United Airlines 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

in the fair value of the derivative instrument exceeds the change in the value of the Company’s expected future cash outlay to purchase and consume fuel. To

the extent that the periodic changes in the fair value of the derivatives are not effective, that ineffectiveness is classified as Nonoperating income (expense):

Miscellaneous, net in the statements of consolidated operations.

The Company also utilizes certain derivative instruments that are economic hedges but do not qualify for hedge accounting under U.S. GAAP. As with

derivatives that qualify for hedge accounting, the purpose of these economic hedges is to mitigate the adverse financial impact of potential increases in the

price of fuel. Currently, the only such economic hedges in the Company’s hedging portfolio are three-way collars (a collar with a higher strike sold call

option). The Company records changes in the fair value of three-way collars to Nonoperating income (expense): Miscellaneous, net in the statements of

consolidated operations.

If the Company settles a derivative prior to its contractual settlement date, then the cumulative gain or loss recognized in AOCI at the termination date

remains in AOCI until the forecasted transaction occurs. In a situation where it becomes probable that a hedged forecasted transaction will not occur, any

gains and/or losses that have been recorded to AOCI would be required to be immediately reclassified into earnings. All cash flows associated with

purchasing and settling derivatives are classified as operating cash flows in the statements of consolidated cash flows.

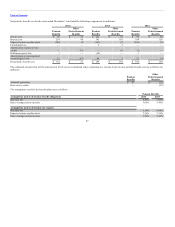

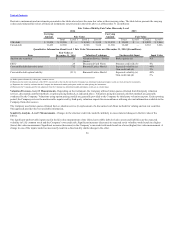

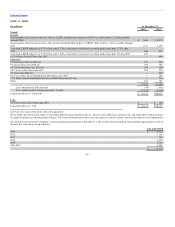

The Company records each derivative instrument as a derivative asset or liability (on a gross basis) in its consolidated balance sheets and, accordingly,

records any related collateral on a gross basis. The table below presents the fair value amounts of fuel derivative assets and liabilities and the location of

amounts recognized in the Company’s financial statements.

96