United Airlines 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

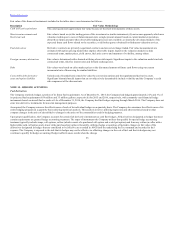

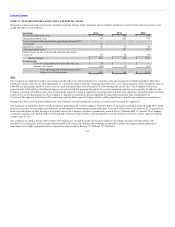

4.5% Senior Limited-Subordination Convertible Notes due 2021. On January 10, 2014, UAL called all of the 4.5% Notes that remained outstanding for

redemption on February 10, 2014. As a result, holders of substantially all of the remaining $156 million outstanding principal amount of the 4.5% Notes

exercised their right to convert such notes into approximately five million shares of UAL common stock at a conversion rate of 30.6419 shares of UAL

common stock per $1,000 principal amount of 4.5% Notes.

Convertible Debt Securities and Derivatives. UAL, United and the trustee for the 6% Convertible Debentures and the 4.5% Convertible Notes were parties to

supplemental indentures that made United’s convertible debt convertible into shares of UAL common stock. For purposes of United separate-entity reporting,

as a result of the remaining outstanding debt having been convertible into the stock of a non-consolidated entity, the embedded conversion options in

United’s convertible debt are required to be separated and accounted for as though they are free-standing derivatives. As a result, the carrying value of

United’s debt, net of current maturities, on a separate-entity reporting basis as of December 31, 2014 and December 31, 2013 was $1 million and $47 million,

respectively, lower than the consolidated UAL carrying value on those dates.

In addition, UAL’s contractual commitment to provide common stock to satisfy United’s obligation upon conversion of the debt is an embedded call option

on UAL common stock that was also required to be separated and accounted for as though it were a free-standing derivative. The fair value of the indenture

derivatives on a separate-entity reporting basis as of December 31, 2014 and December 31, 2013 was an asset of $712 million and $480 million, respectively.

The fair value of the embedded conversion options as of December 31, 2014 and December 31, 2013, was a liability of $511 million and $270 million,

respectively. The 2013 balances of the indenture derivatives and conversion options included amounts related to the 6% Convertible Debentures and the

4.5% Convertible Notes. The 6% Convertible Debentures and their related indenture derivative and conversion options were retired in 2014. The initial

contribution of the indenture derivatives to United by UAL is accounted for as additional paid-in capital in United’s separate-entity financial statements.

Changes in fair value of both the indenture derivatives and the embedded conversion options subsequent to October 1, 2010 are recognized in Nonoperating

income (expense).

6% Convertible Senior Notes due 2029During 2013, UAL issued approximately 28 million shares of UAL common stock pursuant to agreements that UAL

entered into with certain holders of its 6% Convertible Senior Notes in exchange for approximately $240 million in aggregate principal amount of these

notes held by such securityholders. The Company retired the 6% Convertible Senior Notes acquired in the exchange. In 2014, UAL issued approximately

12 million shares of UAL common stock in exchange for, or upon conversion of, $104 million in aggregate principal amount of UAL’s outstanding 6%

Convertible Senior Notes held by the holders of these notes. The Company retired the 6% Convertible Senior Notes acquired in the exchange.

102