United Airlines 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

from one security class will not have an unduly detrimental impact on the entire portfolio. Plan fiduciaries regularly review actual asset allocation and the

pension plans’ investments are periodically rebalanced to the targeted allocation when considered appropriate.

The defined benefit pension plans’ assets consist of return generating investments and risk mitigating investments which are held through direct ownership or

through interests in common collective trusts. Return generating investments include primarily equity securities, fixed-income securities and alternative

investments (e.g. private equity and hedge funds). Risk mitigating investments include primarily U.S. government and investment grade corporate fixed-

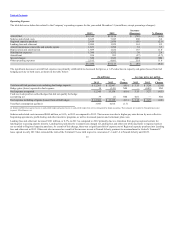

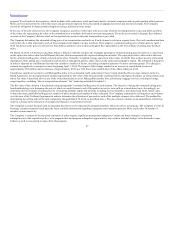

income securities. The allocation of assets was as follows at December 31, 2014:

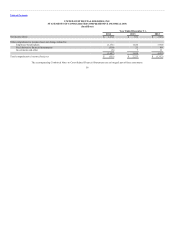

Percent of Total

Expected Long-Term

Rate of Return

Equity securities 46 % 10 %

Fixed-income securities 32 4

Alternatives 14 7

Other 8 6

Pension expense increases as the expected rate of return on plan assets decreases. Lowering the expected long-term rate of return on plan assets by 50 basis

points (from 7.36% to 6.86%) would increase estimated 2015 pension expense by approximately $13 million.

Future pension obligations for United’s plans were discounted using a weighted average rate of 4.20% at December 31, 2014. The Company selected the

2014 discount rate for each of its plans by using a hypothetical portfolio of high quality bonds at December 31, 2014 that would provide the necessary cash

flows to match the projected benefit payments.

The pension liability and future pension expense both increase as the discount rate is reduced. Lowering the discount rate by 50 basis points (from 4.20% to

3.7%) would increase the pension liability at December 31, 2014 by approximately $532 million and increase the estimated 2015 pension expense by

approximately $61 million.

Future changes in plan asset returns, plan provisions, assumed discount rates, pension funding law and various other factors related to the participants in our

pension plans will impact our future pension expense and liabilities. We cannot predict with certainty what these factors will be in the future.

Actuarial gains or losses are triggered by changes in assumptions or experience that differ from the original assumptions. Under the applicable accounting

standards for defined benefit pension plans, those gains and losses are not required to be recognized currently as pension benefit expense, but instead may be

deferred as part of accumulated other comprehensive income and amortized into expense over the average remaining service life of the covered active

employees. All gains and losses in accumulated other comprehensive income are amortized to expense over the remaining years of service of the covered

active employees. At December 31, 2014 and 2013, the Company had unrecognized actuarial losses for pension benefit plans of $982 million and $162

million, respectively, recorded in accumulated other comprehensive income.

During 2014, the Company experienced changes in its benefit obligations related to changes in discount rates and mortality tables in its pension plans. The

Company used the Society of Actuaries’ 2014 mortality tables, modified to reflect the Social Security Administration Trustee’s Report on current projections

regarding expected longevity improvements. See Note 8 to the financial statements included in Part II, Item 8 of this report for additional information related

to pension plans.

Other Postretirement Benefit Plan Accounting. United’s postretirement plan provides certain health care benefits, primarily in the United States, to retirees

and eligible dependents, as well as certain life insurance benefits to certain retirees reflected as “Other Benefits.” United also has retiree medical programs

that permit

49