United Airlines 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

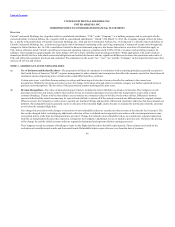

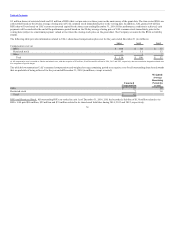

(q) The Company has recorded reserves for income taxes and associated interest that may become payable in

future years. Although management believes that its positions taken on income tax matters are reasonable, the Company nevertheless has

established tax and interest reserves in recognition that various taxing authorities may challenge certain of the positions taken by the Company,

potentially resulting in additional liabilities for taxes and interest. The Company’s uncertain tax position reserves are reviewed periodically and

are adjusted as events occur that affect its estimates, such as the availability of new information, the lapsing of applicable statutes of limitation, the

conclusion of tax audits, the measurement of additional estimated liability, the identification of new tax matters, the release of administrative tax

guidance affecting its estimates of tax liabilities, or the rendering of relevant court decisions. The Company records penalties and interest relating

to uncertain tax positions in Other operating expense and Interest expense, respectively, in its consolidated statements of operations. The

Company has not recorded any significant expense or liabilities related to interest or penalties in its consolidated financial statements.

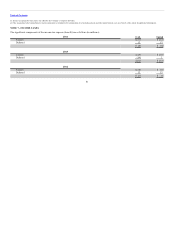

(r) The Company records expenses associated with amendable labor agreements when the employee group has earned the

compensation and the amounts are probable and estimable. These include costs associated with lump sum cash payments that would be made in

conjunction with the ratification of labor agreements. To the extent these upfront costs are in lieu of future pay increases, they would be

capitalized and amortized over the term of the labor agreements. If not, these amounts would be expensed once earned and when they become

probable and estimable.

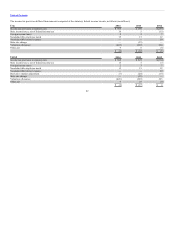

(s) The Company has third-party business revenue that includes fuel sales, catering, ground handling, maintenance services

and frequent flyer award non-air redemptions, and third-party business revenue is recorded in Other operating revenue. The Company also incurs

third-party business expenses, such as maintenance, ground handling and catering services for third parties, fuel sales and non-air mileage

redemptions, and those third-party business expenses are recorded in Other operating expenses. In addition, the Company previously had a

contract to sell aircraft fuel to a third party which was earnings-neutral but resulted in revenue and expense, specifically cost of sales which was

unrelated to the operation of the airline. This contract ended in 2014.

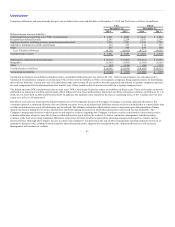

(t) In May 2014, the Financial Accounting Standards Board (“FASB”) amended the FASB Accounting

Standards Codification and created a new Topic 606, Revenue from Contracts with Customers. This amendment prescribes that an entity should

recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity

expects to be entitled in exchange for those goods or services. The amendment supersedes the revenue recognition requirements in Topic 605,

Revenue Recognition, and most industry-specific guidance throughout the Industry Topics of the Codification. The amendments will become

effective for the Company’s annual and interim reporting periods beginning January 1, 2017. Under the new standard, certain airline ancillary fees

directly related to passenger revenue tickets, such as airline change fees and baggage fees, are likely to no longer be considered distinct

performance obligations separate from the passenger travel component. In addition, the change fees which were previously recognized when

incurred, will likely be recognized when transportation is provided. The Company is evaluating other impacts on its consolidated financial

statements.

74