Volvo 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

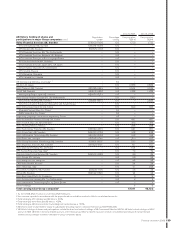

Financial information 2008

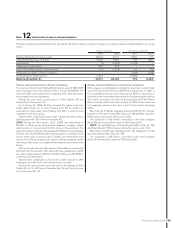

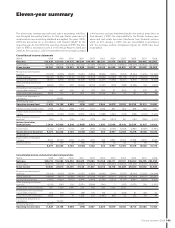

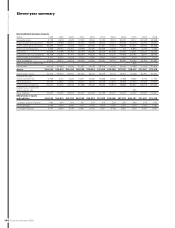

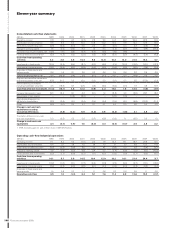

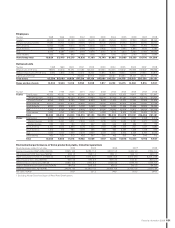

Eleven-year summary

The eleven-year summary presents each year in accordance with Gen-

eral Accepted Accounting Practice for that year. Earlier years are not

restated when new accounting standards are applied. The years 1998–

2003 are accounted for in accordance with Swedish GAAP for the

respective year. As from 2004 the reporting is based on IFRS. The tran-

sition to IFRS is described in note 3 in the Annual Reports 2005 and

2006. As from January 1, 2007, the benefi ts from the synergies created

in the business units are transferred back to the product areas. Also, as

from January 1, 2007, the responsibility for the Group’s treasury oper-

ations and real estate has been transferred from Financial services,

which, as from January 1, 2007, only are consolidated in accordance

with the purchase method. Comparison fi gures for 2006 have been

recalculated.

Consolidated income statements

SEK M 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Net sales 212,936 125,019 130,070 189,280 186,198 183,291 211,076 240,559 258,835 285,405 303,667

Cost of sales (163,876) (99,501) (104,548) (155,592) (151,569) (146,879) (164,170) (186,662) (199,054) (219,600) (237,578)

Gross income 49,060 25,518 25,522 33,688 34,629 36,412 46,906 53,897 59,781 65,805 66,089

Research and development

expenses (10,104) (4,525) (4,876) (5,391) (5,869) (6,829) (7,614) (7,557) (8,354) (11,059) (14,348)

Selling expenses (19,042) (8,865) (10,140) (15,766) (16,604) (16,866) (19,369) (20,778) (21,213) (26,068) (27,129)

Administrative expenses (8,091) (4,791) (4,974) (6,709) (5,658) (5,467) (5,483) (6,301) (6,551) (7,133) (6,940)

Other operating income and

expenses (2,634) (611) 622 (4,096) (4,152) (1,367) (618) (588) (3,466) 163 (1,915)

Income (loss) from investments

in associated companies 444 567 444 50 182 200 27 (557) 61 430 25

Income from other investments 4,526 170 70 1,410 309 (3,579) 830 37 141 93 69

Income from divestment of

subsidiaries – 26,695 –––––––––

Restructuring costs (2,331) ––(3,862) –––––––

Operating income (loss) 11,828 34,158 6,668 (676) 2,837 2,504 14,679 18,153 20,399 22,231 15,851

Interest income and similar credits 1,268 1,812 1,588 1,275 1,217 1,096 821 654 666 952 1,171

Interest expenses and similar

charges (1,315) (1,505) (1,845) (2,274) (1,840) (1,888) (1,254) (972) (585) (1,122) (1,935)

Other fi nancial income and

expenses (162) 131 (165) (191) (201) (55) (1,210) 181 (181) (504) (1,077)

Income (loss) after

fi nancial items 11,619 34,596 6,246 (1,866) 2,013 1,657 13,036 18,016 20,299 21,557 14,010

Income taxes (3,140) (2,270) (1,510) 326 (590) (1,334) (3,129) (4,908) (3,981) (6,529) (3,994)

Income (loss) for the period 8,479 32,326 4,736 (1,540) 1,423 323 9,907 13,108 16,318 15,028 10,016

Attributable to

Equity holders of the parent

company 8,437 32,222 4,709 (1,467) 1,393 298 9,867 13,054 16,268 14,932 9,942

Minority interest 42 104 27 (73) 30 25 40 54 50 96 74

8,479 32,326 4,736 (1,540) 1,423 323 9,907 13,108 16,318 15,028 10,016

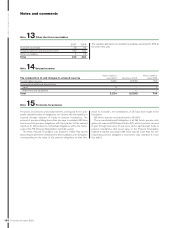

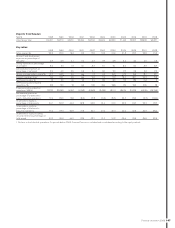

Consolidated income statements Industrial operations

SEK M 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Net sales 205,712 116,382 120,392 180,615 177,080 174,768 202,171 231,191 249,020 276,795 294,932

Cost of sales (158,077) (92,772) (97,131) (149,477) (145,453) (141,256) (158,453) (180,823) (192,400) (214,160) (232,247)

Gross income 47,635 23,610 23,261 31,138 31,627 33,512 43,718 50,368 56,620 62,635 62,685

Research and development

expenses (10,104) (4,525) (4,876) (5,391) (5,869) (6,829) (7,614) (7,557) (8,354) (11,059) (14,348)

Selling expenses (18,468) (8,117) (9,285) (14,663) (15,393) (15,891) (18,317) (19,616) (19,999) (24,671) (25,597)

Administrative expenses (7,950) (4,632) (4,651) (6,474) (5,464) (5,259) (5,310) (6,147) (6,481) (7,092) (6,921)

Other operating income and

expenses (2,515) (587) 309 (3,071) (2,989) (540) 7 (397) (3,275) 249 (1,457)

Income from Financial Services 681 1,066 1,499 325 490 926 1,365 2,033 –––

Income (loss) from investments

in associated companies 354 478 341 (86) 126 166 2 (568) 61 428 23

Income from other investments 4,526 170 70 1,408 309 (3,581) 828 37 141 93 69

Income from divestment of

subsidiaries – 26,695 –––––––––

Restructuring costs (2,331) ––(3,862) –––––––

Operating income (loss) 11,828 34,158 6,668 (676) 2,837 2,504 14,679 18,153 18,713 20,583 14,454