United Airlines 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

planned to be used for significantly shorter periods, as well as relocation for employees and severance primarily associated with administrative headcount

reductions.

On December 31, 2012, UAL and United Air Lines, Inc. entered into an agreement with the Pension Benefit Guaranty Corporation (“PBGC”) that reduced the

aggregate amount of 8% Contingent Senior Notes to be issued by UAL, and eliminated the contingent nature of such obligation by replacing the $188

million principal amount of 8% Contingent Senior Notes incurred as of December 31, 2012 and the obligation to issue any additional 8% Contingent Senior

Notes with $400 million principal amount of new 8% Notes. In addition, UAL agreed to replace the $652 million principal amount outstanding of 6% Senior

Notes due 2031 with $326 million principal amount of new 6% Notes due 2026 and $326 million principal amount of 6% Notes due 2028 (collectively, the

“New 6% Notes” and together with the 8% Notes, the “New PBGC Notes”). The Company did not receive any cash proceeds in connection with the issuance

of the New PBGC Notes. The Company accounted for this agreement as a debt extinguishment, resulting in a charge of $309 million in 2012 that represented

the fair value of $212 million of 8% Notes that it agreed to issue and the change in the fair value of the New 6% Notes and the $188 million of 8% Notes

versus their previous carrying values. The Company classified the expense as a component of special charges within integration-related costs because the

note restructuring would not have occurred if it were not for the Company’s merger transaction in 2010.

The Company recorded impairment charges of $30 million on an intangible asset for European take-off and landing slots in order to reflect the estimated fair

value of these assets as part of its annual impairment test of indefinite-lived intangible assets.

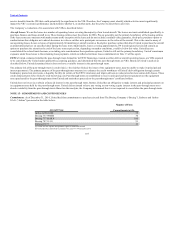

In December 2012, the pilots represented by the Air Line Pilots Association, International ratified a new joint collective bargaining agreement with the

Company. The Company recorded $475 million of expense associated with lump sum cash payments that would be made in conjunction with the ratification

of the contract and the completion of the integrated pilot seniority list. This charge also includes $80 million associated with changes to existing pilot

disability plans negotiated in connection with the agreement. The lump sum payments are not in lieu of future pay increases. The Company completed

substantially all cash payments in 2013.

The Company recorded net gains of $46 million related to gains and losses on the disposal of aircraft and related parts and other assets.

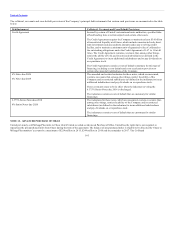

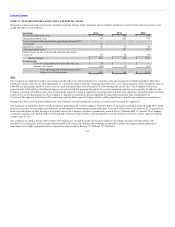

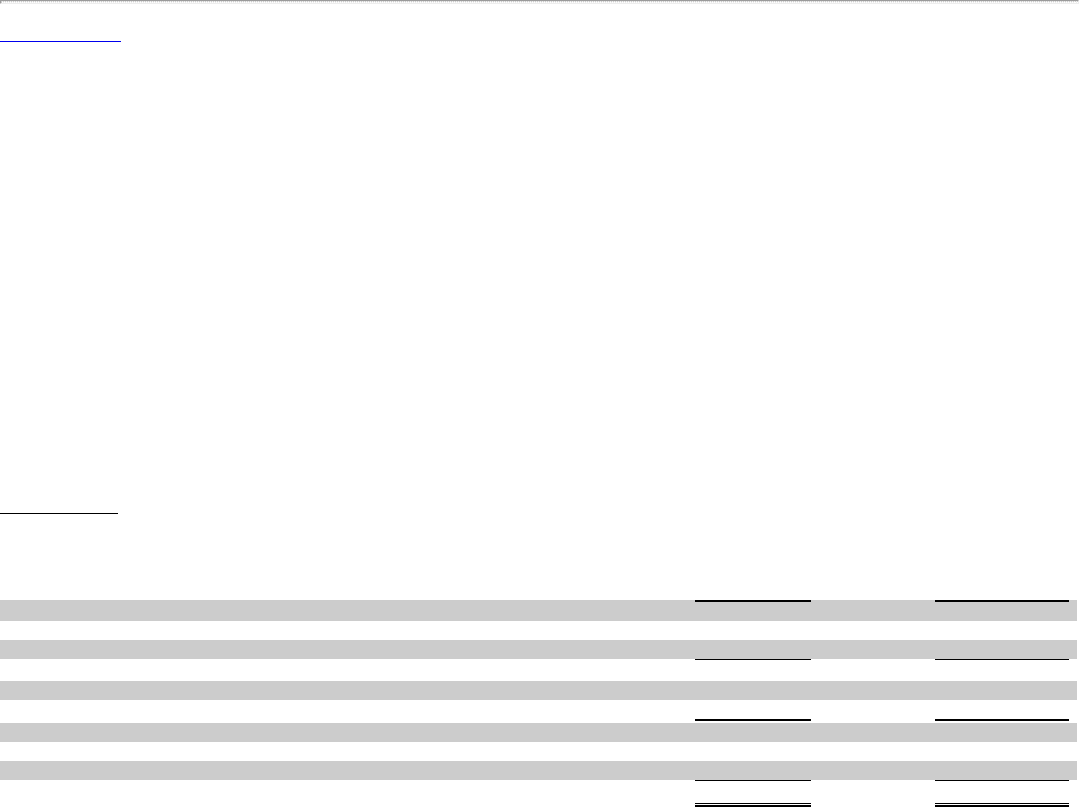

Activity related to the accruals for severance and medical costs and future lease payments on permanently grounded aircraft is as follows (in millions):

Balance at December 31, 2011 $ 55 $ 31

Accrual 170 (1)

Payments (160) (25)

Balance at December 31, 2012 65 5

Accrual 120 10

Payments (94) (4)

Balance at December 31, 2013 91 11

Accrual 199 102

Payments (181) (11)

Balance at December 31, 2014 $ 109 $ 102

The Company’s accrual and payment activity is primarily related to severance and other compensation expense associated with voluntary employee

programs and the Company’s merger transaction in 2010, respectively.

113