United Airlines 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

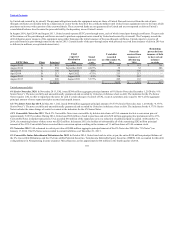

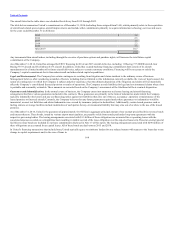

Integration-related costs and special items classified as special charges in the statements of consolidated operations consisted of the following for the years

ended December 31 (in millions):

Operating:

Severance and benefit costs $ 199 $ 105 $ 125

Integration-related costs 96 205 739

Costs associated with permanently grounding Embraer ERJ

135 aircraft 66 — —

Impairment of assets 49 33 30

Labor agreement costs — 127 475

(Gains) losses on sale of assets and other special (gains)

losses, net 33 50 (46)

Special charges $ 443 $ 520 $ 1,323

Nonoperating:

Loss on extinguishment of debt and other, net $ 74 $ — $ —

Income tax benefit (10) (7) (11)

Total operating and nonoperating special

charges, net of income taxes $ 507 $ 513 $ 1,312

2014

The Company recorded $141 million of severance and benefit costs related primarily to a voluntary early-out program for its flight attendants. More than

2,500 participants elected a one-time opportunity to voluntarily separate from the Company and will receive a severance payment, with a maximum value of

$100,000 per participant, based on years of service, with retirement dates from November 30, 2014 through the end of 2015. The Company will record

approximately $100 million of additional expense associated with this program through 2015 over the remaining required service periods. In addition, the

Company recorded $58 million of severance and benefits primarily related to reductions of management and front-line employees, including from Cleveland,

as part of its cost savings initiatives. The Company is currently evaluating its options regarding its long-term contractual lease commitments at

Cleveland. The capacity reductions at Cleveland may result in further special charges, which could be significant, related to our contractual commitments.

Integration-related costs include compensation costs related to systems integration, training, severance and relocation for employees.

The Company recorded $66 million for the permanent grounding of 21 of the Company’s Embraer ERJ 135 regional aircraft under lease through 2018, which

includes an accrual for remaining lease payments and an amount for maintenance return conditions. As a result of fuel prices, new Embraer E175 regional jet

deliveries and impact of pilot shortages at regional carriers, the Company decided to permanently ground these 21 Embraer ERJ 135 aircraft. The Company

continues to operate nine Embraer ERJ 135 aircraft and will assess the possibility of grounding those aircraft when the term of the current capacity purchase

contract ends in 2015.

The Company recorded a charge of $16 million ($10 million net of related income tax benefits) related to its annual assessment of impairment of its

indefinite-lived intangible assets (certain international Pacific routes). In addition, the Company recorded $33 million for charges related primarily to

impairment of its flight equipment held for disposal associated with its Boeing 737-300 and 737-500 fleets.

111