United Airlines 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

receive benefits from the VIE that could potentially be significant to the VIE. Therefore, the Company must identify which activities most significantly

impact the VIE’s economic performance and determine whether it, or another party, has the power to direct those activities.

The Company’s evaluation of its association with VIEs is described below:

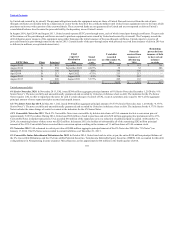

Aircraft Leases. We are the lessee in a number of operating leases covering the majority of our leased aircraft. The lessors are trusts established specifically to

purchase, finance and lease aircraft to us. These leasing entities meet the criteria for VIEs. We are generally not the primary beneficiary of the leasing entities

if the lease terms are consistent with market terms at the inception of the lease and do not include a residual value guarantee, fixed-price purchase option or

similar feature that obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case for many of

our operating leases; however, leases of approximately 60 mainline jet aircraft contain a fixed-price purchase option that allow United to purchase the aircraft

at predetermined prices on specified dates during the lease term. Additionally, leases covering approximately 239 leased regional jet aircraft contain an

option to purchase the aircraft at the end of the lease term at prices that, depending on market conditions, could be below fair value. United has not

consolidated the related trusts because, even taking into consideration these purchase options, United is still not the primary beneficiary. United’s maximum

exposure under these leases is the remaining lease payments, which are reflected in future lease commitments in Note 13 of this report.

EETCs. United evaluated whether the pass-through trusts formed for its EETC financings, treated as either debt or aircraft operating leases, are VIEs required

to be consolidated by United under applicable accounting guidance, and determined that the pass-through trusts are VIEs. Based on United’s analysis as

described below, United determined that it does not have a variable interest in the pass-through trusts.

The primary risk of the pass-through trusts is credit risk (i.e. the risk that United, the issuer of the equipment notes, may be unable to make its principal and

interest payments). The primary purpose of the pass-through trust structure is to enhance the credit worthiness of United’s debt obligation through certain

bankruptcy protection provisions, a liquidity facility (in certain of the EETC structures) and improved loan-to-value ratios for more senior debt classes. These

credit enhancements lower United’s total borrowing cost. Pass-through trusts are established to receive principal and interest payments on the equipment

notes purchased by the pass-through trusts from United and remit these proceeds to the pass-through trusts’ certificate holders.

United does not invest in or obtain a financial interest in the pass-through trusts. Rather, United has an obligation to make interest and principal payments on

its equipment notes held by the pass-through trusts. United did not intend to have any voting or non-voting equity interest in the pass-through trusts or to

absorb variability from the pass-through trusts. Based on this analysis, the Company determined that it is not required to consolidate the pass-through trusts.

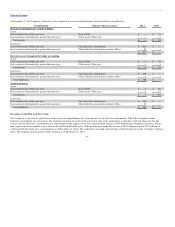

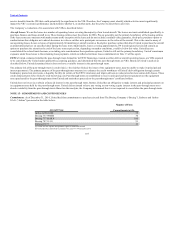

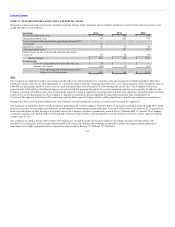

Commitments. As of December 31, 2014, United had firm commitments to purchase aircraft from The Boeing Company (“Boeing”), Embraer and Airbus

S.A.S. (“Airbus”) presented in the table below:

Airbus A350-1000 35

Boeing 737-900ER 34

Boeing 737 MAX 9 100

Boeing 787-9/-10 51

Embraer E175 11

(a) United also has options and purchase rights for additional aircraft.

(b) United also has committed to purchase two used 737-700 aircraft in 2015.

107