United Airlines 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

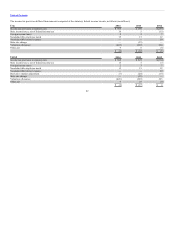

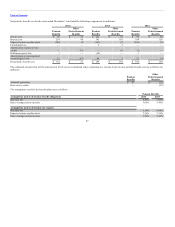

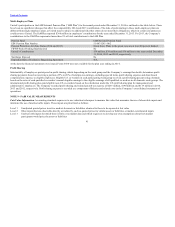

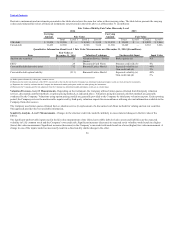

Fair Value Information. Accounting standards require us to use valuation techniques to measure fair value that maximize the use of observable inputs and

minimize the use of unobservable inputs. These inputs are prioritized as follows:

Level 1 Unadjusted quoted prices in active markets for assets or liabilities identical to those to be reported at fair value

Level 2 Other inputs that are observable directly or indirectly, such as quoted prices for similar assets or liabilities or market-corroborated inputs

Level 3

Unobservable inputs for which there is little or no market data and which require us to develop our own assumptions about how market

participants would price the assets or liabilities

Assets and liabilities measured at fair value are based on the valuation techniques identified in the tables below. The valuation techniques are as follows:

(a) Prices and other relevant information generated by market transactions involving identical or comparable assets and liabilities; and

(b) Techniques to convert future amounts to a single current value based on market expectations (including present value techniques,

option-pricing and excess earnings models).

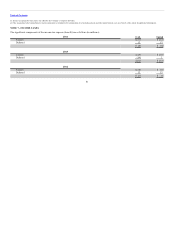

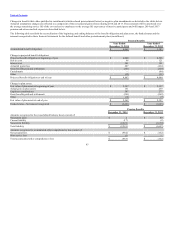

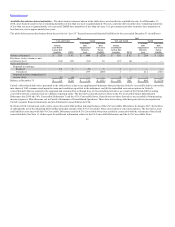

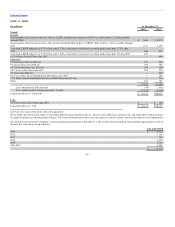

The following tables present information about United’s pension and other postretirement plan assets at December 31 (in millions):

Pension Plan Assets:

Equity securities funds $1,181 $ 388 $ 793 $ — $ 1,158 $ 389 $ 769 $ —

Fixed-income securities 813 — 813 — 702 — 698 4

Alternatives 359 — 148 211 405 — 199 206

Insurance contract 21 — — 21 26 — — 26

Other investments 188 — 165 23 106 — 106 —

Total $2,562 $ 388 $1,919 $ 255 $ 2,397 $ 389 $1,772 $ 236

Other Postretirement Benefit Plan

Assets:

Deposit administration fund $ 57 $ — $ — $ 57 $ 57 $ — $ — $ 57

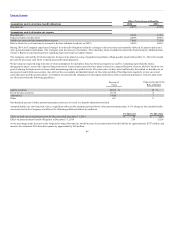

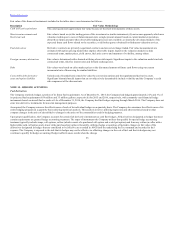

Equity securities include investments in both developed market and emerging market equity securities. Fixed-income

securities include primarily U.S. and non-U.S. government fixed-income securities and U.S. and non-U.S corporate fixed-income securities.

Each of these investments are stable value investment products structured to provide investment

income.

Alternative investments consist primarily of investments in hedge funds, real estate and private equity interests.

Other investments consist primarily of investments in currency and commodity commingled funds.

89