United Airlines 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

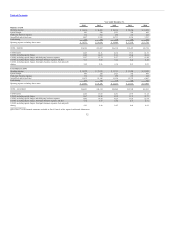

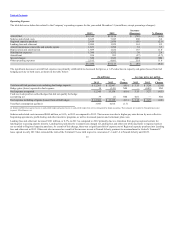

Cash Flows from Investing Activities

The Company’s capital expenditures were $2.0 billion and $2.2 billion in 2014 and 2013, respectively. The Company’s capital expenditures for both years

were primarily attributable to the purchase of aircraft, facility and fleet-related costs.

The Company’s capital expenditures were $2.2 billion and $2 billion in 2013 and 2012, respectively. The Company’s capital expenditures for both years

were primarily attributable to the purchase of aircraft and other fleet-related expenditures to improve the onboard experience of our customers on our existing

aircraft.

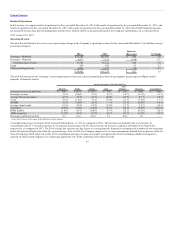

Cash Flows from Financing Activities

Significant financing events in 2014 were as follows:

Share Repurchases

The Company used $320 million of cash to purchase 6.5 million shares of its common stock during 2014 under its $1 billion share repurchase program. As

of December 31, 2014, the Company has $680 million remaining to spend under that program. See Part II, Item 5, “Market for Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” of this report for additional information.

Debt Issuances

During 2014, United issued debt related to three separate enhanced equipment trust certificate (“EETC”) offerings to finance new aircraft deliveries,

bringing the total issued at year end 2014 pursuant to these three EETC offerings to $2.0 billion. Including the EETC offering in 2013, United recorded

$1.8 billion of proceeds as debt during 2014. See Note 16 to the financial statements included in Part II, Item 8 of this report for additional information on

financing activities not affecting cash related to net property and equipment acquired through issuance of debt.

United borrowed a $500 million term loan under the Credit Agreement.

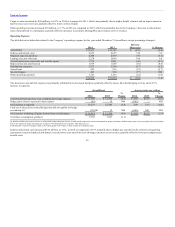

Debt and Capital Lease Payments

During the year ended December 31, 2014, the Company made debt and capital lease payments of $2.6 billion, including the following prepayments:

• UAL retired, at par, $400 million principal balance of its 8% Notes due 2024.

• United used cash to purchase approximately $276 million principal amount of convertible notes and retired the notes.

• United retired, at par, the entire $800 million principal balance of its 6.75% Senior Secured Notes.

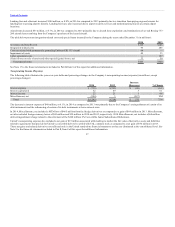

Financing Activities Not Affecting Cash

UAL amended its revolving credit facility under the Credit Agreement increasing the capacity from $1.0 billion to $1.35 billion and establishing the

maturity date for $1.315 billion in lender commitments as January 2, 2019.

UAL issued approximately 17 million shares in exchange for, or conversion of, $260 million of convertible notes and retired the notes.

42