United Airlines 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

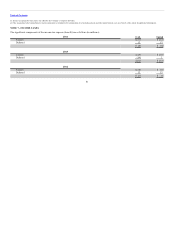

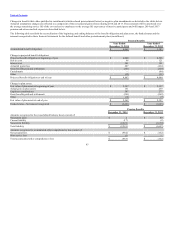

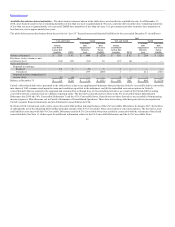

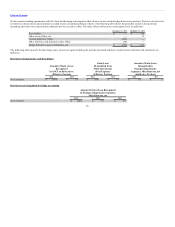

United’s participation in the IAM National Pension Plan (“IAM Plan”) for the annual period ended December 31, 2014 is outlined in the table below. There

have been no significant changes that affect the comparability 2014 and 2013 contributions. The risks of participating in these multi-employer plans are

different from single-employer plans, as United may be subject to additional risks that others do not meet their obligations, which in certain circumstances

could revert to United. The IAM Plan reported $368 million in employers’ contributions for the year ended December 31, 2013. For 2013, the Company’s

contributions to the IAM Plan represented more than 5% of total contributions to the IAM Plan.

Pension Fund IAM National Pension Fund

EIN/ Pension Plan Number 51-6031295 - 002

Pension Protection Act Zone Status (2014 and 2013) Green Zone. Plans in the green zone are at least 80 percent funded.

FIP/RP Status Pending/Implemented No

United’s Contributions

$39 million, $38 million and $36 million in the years ended December

31, 2014, 2013 and 2012, respectively

Surcharge Imposed No

Expiration Date of Collective Bargaining Agreement N/A

At the date the financial statements were issued, Forms 5500 were not available for the plan year ending in 2014.

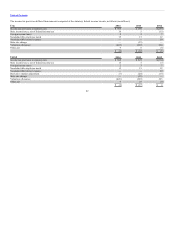

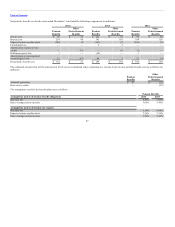

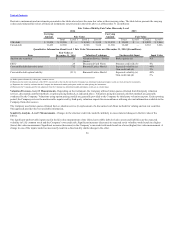

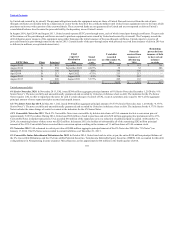

Substantially all employees participated in profit sharing, which depending on the work group and the Company’s earnings thresholds, determines profit

sharing payments based on receiving a portion of 5% to 20% of total pre-tax earnings, excluding special items, profit sharing expense and share-based

compensation expense, to eligible employees. Eligible U.S. co-workers in each participating work group received a profit sharing payout using a formula

based on the ratio of each qualified co-worker’s annual eligible earnings to the eligible earnings of all qualified co-workers in all domestic work groups. The

international profit sharing plan paid eligible non-U.S. co-workers based on the calculation under the U.S. profit sharing plan for management and

administrative employees. The Company recorded profit sharing and related payroll tax expense of $235 million, $190 million and $119 million in 2014,

2013 and 2012, respectively. Profit sharing expense is recorded as a component of Salaries and related costs in the Company’s consolidated statements of

operations.

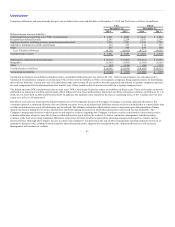

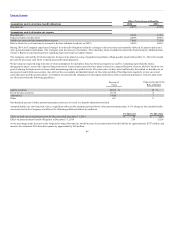

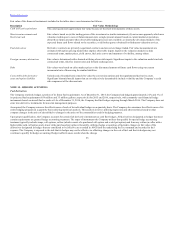

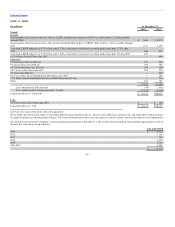

Fair Value Information. Accounting standards require us to use valuation techniques to measure fair value that maximize the use of observable inputs and

minimize the use of unobservable inputs. These inputs are prioritized as follows:

Level 1 Unadjusted quoted prices in active markets for assets or liabilities identical to those to be reported at fair value

Level 2 Other inputs that are observable directly or indirectly, such as quoted prices for similar assets or liabilities or market-corroborated inputs

Level 3

Unobservable inputs for which there is little or no market data and which require us to develop our own assumptions about how market

participants would price the assets or liabilities

91