United Airlines 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company recognizes cargo and other revenue as service is provided.

Under our capacity purchase agreements (“CPAs”) with regional carriers, we purchase all of the capacity related to aircraft covered by the contracts

and are responsible for selling all of the related seat inventory. We record the passenger revenue and related expenses as separate operating

revenue and expense in the consolidated statement of operations.

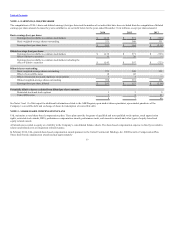

Accounts receivable primarily consist of amounts due from credit card companies and customers of our aircraft maintenance and cargo

transportation services. We provide an allowance for uncollectible accounts equal to the estimated losses expected to be incurred based on

historical write-offs and other specific analyses. Bad debt expense and write-offs were not material for the years ended December 31, 2014, 2013

and 2012.

(c) United’s MileagePlus program is designed to increase customer loyalty. Program participants earn miles by flying

on United and certain other participating airlines. Program participants can also earn miles through purchases from other non-airline partners that

participate in United’s loyalty program. We sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental

companies and our participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or

upgraded air travel and non-travel awards. The Company records its obligation for future award redemptions using a deferred revenue model.

In the case of the sale of air services, the Company recognizes a portion of the ticket sales as revenue when the air transportation occurs and defers

a portion of the ticket sale representing the value of the related miles as a multiple-deliverable revenue arrangement. The miles are recorded in

frequent flyer deferred revenue on the Company’s balance sheet and recognized into revenue when the transportation is provided.

The Company determines the estimated selling price of air transportation and miles as if each element is sold on a separate basis. The total

consideration from each ticket sale is then allocated to each of these elements individually on a pro rata basis. The Company’s estimated selling

price of miles prior to April 1, 2014 was based on the price we sell miles to Star Alliance partners in our reciprocal frequent flyer agreements as the

best estimate of selling price for these miles.

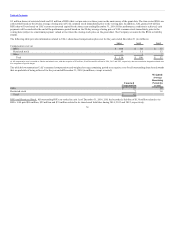

On March 30, 2014, US Airways exited Star Alliance. Effective with the exit date, the Company updated its estimated selling price for miles to a

value based on the equivalent ticket value less fulfillment discount, which incorporates the expected redemption of miles. The equivalent ticket

value used as the basis for the estimated selling price of miles is based on the prior 12 months’ weighted average equivalent ticket value of similar

fares as those used to settle award redemptions while taking into consideration such factors as redemption pattern, cabin class, loyalty status and

geographic region. The estimated selling price of miles is adjusted by a fulfillment discount that considers a number of factors, including

redemption patterns of various customer groups. This change in estimate was applied on a prospective basis beginning April 1, 2014. The impact

of this change resulted in an increase in consolidated revenue of approximately $95 million (and an increase of approximately $0.26 per UAL

basic share and $0.24 per UAL diluted share) in 2014.

United has a significant contract, the Consolidated Amended and Restated Co-Branded Card Marketing Services Agreement (the “Co-Brand

Agreement”), to sell MileagePlus miles to its co-branded credit card partner, Chase Bank USA, N.A. (“Chase”). United identified five revenue

elements in the Co-Brand Agreement: the air transportation element represented by the value of the mile (generally resulting from its redemption

for future air transportation and whose fair value is described above); use

70