United Airlines 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

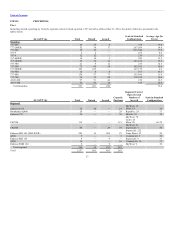

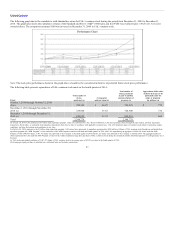

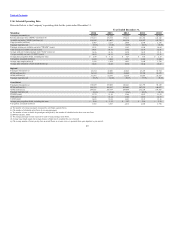

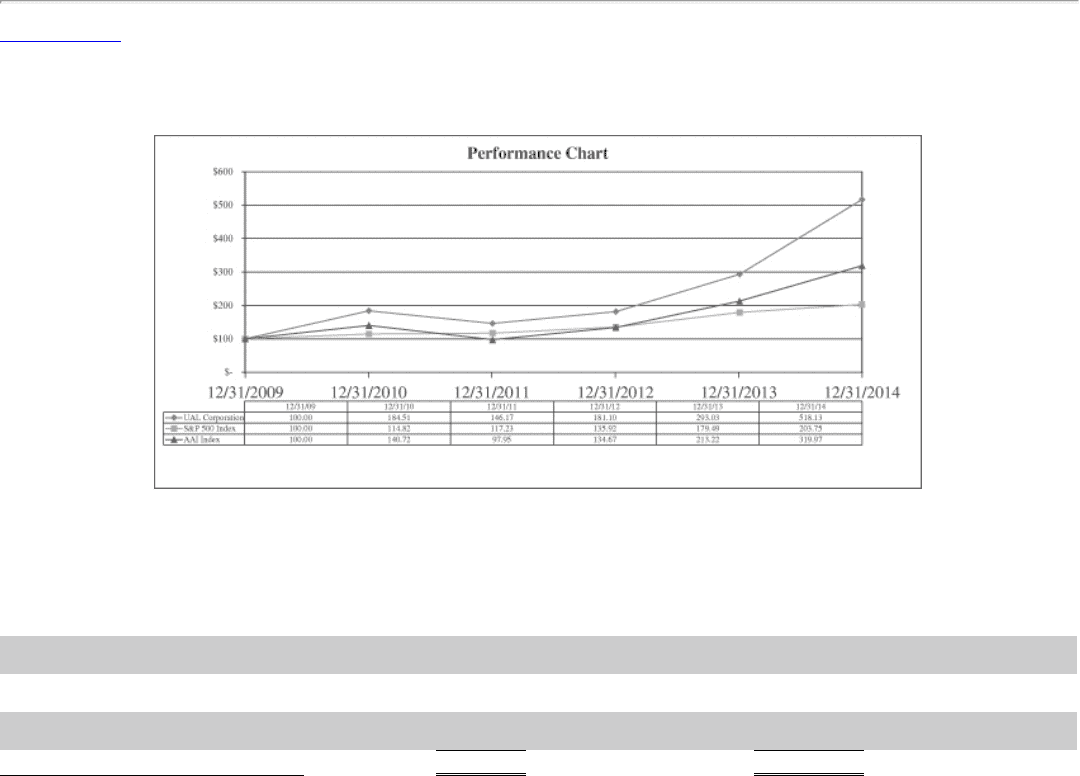

The following graph shows the cumulative total shareholder return for UAL’s common stock during the period from December 31, 2009 to December 31,

2014. The graph also shows the cumulative returns of the Standard and Poor’s (“S&P”) 500 Index and the NYSE Arca Airline Index (“AAI”) of 13 investor-

owned airlines. The comparison assumes $100 was invested on December 31, 2009 in UAL common stock.

The stock price performance shown in the graph above should not be considered indicative of potential future stock price performance.

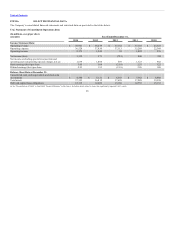

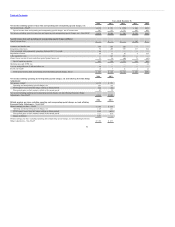

The following table presents repurchases of UAL common stock made in the fourth quarter of 2014:

October 1, 2014 through October 31, 2014

(b)(c) 799,323 $ 46.87 799,323 $ 772

November 1, 2014 through November 30,

2014 (c) 728,900 55.65 728,900 732

December 1, 2014 through December 31,

2014 (c) 820,555 63.32 820,555 680

Total 2,348,778 2,348,778

(a) On July 24, 2014, UAL announced a $1 billion share repurchase program, which was authorized by UAL’s Board of Directors. UAL may repurchase shares through the open market, privately negotiated

transactions, block trades, or accelerated share repurchase transactions from time to time in accordance with applicable securities laws. UAL will repurchase shares of common stock subject to prevailing market

conditions, and may discontinue such repurchases at any time.

(b) On July 24, 2014, pursuant to the $1 billion share repurchase program, UAL entered into agreements to repurchase approximately $200 million of shares of UAL common stock through an accelerated share

repurchase program (the “ASR Program”). Final settlement of the ASR Program occurred in the third and fourth quarters of 2014 with UAL repurchasing an aggregate of 4,446,993 shares under the ASR

Program. Of the 4,446,993 shares, 3,785,770 shares were delivered to the Company in the third quarter of 2014 and 661,223 shares were delivered to the Company in October 2014. The aggregate number of

shares repurchased by UAL under the ASR Program is based on the volume-weighted average price per share of UAL’s common stock during the calculation periods determined pursuant to each agreement, less a

discount.

(c) UAL made open market purchases of 1,687,555 shares of UAL common stock at an average price of $59.07 per share in the fourth quarter of 2014.

(d) Average price paid per share is calculated on a settlement basis and excludes commission.

27