United Airlines 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

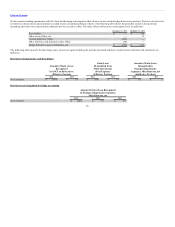

by United and secured by its aircraft. The payment obligations under the equipment notes are those of United. Proceeds received from the sale of pass-

through certificates are initially held by a depositary in escrow for the benefit of the certificate holders until United issues equipment notes to the trust, which

purchases such notes with a portion of the escrowed funds. These escrowed funds are not guaranteed by United and are not reported as debt on United’s

consolidated balance sheet because the proceeds held by the depositary are not United’s assets.

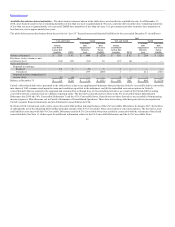

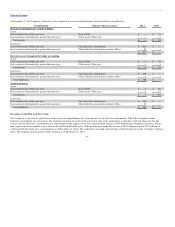

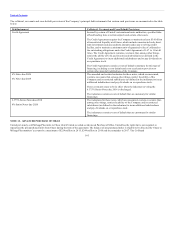

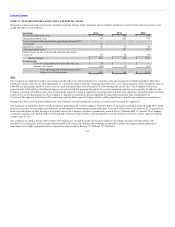

In August 2014, April 2014 and August 2013, United created separate EETC pass-through trusts, each of which issued pass-through certificates. The proceeds

of the issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its aircraft. The Company records the

debt obligation upon issuance of the equipment notes rather than upon the initial issuance of the pass-through certificates. United expects to receive all

proceeds from these pass-through trusts by the end of 2015. Certain details of the pass-through trusts with proceeds received from issuance of debt in 2014 are

as follows (in millions, except stated interest rate):

August 2014 A $ 823 September 2026 3.75% $ 112 $ 112 $ 711

August 2014 B 238 September 2022 4.625% 32 32 206

April 2014 A 736 April 2026 4.0% 736 736 —

April 2014 B 213 April 2022 4.75% 213 213 —

August 2013 A 720 August 2025 4.3% 720 567 —

August 2013 B 209 August 2021 5.375% 209 165 —

$ 2,939 $ 2,022 $ 1,825 $ 917

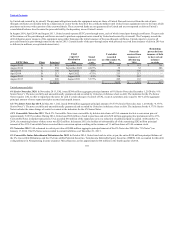

6% Senior Notes due 2020. In November 2013, UAL issued $300 million aggregate principal amount of 6% Senior Notes due December 1, 2020 (the “6%

Senior Notes”). The notes are fully and unconditionally guaranteed and recorded by United on its balance sheet as debt. The indenture for the 6% Senior

Notes requires UAL to offer to repurchase the notes for cash if certain changes of control of UAL occur at a purchase price equal to 101% of the aggregate

principal amount of notes repurchased plus accrued and unpaid interest.

6.375% Senior Notes due 2018. In May 2013, UAL issued $300 million aggregate principal amount of 6.375% Senior Notes due June 1, 2018 (the “6.375%

Senior Notes”). The notes are fully and unconditionally guaranteed and recorded by United on its balance sheet as debt. The indenture for the 6.375% Senior

Notes includes the same change of control covenant as the indenture for the 6% Senior Notes.

4.5% Convertible Notes due 2015. The 4.5% Convertible Notes were convertible by holders into shares of UAL common stock at a conversion price of

approximately $18.93 per share. During 2014, United used $62 million of cash to purchase and retire $28 million aggregate principal amount of its 4.5%

Convertible Notes in market transactions. UAL recorded $34 million of the repurchase cost as a reduction of additional paid-in capital. At December 31,

2014, the remaining balance of these notes was $202 million. In January 2015, the holders of substantially all of the remaining $202 million principal

amount of the 4.5% Convertible Notes exercised their conversion option resulting in the issuance of 11 million shares of UAL common stock.

8% Notes due 2024. UAL redeemed in cash at par value all $400 million aggregate principal amount of the 8% Notes due 2024 (the “8% Notes”) on

January 17, 2014. The 8% Notes were recorded in current liabilities as of December 31, 2013.

6% Convertible Junior Subordinated Debentures due 2030. In October 2014, United used cash to retire, at par, the entire $248 million principal balance of

the 6% Convertible Debentures and the 6% Convertible Preferred Securities, Term Income Deferrable Equity Securities (TIDES). UAL accounted for this debt

extinguishment in Nonoperating income (expense): Miscellaneous, net for approximately $64 million in the fourth quarter of 2014.

101