Volvo 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings

Net sales of the truck operations in 2008 rose

8% to SEK 203,235 M (187,892). Operating

income amounted to SEK 12,167 M (15,193),

while the operating margin was 6.0% (8.1).

The lower operating earnings is an effect of

higher prices for raw materials and com-

ponents, particularly in the fi rst half of the year,

increased costs for research and development

in response to new emission legislation and

signifi cant under absorption of costs following

the rapid deceleration of the production pace

toward year-end. In addition, earnings were

affected adversely by about SEK 450 M in

costs related to personnel downsizing during

the latter part of the year and by impairment

losses on the value of used trucks in inventory

and increased provisions for residual value

commitment.

Joint-venture with Eicher Motors in India

During the year, AB Volvo and Eicher Motors

formed the joint-venture company VE Com-

mercial Vehicles (VECV). As of August 1,

2008, 50% of the joint-venture company is

consolidated in the Volvo Group. VECV com-

prises the entire Eicher Motors truck and bus

operations, while concurrently the Volvo Group

is contributing its Indian sales operations in

the truck segment and the service operations

for trucks and buses.

Established in 1984, Eicher Motors devel-

ops and sells a broad product range compris-

ing light, medium-heavy and heavy trucks and

buses as well as truck chassis, engines and

engine components. With a market share of

nearly 30% in the medium-heavy (5-12 tons)

truck segment, Eicher is India’s third largest

manufacturer of commercial vehicles. Eicher’s

production facilities are in Pithampur in central

India and it has a dealer network nationwide in

India as well as in other markets. The Indian

market weakened signifi cantly during the year

and is expected to decline also in 2009. During

August 1 and December 31, 2008 deliveries

of 2,744 trucks are consolidated in the Volvo

Group. VECV continues to invest in new prod-

ucts, higher quality and expansion to new

markets.

Volvo Trucks

– a record year in a declining

market

2008 was one of Volvo Trucks most success-

ful year so far, with very high customer satis-

faction, a strong position in the market and a

new competitive product range.

However, the global downturn led to a rapid

decline in orders during the second half of the

year.

Retail a core business

Volvo Trucks’ new retail strategy has further

improved customer understanding. Volvo

Trucks has further developed the service busi-

ness with a broader customer offering and

with improved complete solutions adapted to

customer requirements. Focus is on support-

ing customer productivity and profi tability by

providing service, lease and maintenance con-

tracts. The parts and aftermarket business

contributes to improving Volvo Trucks fi nancial

performance by being more stable compared

to the sale of new trucks.

VOLVO TRUCKS

Record fi rst six moths of the year.•

Dealt with the downturn in the market. •

Quick adjustment from eliminating

bottle necks to instead reducing pro-

duction, lowering costs and freeing

tied-up capital during the third and

fourth quarter.

Launch of new, competitive product •

range with Volvo FH, Volvo FH16 and

Volvo FM11 with focus on safety, driver

comfort and new drivelines. Field tests

with hybrid refuse trucks.

Plans for restructuring the North •

American business.

Volvo do Brasil named best employer •

in Brazil.

Handle the downturn so that the market •

position is strengthened and fl exibility

increased.

Roll out the new generation of products •

(Volvo FH, Volvo FH16 and Volvo

FM11). Launch of Volvo FH16 700.

Continue to develop sales of services •

supporting the truck according to the

customer segmentation strategy.

Increase effi ciency in North American •

operations.

Continued focus on selling and admin-•

istration costs and on cash fl ow.

Gradual start-up of production in the •

new factory in Kaluga, Russia.

Continued expansion of delivery cap-•

acity to meet the strong demand for

trucks in virtually all markets outside

North America.

Manage infl ation and strong cost focus. •

Maintain a high level of preparedness

for economic and demand trends.

Launch new generation of trucks, Volvo •

FH and Volvo FM by summer.

Manage a continued weak demand in •

North America.

Outcome 2008 Ambitions 2009Ambitions 2008

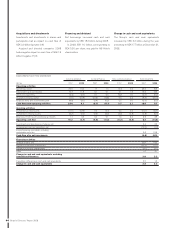

Deliveries by model

Volvo Trucks 2007 2008

Volvo FL, FE, FM 31,570 32,379

Volvo FH, FH16 48,366 53,098

Volvo NH 24 0

Volvo VN, VHD, VT 16,565 15,788

Volvo VM 3,584 4,687

Total 100,109 105,952

Deliveries by market

Volvo Trucks 2007 2008

Western Europe 41,009 41,025

Eastern Europe 18,456 17,162

North America 16,692 15,887

South America 10,166 12,890

Asia 9,002 13,440

Other markets 4,784 5,548

Total 100,109 105,952

In 2008, Volvo Trucks introduced new versions

of the heavy-duty trucks Volvo FH, Volvo FH16

and Volvo FM.

Business areas 2008

53