United Airlines 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

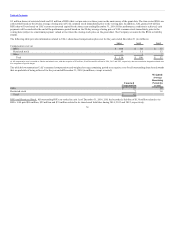

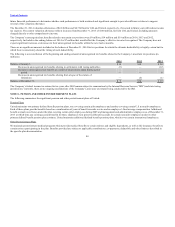

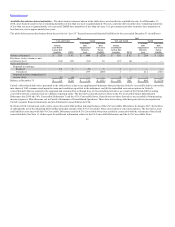

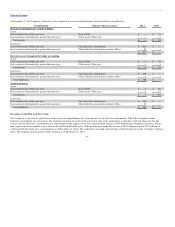

Discount rate 4.07% 4.94%

Discount rate 4.94% 4.12%

Expected return on plan assets 4.00% 4.00%

Health care cost trend rate assumed for next year 7.00% 7.25%

Rate to which the cost trend rate is assumed to decline (ultimate trend rate in 2023) 5.00% 5.00%

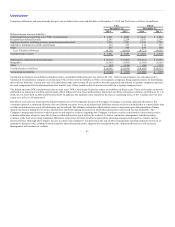

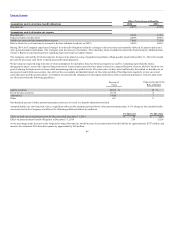

During 2014, the Company experienced changes in its benefit obligations related to changes in discount rates and mortality tables in its pension plans and

other postretirement benefit plans. The Company used the Society of Actuaries’ 2014 mortality tables, modified to reflect the Social Security Administration

Trustee’s Report on current projections regarding expected longevity improvements.

The Company selected the 2014 discount rate for most of its plans by using a hypothetical portfolio of high quality bonds at December 31, 2014, that would

provide the necessary cash flows to match projected benefit payments.

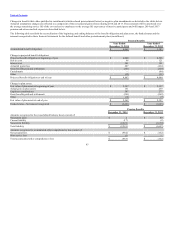

We develop our expected long-term rate of return assumption for such plans based on historical experience and by evaluating input from the trustee

managing the plans’ assets. Our expected long-term rate of return on plan assets for these plans is based on a target allocation of assets, which is based on our

goal of earning the highest rate of return while maintaining risk at acceptable levels. The plans strive to have assets sufficiently diversified so that adverse or

unexpected results from one security class will not have an unduly detrimental impact on the entire portfolio. Plan fiduciaries regularly review our actual

asset allocation and the pension plans’ investments are periodically rebalanced to our targeted allocation when considered appropriate. United’s plan assets

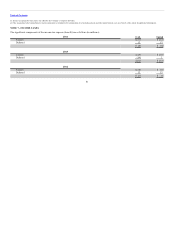

are allocated within the following guidelines:

Percent of

Total

Expected Long-Term

Rate of Return

Equity securities 40-54 % 10 %

Fixed-income securities 26-34 4

Alternatives 14-20 7

Other 4-8 6

One-hundred percent of other postretirement plan assets are invested in a deposit administration fund.

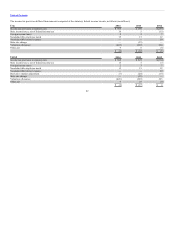

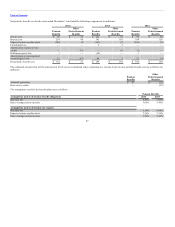

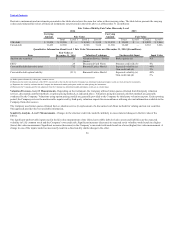

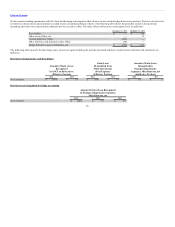

Assumed health care cost trend rates have a significant effect on the amounts reported for the other postretirement plans. A 1% change in the assumed health

care trend rate for the Company would have the following additional effects (in millions):

Effect on total service and interest cost for the year ended December 31, 2014 $ 13 $ (11)

Effect on postretirement benefit obligation at December 31, 2014 254 (220)

A one percentage point decrease in the weighted average discount rate would increase the postretirement benefit liability by approximately $247 million and

increase the estimated 2014 benefits expense by approximately $10 million.

88