United Airlines 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

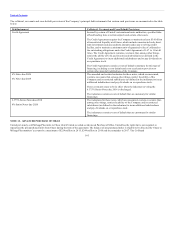

Table of Contents

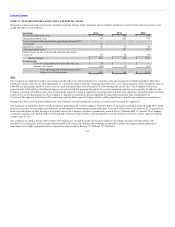

United used cash to retire, at par, the entire $248 million principal balance of the 6% Convertible Debentures and the 6% Convertible Preferred Securities,

Term Income Deferrable Equity Securities (TIDES) and incurred $74 million of expense primarily associated with the write-off of the related non-cash debt

discounts recorded due to purchase accounting during the Company’s merger transaction in 2010.

2013

The Company offered a voluntary retirement program for its fleet service, passenger service, storekeeper and pilot work groups. Approximately 1,200

employees volunteered under the program during the fourth quarter of 2013 and United recorded approximately $64 million of severance and benefit costs

for the programs. The Company also offered voluntary leave of absence programs which allowed for continued medical coverage for flight attendants who

volunteered during the leave of absence period, resulting in a charge of approximately $26 million. The remaining $15 million of severance and benefit costs

was related to involuntary severance programs associated with flight attendants and other work groups.

Integration-related costs included compensation costs related to systems integration and training, branding activities, new uniforms, write-off or acceleration

of depreciation on systems and facilities that were no longer used or planned to be used for significantly shorter periods, relocation for employees and

severance primarily associated with administrative headcount reductions.

The Company recorded $32 million of impairment charges of its flight equipment held for disposal associated with its Boeing 737-300 and 737-500 fleets

and $1 million on an intangible asset for a route to Manila in order to reflect the estimated fair value of this asset as part of the Company’s annual impairment

test of indefinite-lived intangible assets.

The fleet service, passenger service and storekeeper employees represented by the International Association of Machinists ratified a joint collective

bargaining agreement with the Company during 2013. The Company recorded a $127 million special charge for lump sum payments made in conjunction

with the ratification. The lump sum payments were not in lieu of future pay increases. The Company completed substantially all cash payments in 2013.

The Company recorded $18 million associated with the temporary grounding of its Boeing 787 aircraft. The charges were comprised of aircraft depreciation

expense and dedicated personnel costs that the Company incurred while the aircraft were grounded. The aircraft returned to service in May 2013. In addition,

the Company adjusted its reserves for certain legal matters by $29 million and recorded approximately $11 million in accruals for future rent associated with

the early retirement of four leased Boeing 757-200 aircraft. Additionally, the Company recorded a $5 million gain related to a contract termination and $3

million in gains on the sale of assets.

2012

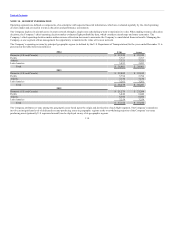

The Company recorded $125 million of severance and benefits associated with various voluntary retirement and leave of absence programs for its various

employee groups. During the first quarter of 2012, approximately 400 mechanics offered to retire early in exchange for a cash severance payment that was

based on the number of years of service each employee had accumulated. The expense for this voluntary program was approximately $32 million. The

Company also offered a voluntary leave of absence program that approximately 1,800 flight attendants accepted, which allowed for continued medical

coverage during the leave of absence period. The expense for this voluntary program was approximately $17 million. During the second quarter of 2012, as

part of the recently amended collective bargaining agreement with the Association of Flight Attendants, the Company offered a voluntary program for flight

attendants to retire early in exchange for a cash severance payment. The payments are dependent on the number of years of service each employee has

accumulated. Approximately 1,300 flight attendants accepted this program and the expense for this voluntary program was approximately $76 million.

Integration-related costs included compensation costs related to systems integration and training, branding activities, write-off or acceleration of depreciation

on systems and facilities that are either no longer used or

112