United Airlines 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company is committed to improving the efficiency and quality of all aspects of its business in 2015. Key initiatives for the year include improving our

operational reliability and the handling of customers during irregular operations, such as adverse weather, improving our customer experience by adding

satellite-based Wi-Fi to nearly all our mainline aircraft, introducing a new united.com website, refurbishing aircraft interiors, investing in our airports and

taking delivery of more than 40 new, highly-efficient and customer-pleasing aircraft, and improving our financial performance.

Economic Conditions. The economic outlook for the aviation industry in 2015 is characterized by expected slow or modest U.S. and global economic

growth. In such conditions, we expect a modest increase in the demand for air travel. Continuing economic uncertainty, along with the strengthening U.S.

dollar, is providing uncertainty in key Asian and European markets, and along with continued political and socioeconomic tensions in regions such as the

Middle East, may result in diminished demand for air travel. The global economy is also being impacted by declining oil prices, putting pressure on certain

geographic markets.

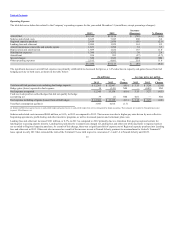

Capacity. Over the past three years, the Company leveraged the flexibility of its fleet to better match capacity with market demand. In 2015, the Company

expects consolidated ASMs to grow between 1.5% and 2.5% year-over-year.

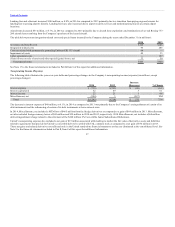

Fuel. The Company’s average aircraft fuel price per gallon including related taxes was $2.99 in 2014 as compared to $3.13 in 2013. Recently, the price of jet

fuel has declined, but remains volatile. Decreases in fuel prices for an extended period may result in increased industry capacity, increased competitive

actions for market share and lower fares or surcharges in general. If fuel prices were subsequently to rise significantly, there may be a lag between

improvement of revenue and the adverse impact of higher fuel prices. Given the highly competitive nature of the airline industry, the Company may not be

able to increase its fares and fees sufficiently to offset the full impact of increases in fuel prices, especially if these increases are rapid and sustained. Further,

such fare and fee increases may not be sustainable, may reduce the general demand for air travel and may also eventually impact the Company’s strategic

growth and investment plans for the future. Based on projected fuel consumption in 2015, a one dollar change in the price of a barrel of crude oil would

change the Company’s annual fuel expense by approximately $93 million. To protect against increases in the prices of aircraft fuel, the Company routinely

hedges a portion of its future fuel requirements.

Labor. As of December 31, 2014, United had approximately 80% of employees represented by unions. During 2014, United’s maintenance instructor, load

planner, fleet technical instructor, security officer and dispatcher work groups ratified new joint labor agreements. We are in the process of negotiating joint

collective bargaining agreements with our technicians and flight attendants. The Company cannot predict the outcome of negotiations with its unionized

employee groups, although significant increases in the pay and benefits resulting from new collective bargaining agreements would have a material financial

impact on the Company.

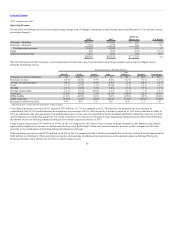

CASM. In 2015, the Company expects CASM, excluding fuel, third-party business expense, profit sharing and special charges to be flat to up one percent

year-over-year. We are unable to project CASM on a GAAP basis as the nature and amount of special charges are not determinable at this time.

The Company’s cost initiative project that began in 2014, called Project Quality, has a goal to reduce the Company’s annual costs by $2 billion and generate

an incremental $700 million in additional ancillary revenue by the end of 2017. The anticipated savings are comprised of $1 billion in annual fuel savings,

based on fuel prices in 2013, and $1 billion of non-fuel savings. In 2014, the Company achieved approximately $200 million in fuel savings and $380

million in non-fuel savings.

MileagePlus. Effective March 1, 2015, the Company will modify its MileagePlus program for most tickets from the current model in which members earn

redeemable miles based on distance traveled to one based on ticket price (including base fare and carrier imposed surcharges). Members will be able to earn

between five and eleven miles per dollar spent based on their MileagePlus status. The updated program will enhance the rewards for customers who spend

more with United and give them improved mileage-earning opportunities.

34