Volvo 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated fi nancial statements

122

THE VOLVO GROUP

Financial information 2008

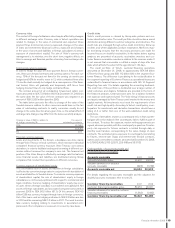

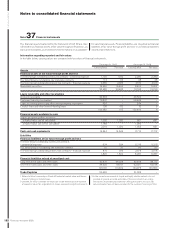

Note 37 Financial instruments

The fi nancial assets treated within the framework of IAS 39 are clas-

sifi ed either as fi nancial assets at fair value through profi t and loss, as

loans and receivables, as investments held to maturity or as available-

for-sale fi nancial assets. Financial liabilities are classifi ed as fi nancial

liabilities at fair value through profi t and loss or as fi nancial liabilities

valued at amortized cost.

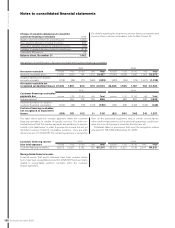

Information regarding reported and fair values

In the table below, carrying values are compared with fair values of fi nancial instruments.

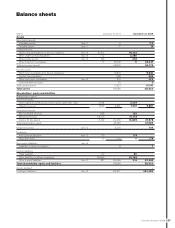

December 31, 2007 December 31, 2008

Carrying value Fair value Carrying value Fair value

Assets

Financial assets at fair value through profi t and loss

The Volvo Group’s outstanding currency risk contracts – commercial exposure 1,192 1,192 2,280 2,280

The Volvo Group’s outstanding raw materials contracts 113 113 38 38

The Volvo Group’s outstanding interest risk contracts – fi nancial exposure 2,685 2,685 4,510 4,510

Marketable securities 16,490 16,490 5,902 5,902

20,480 20,480 12,730 12,730

Loans receivable and other receivables

Accounts receivable 30,504 – 30,523 –

Customer fi nancing receivables378,847 – 98,489 –

Loans to external parties and other interest-bearing receivables 525 – 384 –

Conduit loans and other interest-bearing loans 106 102 10 6

109,982 102 129,406 6

Financial assets available for sale

Shares and participations for which:

a market value can be calculated11,030 1,030 661 661

a market value can not be calculated21,189 – 1,292 –

2,219 1,030 1,953 661

Cash and cash equivalents 14,544 14,544 17,712 17,712

Liabilities

Financial liabilities at fair value through profi t and loss

The Volvo Group's outstanding currency risk contracts

– commercial exposure 924 924 5,216 5,216

The Volvo Group’s outstanding raw materials contract 20 20 93 93

The Volvo Group's outstanding interest risk contracts – fi nancial exposure 876 876 2,978 2,978

1,820 1,820 8,287 8,287

Financial liabilities valued at amortized cost

Long term bond loans and other loans 63,470 66,338 82,948 84,712

Short term bank loans and other loans 44,630 44,161 62,027 62,148

108,100 110,499 144,975 146,860

Trade Payables 52,663 – 51,025 –

1 Refers to Volvo’s ownership in Deutz AG valued at market value and Nissan

Diesel’s holdings in listed shares.

2 Unlisted, for which a reliable fair value can not be determined, are reported

at aquisition value. No single block of shares represent a signifi cant amount.

3 In the current environment of illiquid and highly volatile markets, it is not

possible to provide accurate estimates of the price at which an orderly

transaction would take place between willing participants. As such, fair

value estimates have not been provided for the customer fi nance portfolio.