United Airlines 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

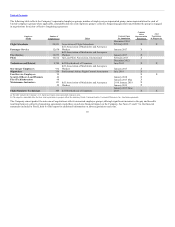

Table of Contents

transaction in 2010. There is also a possibility that employees or unions could engage in job actions such as slow-downs, work-to-rule campaigns, sick-outs

or other actions designed to disrupt the Company’s normal operations, in an attempt to pressure the Company in collective bargaining negotiations.

Although the RLA makes such actions unlawful until the parties have been lawfully released to self-help, and the Company can seek injunctive relief against

premature self-help, such actions can cause significant harm even if ultimately enjoined. In addition, achieving joint collective bargaining agreements with

the Company’s represented employee groups is likely to increase the Company’s labor costs, which increase could be material.

See Notes 15 and 17 to the financial statements included in Part II, Item 8 of this report for additional information on labor negotiations and costs.

An outbreak of a disease or similar public health threat could have a material adverse impact on the Company’s business, financial position and results of

operations.

An outbreak of a disease or similar public health threat that affects travel demand or travel behavior, or travel restrictions or reduction in the demand for air

travel caused by an outbreak of a disease or similar public health threat in the future, could have a material adverse impact on the Company’s business,

financial condition and results of operations.

The Company is subject to economic and political instability and other risks of doing business globally.

The Company is a global business with operations outside of the United States from which it derives approximately 40% of its operating revenues, as

measured and reported to the DOT. The Company’s operations in Asia, Europe, Latin America, Africa and the Middle East are a vital part of its worldwide

airline network. Volatile economic, political and market conditions in these international regions may have a negative impact on the Company’s operating

results and its ability to achieve its business objectives. In addition, significant or volatile changes in exchange rates between the U.S. dollar and other

currencies, and the imposition of exchange controls or other currency restrictions, may have a material adverse impact upon the Company’s liquidity,

revenues, costs and operating results.

Most recently, economic instability in Venezuela resulted in exchange rate changes that apply to the Company’s funds held in Venezuelan bolivars. The

Company had approximately $100 million of its unrestricted cash balance held in Venezuelan bolivars as of December 31, 2014 based on a mix of historical

rates in effect at the time of submission for repatriation. There can be no assurance that the Company will be able to repatriate any or all of the funds held in

Venezuelan bolivars in the future. Additionally, the amount and exchange rate at which the balance of funds will be repatriated could change resulting in a

loss to the Company. If economic instability and devaluation of the local currency continue for a period of time in Venezuela, such conditions may have an

adverse impact on the Company’s business.

Extensive government regulation could increase the Company’s operating costs and restrict its ability to conduct its business.

Airlines are subject to extensive regulatory and legal oversight. Compliance with U.S. and international regulations imposes significant costs and may have

adverse effects on the Company. Laws, regulations, taxes and airport rates and charges, both domestically and internationally, have been proposed from time

to time that could significantly increase the cost of airline operations or reduce airline revenue. The Company cannot provide any assurance that current laws

and regulations, or laws or regulations enacted in the future, will not adversely affect its financial condition or results of operations.

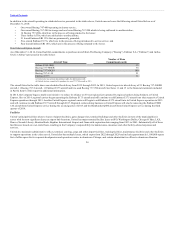

United provides air transportation under certificates of public convenience and necessity issued by the DOT. If the DOT altered, amended, modified,

suspended or revoked these certificates, it could have a material adverse effect on the Company’s business. The DOT is also responsible for promulgating

consumer protection and other regulations such as the rule against lengthy tarmac delays, that will impose significant compliance costs on the Company. The

FAA regulates the safety of United’s operations. United operates pursuant to an air carrier operating certificate issued by the FAA. In January 2014, the FAA’s

more stringent pilot flight and duty time

16