United Airlines 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company records passenger revenue related to the air transportation element when the transportation is delivered. The other elements are generally

recognized as Other operating revenue when earned.

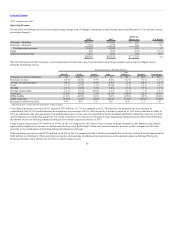

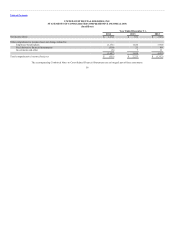

The following table summarizes information related to the Company’s frequent flyer deferred revenue liability:

Frequent flyer deferred revenue at December 31, 2014 (in millions) $4,937

% of miles earned expected to expire 18%

Impact of 1% change in outstanding miles or weighted average ticket value on deferred revenue (in millions) $ 55

Effective March 1, 2015, the Company will modify its MileagePlus program for most tickets from the current model in which members earn redeemable miles

based on distance traveled to one based on ticket price (including base fare and carrier imposed surcharges). Members will be able to earn between five and

eleven miles per dollar spent based on their MileagePlus status. The updated program will enhance the rewards for customers who spend more with United

and give them improved mileage-earning opportunities.

Long-Lived Assets. The net book value of operating property and equipment for the Company was $19 billion and $18 billion at December 31, 2014 and

December 31, 2013, respectively. The assets’ recorded value is impacted by a number of accounting policy elections, including the estimation of useful lives

and residual values and, when necessary, the recognition of asset impairment charges.

The Company records assets acquired, including aircraft, at acquisition cost. Depreciable life is determined through economic analysis, such as reviewing

existing fleet plans, obtaining appraisals and comparing estimated lives to other airlines that operate similar fleets. As aircraft technology has improved,

useful life has increased and the Company has generally estimated the lives of those aircraft to be 30 years. Residual values are estimated based on historical

experience with regard to the sale of both aircraft and spare parts and are established in conjunction with the estimated useful lives of the related fleets.

Residual values are based on when the aircraft are acquired and typically reflect asset values that have not reached the end of their physical life. Both

depreciable lives and residual values are revised periodically as facts and circumstances arise to recognize changes in the Company’s fleet plan and other

relevant information. A one-year increase in the average depreciable life of the Company’s flight equipment would reduce annual depreciation expense on

flight equipment by approximately $50 million.

The Company evaluates the carrying value of long-lived assets and intangible assets subject to amortization whenever events or changes in circumstances

indicate that an impairment may exist. For purposes of this testing, the Company has generally identified the aircraft fleet type as the lowest level of

identifiable cash flows for purposes of testing aircraft for impairment. An impairment charge is recognized when the asset’s carrying value exceeds its net

undiscounted future cash flows and its fair market value. The amount of the charge is the difference between the asset’s carrying value and fair market value.

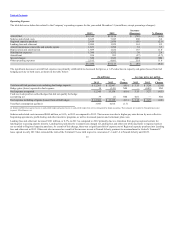

Defined Benefit Plan Accounting. We sponsor defined benefit pension plans for eligible employees and retirees. The most critical assumptions impacting our

defined benefit pension plan obligations and expenses are the weighted average discount rate and the expected long-term rate of return on the plan assets.

United’s pension plans’ under-funded status was $2.2 billion at December 31, 2014. Funding requirements for tax-qualified defined benefit pension plans are

determined by government regulations. In 2015, we anticipate contributing at least $400 million to our pension plans, substantially all of which is in excess

of the minimum funding requirements. The fair value of the plans’ assets was $2.6 billion at December 31, 2014.

When calculating pension expense for 2015, the Company assumed that its plans’ assets would generate a long-term rate of return of 7.36%. The expected

long-term rate of return assumption was developed based on historical experience and input from the trustee managing the plans’ assets. The expected long-

term rate of return on plan assets is based on a target allocation of assets, which is based on a goal of earning the highest rate of return while maintaining risk

at acceptable levels. Our projected long-term rate of return reflects the active management of our plans’ assets. The plans strive to have assets sufficiently

diversified so that adverse or unexpected results

48