United Airlines 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

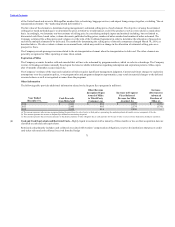

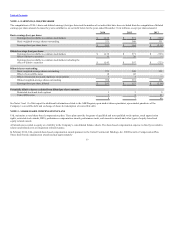

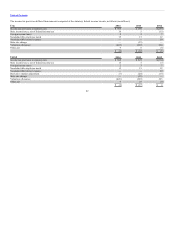

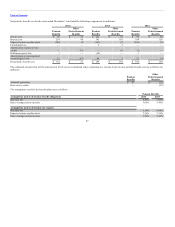

The table below summarizes UAL’s RSUs and restricted stock activity for the years ended December 31 (shares in millions):

Non-vested at December 31, 2011 3.4 1.0 $ 23.33

Granted 2.0 0.5 24.01

Vested (0.6) (0.6) 23.05

Surrendered (0.5) (0.1) 24.01

Non-vested at December 31, 2012 4.3 0.8 23.94

Granted 1.8 0.5 25.98

Vested (0.5) (0.3) 23.93

Surrendered (0.2) (0.1) 24.76

Non-vested at December 31, 2013 5.4 0.9 25.02

Granted 0.9 0.3 43.33

Vested (2.2) (0.4) 24.66

Surrendered (0.3) (0.1) 28.88

Non-vested at December 31, 2014 3.8 0.7 32.55

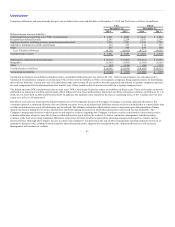

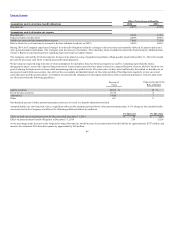

The fair value of RSUs and restricted stock vested in 2014, 2013 and 2012 was $97 million, $22 million and $27 million, respectively. The fair value of the

restricted stock awards was primarily based upon the UAL common stock price on the date of grant. These awards are accounted for as equity awards. The fair

value of the RSUs was based on the UAL common stock price as of the last day preceding the settlement date. These awards were accounted for as liability

awards. Restricted stock vesting and the recognition of the expense is similar to the stock option vesting described below.

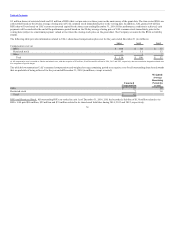

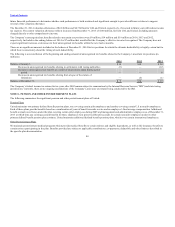

Stock Options. UAL has not granted any stock options since 2010. Historically, stock options were awarded with exercise prices equal to the fair market

value of UAL’s common stock on the date of grant. UAL stock options generally vested over a period of either three or four years and have a contractual life

of 10 years. Expense related to each portion of an option grant was recognized on a straight-line basis over the specific vesting period for those options. The

Company determined the fair value of stock options at the grant date using a Black Scholes option pricing model. As of December 31, 2014, there were

approximately 1 million outstanding stock option awards, all of which were exercisable, with a weighted-average exercise price of $29.73.

79