United Airlines 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

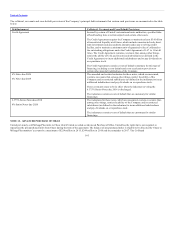

Table of Contents

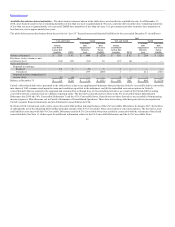

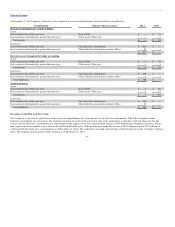

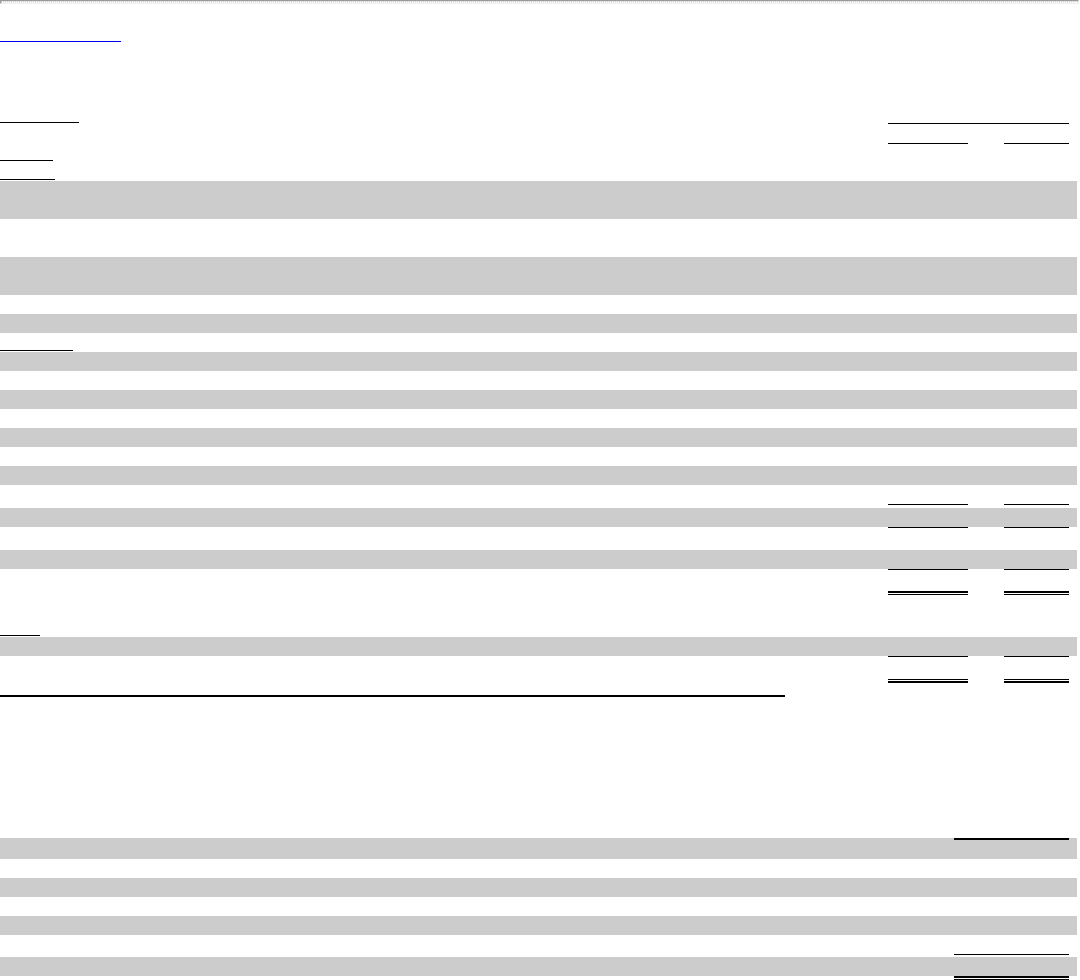

Secured

Notes payable, fixed interest rates of 1.42% to 12.00% (weighted average rate of 5.86% as of December 31, 2014), payable

through 2026 $ 7,464 $ 6,279

Notes payable, floating interest rates of the London Interbank Offered Rate (“LIBOR”) plus 0.20% to 5.46%, payable through

2026 1,151 1,243

Term loan, LIBOR subject to a 0.75% floor, plus 2.75%, or alternative rate based on certain market rates plus 1.75%, due

2019 884 893

Term loan, LIBOR subject to a 0.75% floor, plus 3.00%, or alternative rate based on certain market rates plus 2%, due 2021 499 —

6.75% Senior Secured Notes due 2015 — 800

Unsecured

6% Notes due 2026 to 2028 (a) 632 652

6% Senior Notes due 2020 (a) 300 300

6.375% Senior Notes due 2018 (a) 300 300

4.5% Convertible Notes due 2015 202 230

8% Notes due 2024 (a) — 400

6% Convertible Junior Subordinated Debentures due 2030 — 248

4.5% Senior Limited-Subordination Convertible Notes due 2021 (a) — 156

Other 101 103

11,533 11,604

Less: unamortized debt discount (99) (169)

Less: current portion of long-term debt—United (1,313) (1,368)

Long-term debt, net—United (b) $ 10,121 $10,067

6% Convertible Senior Notes due 2029 $ — $ 104

Long-term debt, net—UAL $ 10,121 $ 10,171

(a) UAL is the issuer of this debt. United is a guarantor.

(b) As further described below under “Convertible Debt Securities and Derivatives,” there is a basis difference between UAL and United debt values, because

we applied different accounting methodologies. The United debt presented above does not agree to United’s balance sheet by the amount of this adjustment.

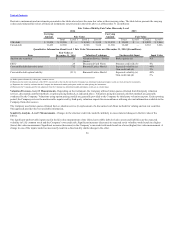

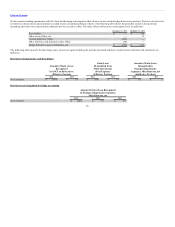

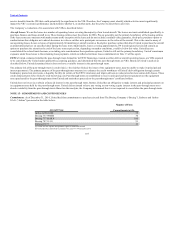

The table below presents the Company’s contractual principal payments at December 31, 2014 under then-outstanding long-term debt agreements in each of

the next five calendar years (in millions):

2015 $ 1,313

2016 1,195

2017 755

2018 1,269

2019 1,721

After 2019 5,280

$ 11,533

99