United Airlines 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

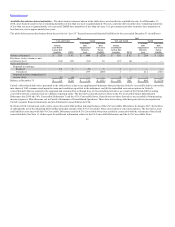

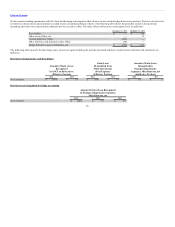

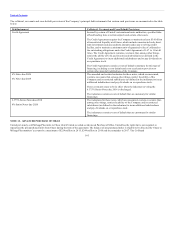

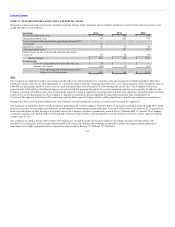

The collateral, covenants and cross default provisions of the Company’s principal debt instruments that contain such provisions are summarized in the table

below:

Credit Agreement

Secured by certain of United’s international route authorities, specified take-

off and landing slots at certain airports and certain other assets.

The Credit Agreement requires the Company to maintain at least $3.0 billion

of unrestricted liquidity at all times, which includes unrestricted cash, short-

term investments and any undrawn amounts under any revolving credit

facility, and to maintain a minimum ratio of appraised value of collateral to

the outstanding obligations under the Credit Agreement of 1.67 to 1.0 at all

times. The Credit Agreement contains covenants that, among other things,

restrict the ability of UAL and its restricted subsidiaries (as defined in the

Credit Agreement) to incur additional indebtedness and to pay dividends on

or repurchase stock.

The Credit Agreement contains events of default customary for this type of

financing, including a cross default and cross acceleration provision to

certain other material indebtedness of the Company.

6% Notes due 2026

6% Notes due 2028

The amended and restated indenture for these notes, which are unsecured,

contains covenants that, among other things, restrict the ability of the

Company and its restricted subsidiaries (as defined in the indenture) to incur

additional indebtedness and pay dividends on or repurchase stock.

These covenants cease to be in effect when the indenture covering the

6.375% Senior Notes due 2018 is discharged.

The indenture contains events of default that are customary for similar

financings.

6.375% Senior Notes due 2018

6% Senior Notes due 2020

The indentures for these notes, which are unsecured, contain covenants that,

among other things, restrict the ability of the Company and its restricted

subsidiaries (as defined in the indenture) to incur additional indebtedness

and pay dividends on or repurchase stock.

The indentures contain events of default that are customary for similar

financings.

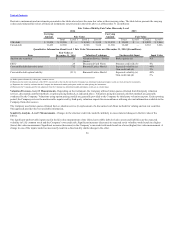

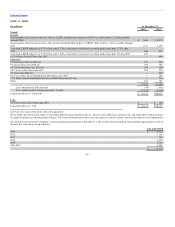

United previously sold MileagePlus miles to Chase which United recorded as Advanced Purchase of Miles. United has the right, but is not required, to

repurchase the pre-purchased miles from Chase during the term of the agreement. The balance of pre-purchased miles is eligible to be allocated by Chase to

MileagePlus members’ accounts by a maximum of $224 million in 2015, $249 million in 2016 and the remainder in 2017. The Co-Brand

103