United Airlines 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

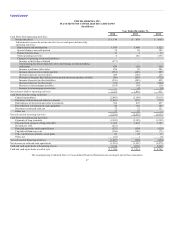

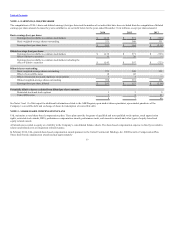

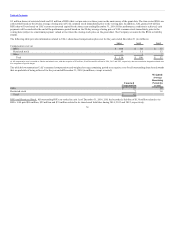

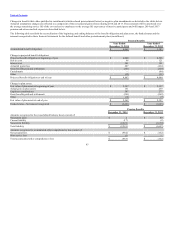

The following table presents information about the Company’s goodwill and other intangible assets at December 31 (in millions):

Goodwill $ 4,523 $ 4,523

Finite-lived intangible assets

Airport slots and gates 8 $ 97 $ 97 $ 98 $ 88

Hubs 20 145 67 145 59

Patents and tradenames 3 108 108 108 108

Frequent flyer database (b) 22 1,177 624 1,177 536

Contracts 12 155 86 167 86

Other 25 109 67 109 56

Total $ 1,791 $ 1,049 $ 1,804 $ 933

Indefinite-lived intangible assets

Airport slots and gates $ 956 $ 963

Route authorities 1,589 1,605

Tradenames and logos 593 593

Alliances 404 404

Total $ 3,542 $ 3,565

(a) Weighted average life expressed in years.

(b) The frequent flyer database is amortized based on an accelerated amortization schedule to reflect utilization of the assets. Estimated cash flows correlating to the expected attrition rate of customers in the

frequent flyer database is considered in the determination of the amortization schedules.

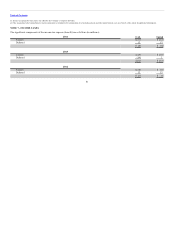

Amortization expense in 2014, 2013 and 2012 was $128 million, $142 million and $121 million, respectively. Projected amortization expense in 2015,

2016, 2017, 2018 and 2019 is $105 million, $92 million, $81 million, $72 million and $66 million, respectively.

See Note 17 of this report for additional information related to impairment of intangible assets.

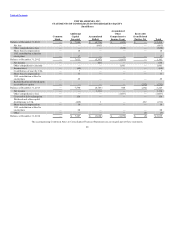

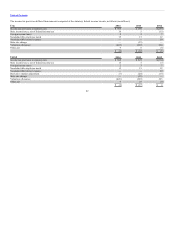

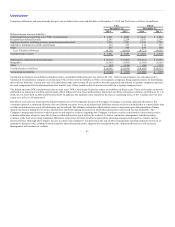

During 2014, United used $62 million of cash to purchase and retire $28 million aggregate principal amount of United’s 4.5% Convertible Notes due 2015

(the “4.5% Convertible Notes”) in market transactions. UAL and United recorded reductions of additional paid-in capital of $34 million and $62 million,

respectively, to record the transactions. At December 31, 2014, the remaining balance of these notes was $202 million. In January 2015, the holders of

substantially all of the remaining $202 million principal amount of the 4.5% Convertible Notes exercised their conversion option resulting in the issuance of

11 million shares of UAL common stock.

United paid a dividend of $212 million to UAL in 2014. United recorded the dividend as a reduction of additional paid-in capital.

At December 31, 2013, United had receivables from two affiliates, which were wholly-owned subsidiaries of UAL, of $232 million that were classified against

stockholder’s equity. UAL transferred all of its equity interest in each of the two subsidiaries to United in 2014, and United reflected the transfers as

reductions in additional paid-in capital.

In 2014, UAL issued approximately 12 million shares of UAL common stock in exchange for, or upon conversion of, $104 million in aggregate principal

amount of its 6% Convertible Senior Notes due 2029 (the “6% Convertible Senior Notes”) held by the holders of these notes.

75