United Airlines 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

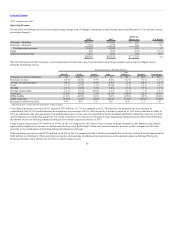

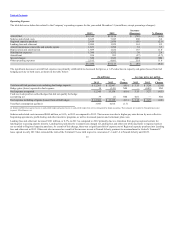

Significant financing events in 2013 were as follows:

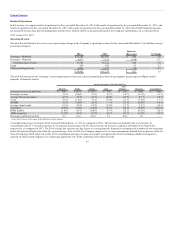

Debt Issuances

During 2013, United issued debt related to three separate EETC offerings to finance new aircraft deliveries, bringing the total issued at year end 2013

pursuant to these three EETC offerings to $1.5 billion. Including the EETC offerings in 2012, United recorded $900 million of proceeds as debt during

2013.

UAL issued $600 million unsecured Senior Notes.

United and UAL entered into the Credit Agreement as the borrower and guarantor, respectively. The Company’s Credit Agreement originally consisted of

a $900 million term loan due April 1, 2019 and a $1.0 billion revolving credit facility available for drawing until April 1, 2018.

Debt and Capital Lease Payments

During the year ended December 31, 2013, the Company made debt and capital lease payments of $2.3 billion, including the following prepayments:

• The Company used $900 million from the Credit Agreement, together with approximately $300 million of cash to retire the entire principal

balance of a $1.2 billion term loan due 2014 that was outstanding under United’s Amended and Restated Revolving Credit, Term Loan and

Guaranty Agreement, dated as of February 2, 2007.

• United redeemed all of the $400 million aggregate principal amount of its 9.875% Senior Secured Notes due 2013 and $200 million aggregate

principal amount of 12.0% Senior Second Lien Notes due 2013.

• United redeemed $303 million aggregate principal amount of EETC notes.

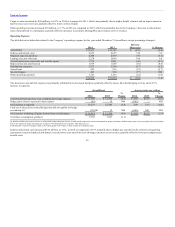

Financing Activities Not Affecting Cash

UAL issued approximately 28 million shares of UAL common stock pursuant to agreements that UAL entered into with certain of its securityholders in

exchange for approximately $240 million in aggregate principal amount of UAL’s outstanding 6% Convertible Senior Notes held by the holders of these

notes. The Company retired the 6% Convertible Senior Notes acquired in the exchange.

Significant financing events in 2012 were as follows:

The Company received $1.5 billion in proceeds from EETC transactions in 2012.

During the year ended December 31, 2012, the Company made debt and capital lease payments of $1.5 billion, including prepayments. These payments

include $195 million related to United’s Series 2002-1 EETCs.

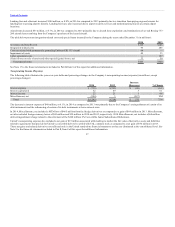

In August 2012, the New Jersey Economic Development Authority (the “Authority”) issued approximately $101 million of special facility revenue bonds

(the “2012 Bonds”) to provide funds for the defeasance of approximately $100 million of the Authority’s previously issued and outstanding special

facility revenue bonds maturing on September 15, 2012 (the “Refunded Bonds”). The Refunded Bonds were guaranteed by United and payable from

certain rental payments made by United pursuant to two lease agreements between the Authority and United. The 2012 Bonds are payable from certain

loan repayments made by United under a loan agreement between United and the Authority. The 2012 Bonds are recorded by the Company as unsecured

long-term debt.

For additional information regarding these matters, see Notes 3, 11, 13, 14 and 16 to the financial statements included in Part II, Item 8 of this report.

43