United Airlines 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

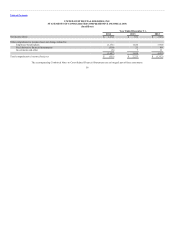

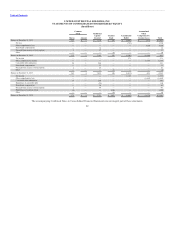

Our net income (loss) is affected by fluctuations in interest rates (e.g. interest expense on variable rate debt and interest income earned on

short-term investments). The Company’s policy is to manage interest rate risk through a combination of fixed and variable rate debt. The following table

summarizes information related to the Company’s interest rate market risk at December 31 (in millions):

Carrying value of variable rate debt at December 31 $2,534 $2,534 $ 2,136 $ 2,136

Impact of 100 basis point increase on projected interest expense for the following year 24 24 20 20

Carrying value of fixed rate debt at December 31 8,900 8,899 9,403 9,252

Fair value of fixed rate debt at December 31 9,971 9,971 10,575 10,128

Impact of 100 basis point increase in market rates on fair value (385) (385) (321) (320)

A change in market interest rates would also impact interest income earned on our cash, cash equivalents and short-term investments. Assuming our cash,

cash equivalents and short-term investments remain at their average 2014 levels, a 100 basis point increase in interest rates would result in a corresponding

increase in the Company’s interest income of approximately $51 million during 2015.

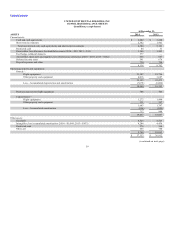

Commodity Price Risk (Aircraft Fuel). The price level of aircraft fuel can significantly affect the Company’s operations, results of operations, financial

position and liquidity.

To protect against increases in the prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. The Company generally uses

financial hedge instruments including fixed price swaps, purchased call options, and commonly used combinations using put and call options including

collars (a sold put option combined with a purchased call option), three-ways (a collar with a higher strike sold call option) and four-way collars (a collar with

a higher strike sold call option and a lower strike purchased put option). These hedge instruments are generally based on aircraft fuel or closely related

commodities including diesel fuel and crude oil.

If the prices of the underlying commodity drop and stay below specified floor prices in some hedge contracts such as fixed price swaps and collars, the

Company may incur losses. However, the negative impact of these losses would be significantly outweighed by the benefit of lower aircraft fuel cost since the

Company typically hedges only a portion of its future fuel requirements. In addition, the Company continually monitors its portfolio of hedge contracts and

may take actions to curtail or limit its losses from such hedge contracts if market conditions change. The Company does not enter into derivative instruments

for non-risk management purposes.

If fuel prices decline significantly from the levels existing at the time we enter into a hedge contract, we may be required to post collateral (margin) with our

hedge counterparties. The Company frequently monitors this margin risk and assesses the potential of depositing additional collateral with each of its

counterparties. At times, when the fair market value of the Company’s hedge contracts is net positive to the Company, it is exposed to the event of non-

performance by the counterparty to the hedge contract. The Company periodically monitors the credit worthiness of its counterparties, requires its

counterparties to post collateral above certain thresholds and generally limits its exposure to any single counterparty.

52