United Airlines 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

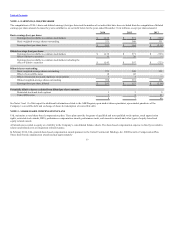

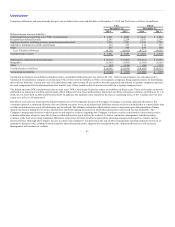

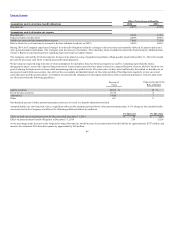

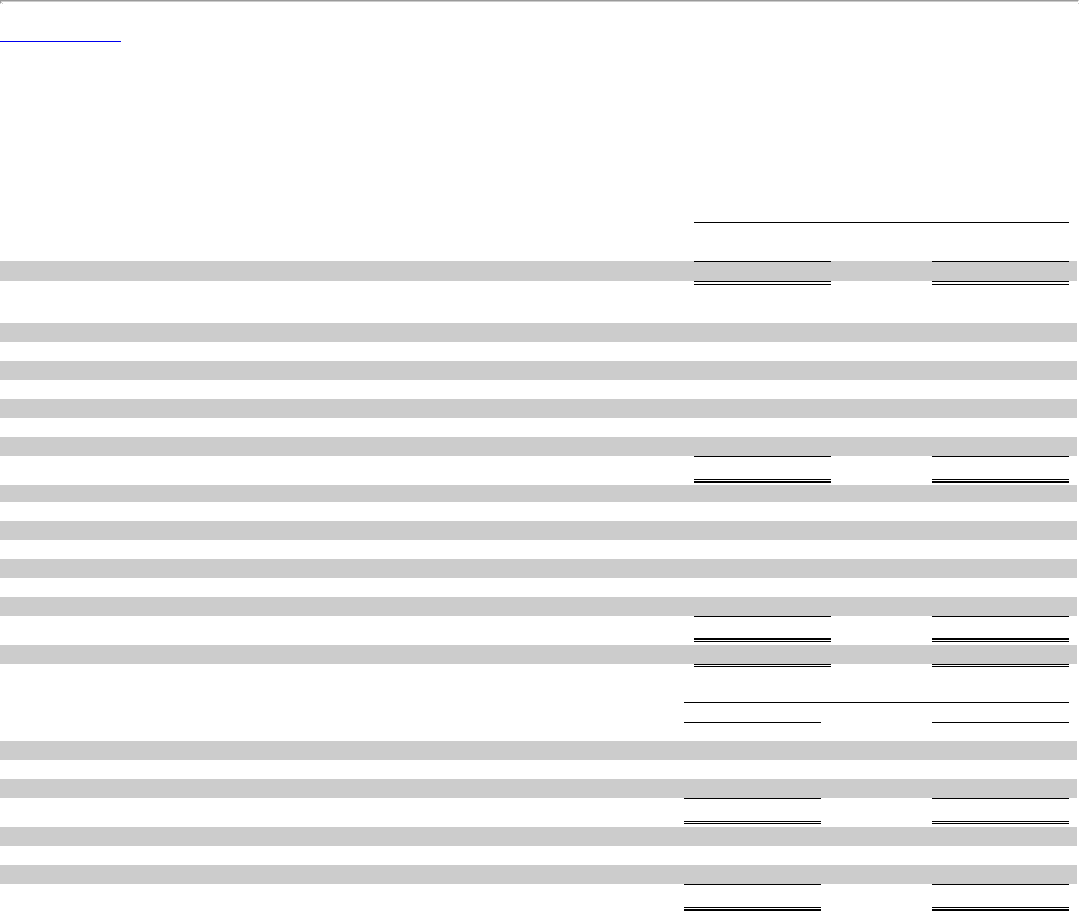

Changes in benefits that either qualified as curtailments (which reduced prior actuarial losses) or negative plan amendments are detailed in the tables below.

Actuarial assumption changes are reflected as a component of the net actuarial gains/(losses) during 2014 and 2013. These amounts will be amortized over

the average remaining service life of the covered active employees or the average life expectancy of inactive participants and will impact 2014 and 2013

pension and retiree medical expense as described below.

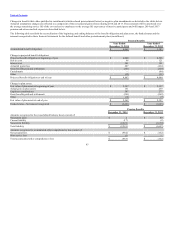

The following table sets forth the reconciliation of the beginning and ending balances of the benefit obligation and plan assets, the funded status and the

amounts recognized in these financial statements for the defined benefit and other postretirement plans (in millions):

Accumulated benefit obligation: $ 4,068 $ 3,383

Change in projected benefit obligation:

Projected benefit obligation at beginning of year $ 4,000 $ 4,526

Service cost 98 121

Interest cost 201 191

Actuarial (gain) loss 807 (464)

Gross benefits paid and settlements (281) (269)

Curtailments — (84)

Other (22) (21)

Projected benefit obligation at end of year $ 4,803 $ 4,000

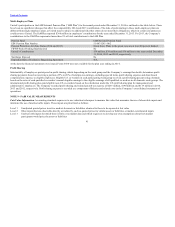

Change in plan assets:

Fair value of plan assets at beginning of year $ 2,397 $ 2,157

Actual gain on plan assets 151 239

Employer contributions 307 277

Gross benefits paid and settlements (281) (269)

Other (12) (7)

Fair value of plan assets at end of year $ 2,562 $ 2,397

Funded status—Net amount recognized $ (2,241) $ (1,603)

Amounts recognized in the consolidated balance sheets consist of:

Noncurrent asset $ 2 $ 49

Current liability (17) (2)

Noncurrent liability (2,226) (1,650)

Total liability $ (2,241) $ (1,603)

Amounts recognized in accumulated other comprehensive loss consist of:

Net actuarial loss $ (982) $ (162)

Prior service loss (1) —

Total accumulated other comprehensive loss $ (983) $ (162)

85