United Airlines 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

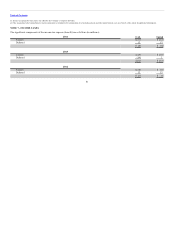

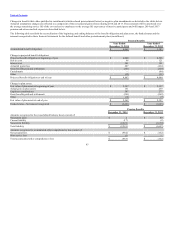

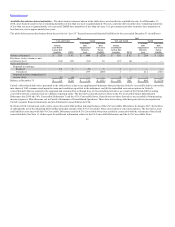

The reconciliation of United’s defined benefit plan assets measured at fair value using unobservable inputs (Level 3) for the years ended December 31, 2014

and 2013 is as follows (in millions):

Balance at beginning of year $ 293 $ 256

Actual return on plan assets:

Sold during the year 7 15

Held at year end 6 7

Purchases, sales, issuances and settlements (net) 6 15

Balance at end of year $ 312 $ 293

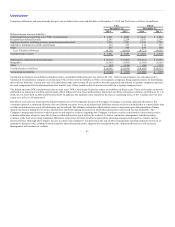

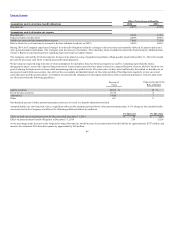

Funding requirements for tax-qualified defined benefit pension plans are determined by government regulations. United’s contributions reflected above have

satisfied its required contributions through the 2014 calendar year. In 2015, employer anticipated contributions to all of United’s pension and postretirement

plans are at least $400 million and approximately $120 million, respectively.

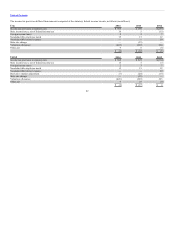

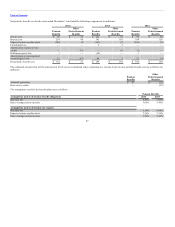

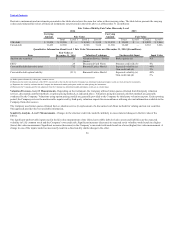

The estimated future benefit payments, net of expected participant contributions, in United’s pension plans and other postretirement benefit plans as of

December 31, 2014 are as follows (in millions):

2015 $ 299 $ 125 $ 6

2016 283 126 7

2017 294 129 8

2018 291 132 9

2019 293 135 9

Years 2020 – 2024 1,581 732 56

Depending upon the employee group, employer contributions consist of matching contributions and/or non-elective employer contributions. United’s

employer contribution percentages vary from 1% to 16% of eligible earnings depending on the terms of each plan. United recorded contributions to its

defined contribution plans of $503 million, $433 million and $330 million in the years ended December 31, 2014, 2013 and 2012, respectively.

90