United Airlines 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

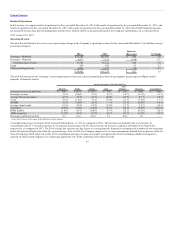

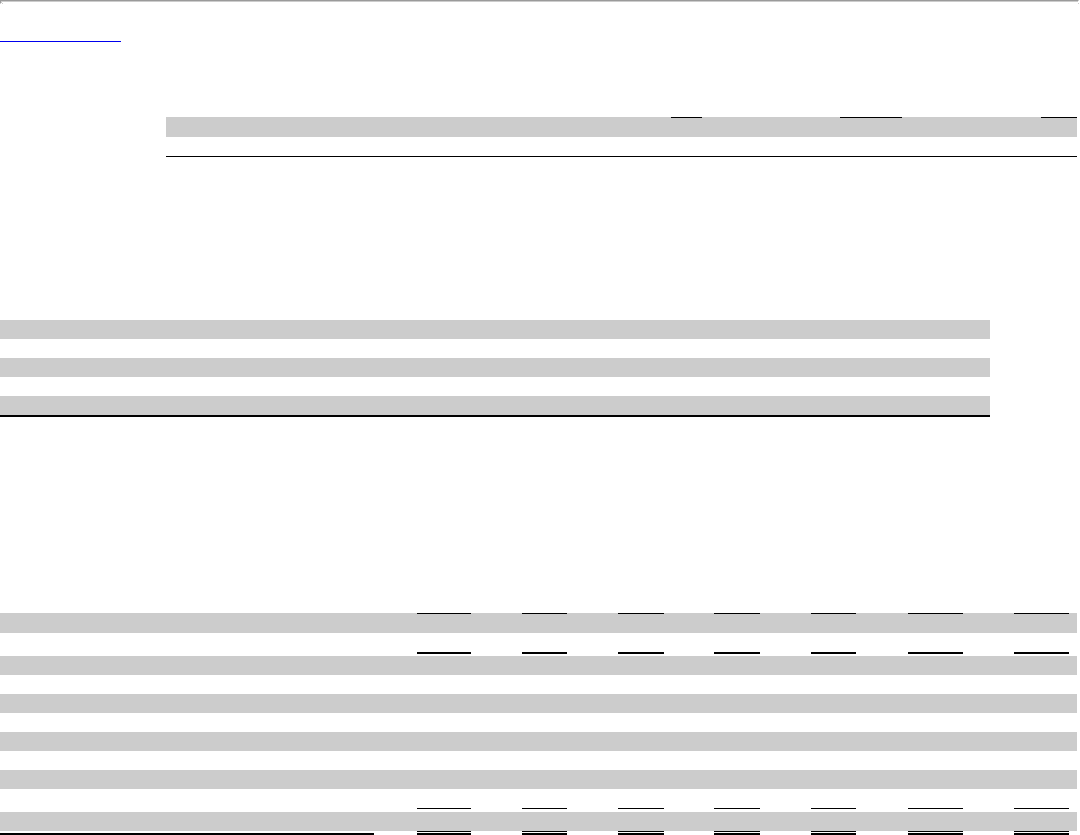

Credit Ratings. As of the filing date of this report, UAL and United had the following corporate credit ratings:

S&P Moody’s Fitch

UAL B B1 B

United B * B

*The credit agency does not issue corporate credit ratings for subsidiary entities.

These credit ratings are below investment grade levels. Downgrades from these rating levels, among other things, could restrict the availability or increase the

cost of future financing for the Company.

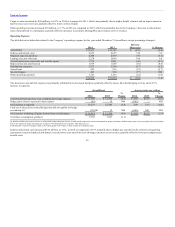

Below is a summary of additional liquidity matters. See the indicated notes to our consolidated financial statements included in Part II, Item 8 of this report

for additional details related to these and other matters affecting our liquidity and commitments.

Pension and other postretirement plans Note 8

Hedging activities Note 10

Long-term debt and debt covenants (a) Note 11

Leases and capacity purchase agreements Note 13

Commitments and contingencies Note 15

(a) Certain of the Company’s financing agreements have covenants that impose certain operating and financial restrictions, as applicable, on the Company and its material subsidiaries.

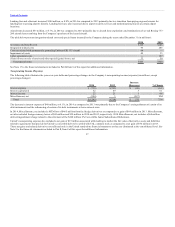

Contractual Obligations. The Company’s business is capital intensive, requiring significant amounts of capital to fund the acquisition of assets, particularly

aircraft. In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing debt, by entering into capital or operating

leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports to ensure access to terminal, cargo,

maintenance and other required facilities.

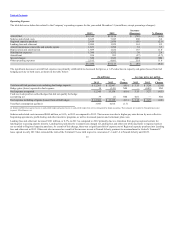

The table below provides a summary of the Company’s material contractual obligations as of December 31, 2014 (in billions):

Long-term debt (a) $ 1.3 $1.2 $0.8 $1.3 $1.7 $ 5.2 $11.5

Capital lease obligations—principal portion 0.1 0.1 0.1 0.1 — 0.3 0.7

Total debt and capital lease obligations 1.4 1.3 0.9 1.4 1.7 5.5 12.2

Interest on debt and capital lease obligations (b) 0.7 0.6 0.5 0.3 0.3 1.1 3.5

Aircraft operating lease obligations 1.4 1.2 1.1 0.9 0.7 2.0 7.3

Regional CPAs (c) 1.9 1.8 1.7 1.3 1.0 3.4 11.1

Other operating lease obligations 1.3 1.1 1.1 0.8 0.8 7.9 13.0

Postretirement obligations (d) 0.1 0.1 0.1 0.1 0.1 0.8 1.3

Pension obligations (e) 0.1 — 0.1 0.2 0.2 1.6 2.2

Capital purchase obligations (f) 3.2 2.3 1.3 2.2 3.3 10.7 23.0

Total contractual obligations $10.1 $8.4 $6.8 $7.2 $8.1 $33.0 $73.6

(a) Long-term debt presented in the Company’s financial statements is net of a $99 million debt discount which is being amortized over the debt terms. Contractual payments are not net of the debt discount.

Contractual long-term debt includes $65 million of non-cash obligations as these debt payments are made directly to the creditor by a company that leases three aircraft from United. The creditor’s only

recourse to United is repossession of the aircraft.

44