Group. At the same time, by strengthening the

dealer and service network, the Volvo Group has positioned itself well in

Eastern Europe.

To meet the challenges and distribute development costs, for instance

for engines, over large volumes, consolidation is occurring among manu-

facturers. Mergers and acquisitions have been common in both North Amer-

ica and Europe. In the past few years attention has increasingly focused on Asia,

where the Volvo Group had a head start with several signifi cant acquisitions.

A global group 2008

9