United Airlines 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

counterparties. Restricted cash is classified as short-term or long-term in the consolidated balance sheets based on the expected timing of return of

the assets to the Company. Airline industry practice includes classification of restricted cash flows as either investing cash flows or operating cash

flows. Cash flows related to restricted cash activity are classified as investing activities because the Company considers restricted cash arising from

these activities similar to an investment.

(e) Short-term investments are classified as available-for-sale and are stated at fair value. Realized gains and losses on sales

of investments are reflected in nonoperating income (expense) in the consolidated statements of operations. Unrealized gains and losses on

available-for-sale securities are reflected as a component of accumulated other comprehensive income (loss).

(f) The Company accounts for aircraft fuel, spare parts and supplies at average cost and provides an

obsolescence allowance for aircraft spare parts with an assumed residual value of 10% to 11% of original cost depending on the fleet type.

(g) The Company records additions to owned operating property and equipment at cost when acquired. Property under

capital leases and the related obligation for future lease payments are recorded at an amount equal to the initial present value of those lease

payments. Modifications that enhance the operating performance or extend the useful lives of airframes or engines are capitalized as property and

equipment. It is the Company’s policy to record compensation from delays in delivery of aircraft as a reduction of the cost of the related aircraft.

Depreciation and amortization of owned depreciable assets is based on the straight-line method over the assets’ estimated useful lives. Leasehold

improvements are amortized over the remaining term of the lease, including estimated facility renewal options when renewal is reasonably assured

at key airports, or the estimated useful life of the related asset, whichever is less. Properties under capital leases are amortized on the straight-line

method over the life of the lease or, in the case of certain aircraft, over their estimated useful lives, whichever is shorter. Amortization of capital

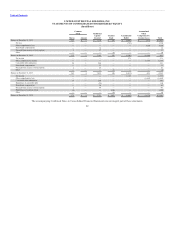

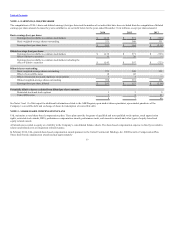

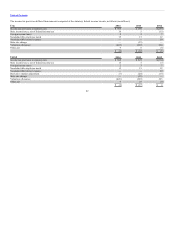

lease assets is included in depreciation and amortization expense. The estimated useful lives of property and equipment are as follows:

Aircraft and related rotable parts 25 to 30

Buildings 25 to 45

Other property and equipment 3 to 15

Computer software 5

Building improvements 1 to 40

As of December 31, 2014 and 2013, the Company had a carrying value of computer software of $281 million and $290 million, respectively. For

the years ended December 31, 2014, 2013 and 2012, the Company’s depreciation expense related to computer software was $81 million, $72

million and $81 million, respectively. Aircraft and aircraft parts were assumed to have residual values with a range of 10% to 11% of original cost,

depending on type, and other categories of property and equipment were assumed to have no residual value.

(h) The cost of maintenance and repairs, including the cost of minor replacements, is charged to expense as incurred,

except for costs incurred under our power-by-the-hour (“PBTH”) engine maintenance agreements. PBTH contracts transfer certain risk to third-

party service providers and fix the amount we pay per flight hour or per cycle to the service provider in exchange for maintenance and repairs

under a predefined maintenance program. Under PBTH agreements, the Company recognizes expense at a level rate per engine hour, unless the

level of service effort and the related payments during the period are substantially consistent, in which case the Company recognizes expense

based on the amounts paid.

72