United Airlines 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

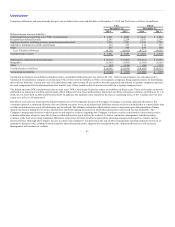

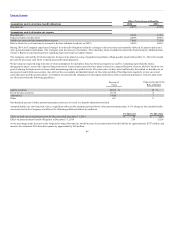

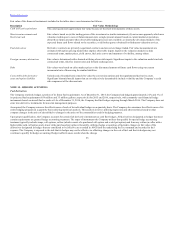

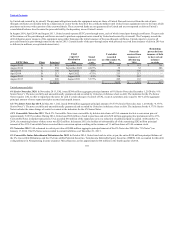

—The short-term investments shown in the table above are classified as available-for-sale. As of December 31,

2014, asset-backed securities have remaining maturities of less than one year to approximately 40 years, corporate debt securities have remaining maturities

of less than one year to approximately six years and CDARS have maturities of less than one year. U.S. government and other securities have maturities of

less than one year to approximately four years.

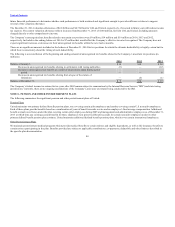

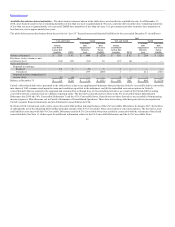

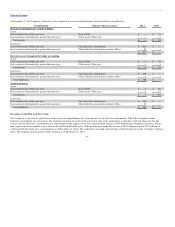

The tables below present disclosures about the activity for “Level 3” financial assets and financial liabilities for the year ended December 31 (in millions):

Balance at January 1 $ 105 $ 61 $ 480 $ (270) $ 116 $ 63 $ 268 $ (128)

Purchases, (sales), issuances and

settlements (net) (84) (33) (62) 34 (19) (4) — —

Gains and (losses):

Reported in earnings:

Realized 10 1 (5) 5 3 — — —

Unrealized — — 299 (280) 1 — 212 (142)

Reported in other comprehensive

income (loss) (5) (1) — — 4 2 — —

Balance at December 31 $ 26 $ 28 $ 712 $ (511) $ 105 $61 $ 480 $ (270)

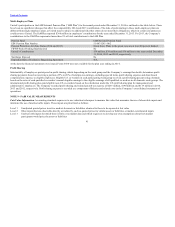

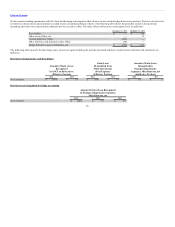

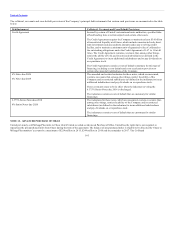

United’s debt-related derivatives presented in the tables above relate to (a) supplemental indentures that provide that United’s convertible debt is convertible

into shares of UAL common stock upon the terms and conditions specified in the indentures, and (b) the embedded conversion options in United’s

convertible debt that are required to be separated and accounted for as though they are free-standing derivatives as a result of the United debt becoming

convertible into the common stock of a different reporting entity. The derivatives described above relate to the 6% Convertible Junior Subordinated

Debentures due 2030 (the “6% Convertible Debentures”) and the 4.5% Convertible Notes. Gains (losses) on these derivatives are recorded in Nonoperating

income (expense): Miscellaneous, net in United’s Statements of Consolidated Operations. These derivatives along with their gains (losses) are reported in

United’s separate financial statements and are eliminated in consolidation for UAL.

In October 2014, United used cash to retire, at par, the entire $248 million principal balance of the 6% Convertible Debentures. In January 2015, the holders

of substantially all of the remaining $202 million principal amount of the 4.5% Convertible Notes exercised their conversion options. The derivative assets

and liabilities associated with the 6% Convertible Debentures and the 4.5% Convertible Notes were settled in connection with the retirement of the related

convertible debt. See Note 11 of this report for additional information related to the 6% Convertible Debentures and the 4.5% Convertible Notes.

93