United Airlines 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

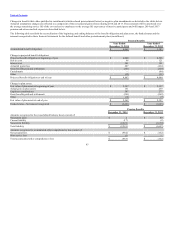

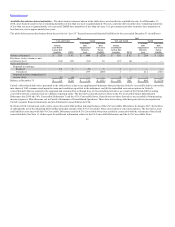

Fair value of the financial instruments included in the tables above was determined as follows:

The carrying amounts approximate fair value because of the short-term maturity of these assets.

Fair value is based on (a) the trading prices of the investment or similar instruments, (b) an income approach, which uses

valuation techniques to convert future amounts into a single present amount based on current market expectations

about those future amounts when observable trading prices are not available, (c) internally-developed models of the

expected future cash flows related to the securities, or (d) broker quotes obtained by third-party valuation services.

Derivative contracts are privately negotiated contracts and are not exchange traded. Fair value measurements are

estimated with option pricing models that employ observable inputs. Inputs to the valuation models include

contractual terms, market prices, yield curves, fuel price curves and measures of volatility, among others.

Fair value is determined with a formula utilizing observable inputs. Significant inputs to the valuation models include

contractual terms, risk-free interest rates and forward exchange rates.

Fair values were based on either market prices or the discounted amount of future cash flows using our current

incremental rate of borrowing for similar liabilities.

United used a binomial lattice model to value the conversion options and the supplemental derivative assets.

Significant binomial model inputs that are not objectively determinable include volatility and the Company’s credit

risk component of the discount rate.

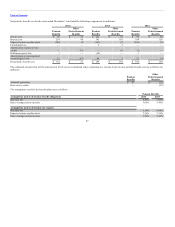

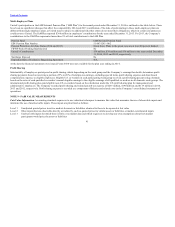

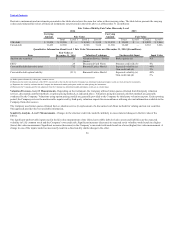

Fuel Derivatives

The Company routinely hedges a portion of its future fuel requirements. As of December 31, 2014, the Company had hedged approximately 22% and 1% of

its projected fuel requirements (859 million and 35 million gallons, respectively) for 2015 and 2016, respectively, with commonly used financial hedge

instruments based on aircraft fuel or crude oil. As of December 31, 2014, the Company had fuel hedges expiring through March 2016. The Company does not

enter into derivative instruments for non-risk management purposes.

As required, the Company assesses the effectiveness of each of its individual hedges on a quarterly basis. The Company also examines the effectiveness of its

entire hedging program on a quarterly basis utilizing statistical analysis. This analysis involves utilizing regression and other statistical analyses that

compare changes in the price of aircraft fuel to changes in the prices of the commodities used for hedging purposes.

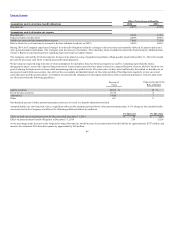

Upon proper qualification, the Company accounts for certain fuel derivative instruments as cash flow hedges. All derivatives designated as hedges that meet

certain requirements are granted hedge accounting treatment. The types of instruments the Company utilizes that qualify for special hedge accounting

treatment typically include swaps, call options, collars (which consist of a purchased call option and a sold put option) and four-way collars (a collar with a

higher strike sold call option and a lower strike purchased put option). Generally, utilizing hedge accounting, all periodic changes in fair value of the

derivatives designated as hedges that are considered to be effective are recorded in AOCI until the underlying fuel is consumed and recorded in fuel

expense. The Company is exposed to the risk that its hedges may not be effective in offsetting changes in the cost of fuel and that its hedges may not

continue to qualify for hedge accounting. Hedge ineffectiveness results when the change

95