Volvo 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160

|

|

101

Financial information 2008

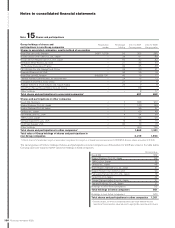

Dong Feng Nissan Diesel Motor Co., Ltd

The company is consolidated in the Volvo Group according to the pro-

portionate method as from July 1, 2008.

Petro Stopping Centers

Volvo’s holdings in the company were divested in 2007.

Småföretagarinvest AB

Volvo’s holdings in the company were divested in 2007.

Nissan Diesel

Nissan Diesel is consolidated in the Volvo Group as of the fi rst quarter

of 2007.

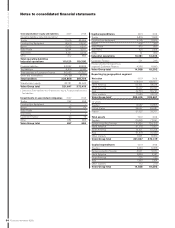

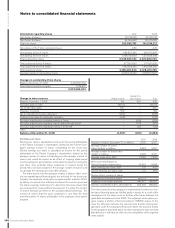

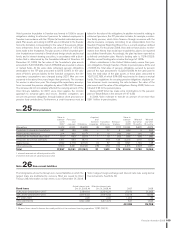

Changes in the Volvo Group’s holdings of shares and participations: 2007 2008

Balance sheet, December 31, preceding year 6,890 2,219

Change in Group structure (5,535) (88)

Acquisitions and divestments, net 907 16

Net of write-downs/revaluations (15) (33)

Capital contribution 155 56

Share of income in associated companies 108 15

Revaluation of shares to fair value (204) (546)

Translation differences (39) 325

Dividends 0 (7)

Other (48) (4)

Balance sheet, December 31 2,219 1,953

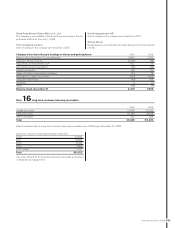

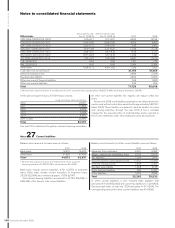

Note 16 Long-term customer-fi nancing receivables

2007 2008

Installment credits 19,836 23,029

Financial leasing 20,298 26,874

Other receivables 352 529

Total 40,486 50,432

Effective interest rate for Long-term customer-fi nancing receivables was 7.20% as per December 31, 2008.

Long-term customer-fi nancing receivables maturities

2010 20,643

2011 15,653

2012 9,243

2013 3,552

2014 or later 1,341

Total 50,432

See notes 36 and 37 for fi nancial instruments and goals and policies

in fi nancial risk management.