United Airlines 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

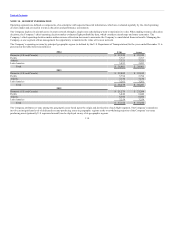

letters, consents, assistance with and review of documents filed with the SEC, work performed by tax professionals in connection with the audit and quarterly

reviews, and accounting and financial reporting consultations and research work necessary to comply with generally accepted auditing standards.

AUDIT RELATED FEES

In 2014, fees for audit related services consisted of an assessment of certain information technology security related controls.

TAX FEES

Tax fees for 2014 and 2013 include professional services provided for preparation of tax returns of certain expatriate employees, personal tax compliance and

advice, preparation of federal, foreign and state tax returns, review of tax returns prepared by the Company, research and consultations regarding tax

accounting and tax compliance matters and assistance in assembling data to prepare for and respond to governmental reviews of past tax filings, exclusive of

tax services rendered in connection with the audit.

ALL OTHER FEES

Fees for all other services billed in 2014 and 2013 consist of subscriptions to Ernst & Young LLP’s on-line accounting research tool.

(a)(1)

The financial statements required by this item are listed in Part II, Item 8,

herein.

(2)

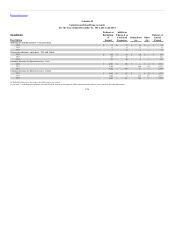

The financial statement schedule required by this item is listed below and included in this report after the

signature page hereto.

Schedule II-Valuation and Qualifying Accounts for the years ended December 31, 2014, 2013 and 2012.

All other schedules are omitted because they are not applicable, not required or the required information is shown in the consolidated

financial statements or notes thereto.

(b)

The exhibits required by this item are listed in the Exhibit Index which immediately precedes the exhibits filed with this Form 10-K

and is incorporated herein by this reference. Each management contract or compensatory plan or arrangement is denoted with a “†” in the

Exhibit Index.

123