United Airlines 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

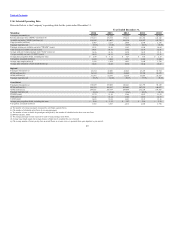

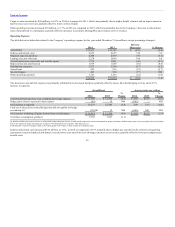

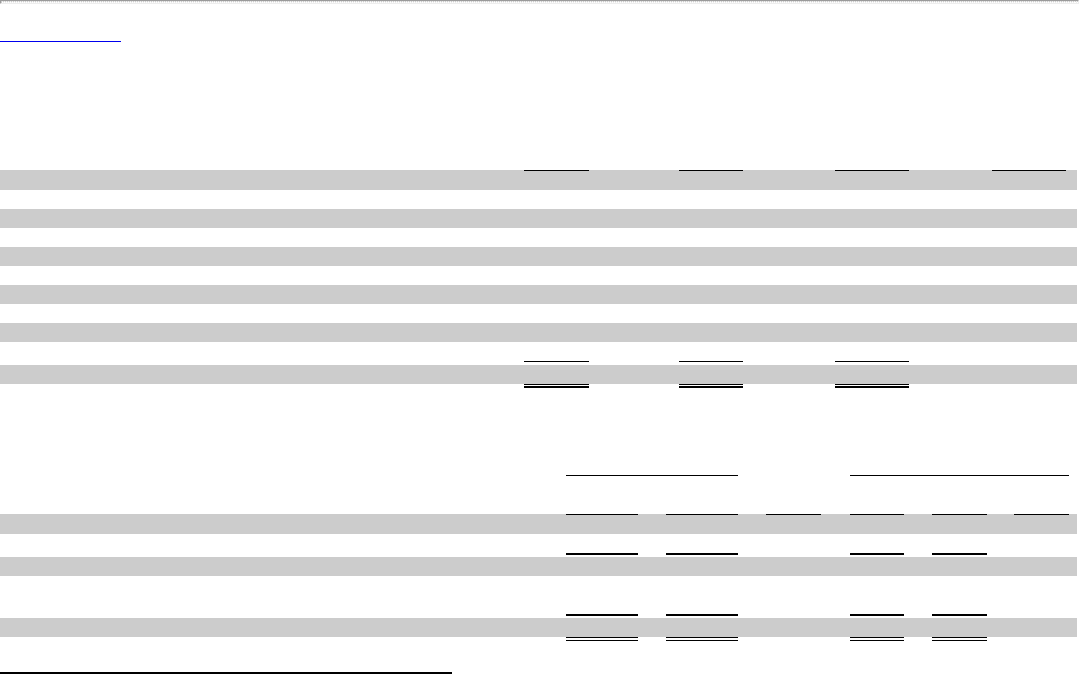

Operating Expense

The table below includes data related to the Company’s operating expense for the year ended December 31 (in millions, except percentage changes):

Aircraft fuel $12,345 $13,138 $ (793) (6.0)

Salaries and related costs 8,625 7,945 680 8.6

Regional capacity purchase 2,419 2,470 (51) (2.1)

Landing fees and other rent 2,090 1,929 161 8.3

Aircraft maintenance materials and outside repairs 1,821 1,760 61 3.5

Depreciation and amortization 1,689 1,522 167 11.0

Distribution expenses 1,390 1,352 38 2.8

Aircraft rent 936 993 (57) (5.7)

Special charges 520 1,323 (803) NM

Other operating expenses 5,195 4,681 514 11.0

$37,030 $37,113 $ (83) (0.2)

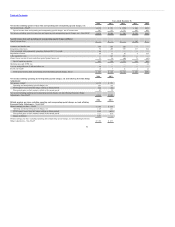

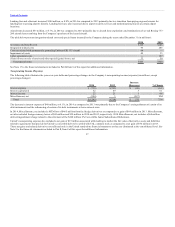

The significant decrease in aircraft fuel expense was primarily attributable to decreased fuel prices, a 1.4% reduction in capacity and gains (losses) from fuel

hedging activity in both years, as shown in the table below:

Total aircraft fuel purchase cost excluding fuel hedge impacts $ 12,363 $ 12,997 (4.9) $ 3.13 $ 3.24 (3.4)

Hedge gains (losses) reported in fuel expense 18 (141) NM — (0.03) NM

Fuel expense as reported 12,345 13,138 (6.0) 3.13 3.27 (4.3)

Cash received (paid) on settled hedges that did not qualify for hedge

accounting (a) 39 (1) NM 0.01 — NM

Fuel expense including all gains (losses) from settled hedges $ 12,306 $ 13,139 (6.3) $ 3.12 $ 3.27 (4.6)

Total fuel consumption (gallons) 3,947 4,016 (1.7)

(a) Includes ineffectiveness gains (losses) on cash-settled hedges and gains (losses) on cash-settled hedges that were not designated for hedge accounting. These amounts are recorded in Nonoperating income

(expense): Miscellaneous, net.

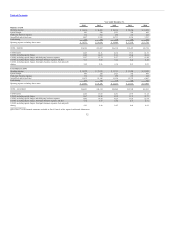

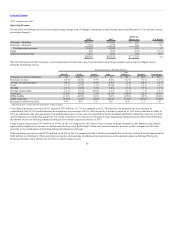

Salaries and related costs increased $680 million, or 8.6%, in 2013 as compared to 2012. The increase was due to higher pay rates driven by new collective

bargaining agreements, profit sharing and other incentive programs, as well as increased pension and retirement plan costs.

Landing fees and other rent increased $161 million, or 8.3%, in 2013 as compared to 2012 primarily due to a transition from paying regional carriers for

landing fees to paying airports directly. Landing fees paid directly to airports are charged to Landing fees and other rent while payments to regional carriers

are recorded to Regional capacity purchase. As a result of this change, there was a significant shift of expense out of Regional capacity purchase into Landing

fees and other rent in 2013. Other rent also increased as a result of the increase in rent at Newark Liberty pursuant to an amendment to United’s Terminal C

lease signed in early 2013 that extended the term of the Terminal C lease with respect to concourses C-1 and C-2 at Newark Liberty until 2033.

39