United Airlines 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

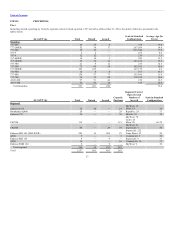

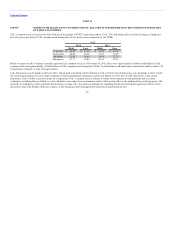

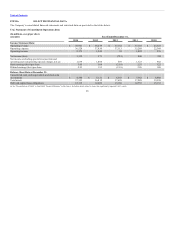

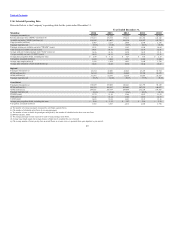

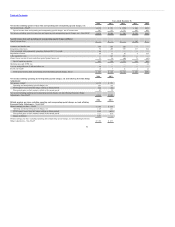

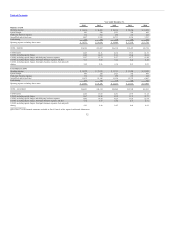

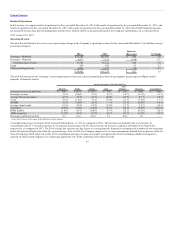

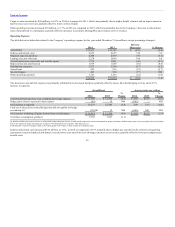

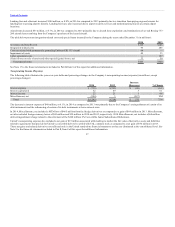

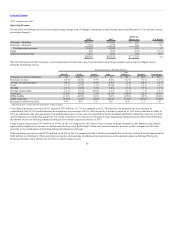

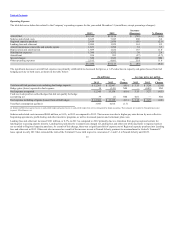

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and

Non-GAAP financial measures including net income/loss excluding special charges, net earnings/loss per share excluding special charges and CASM, among

others. CASM is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. The Company believes that excluding fuel

costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a

significant cost item over which management has limited influence. Fuel hedge operating non-cash mark-to-market (“MTM”) gains (losses) are excluded as

the Company did not apply cash flow hedge accounting for certain of the periods presented, and these adjustments may provide a better comparison to the

Company’s peers, most of which either apply cash flow hedge accounting or exclude cash MTM gains or losses in certain disclosures of fuel expense. The

Company believes that adjusting for special items is useful to investors because the special items are non-recurring items not indicative of the Company’s

ongoing performance. The Company also believes that excluding third-party business expenses, such as maintenance, ground handling and catering services

for third parties, fuel sales and non-air mileage redemptions, provides more meaningful disclosure because these expenses are not directly related to the

Company’s core business. In addition, the Company believes that reflecting Economic Hedge Adjustments, consisting of MTM gains and losses recorded in

Nonoperating expense from fuel hedges settling in future periods and of prior period gains recorded in Nonoperating expense on fuel contracts settled in the

current period, is useful because the adjustments allow investors to better understand the cash impact of settled hedges in a given period. The Company

excludes profit sharing because this exclusion allows investors to better understand and analyze its recurring cost performance and provides a more

meaningful comparison of its core operating costs to the airline industry. Pursuant to SEC Regulation G, the Company has included the following

reconciliation of reported Non-GAAP financial measures to comparable financial measures reported on a GAAP basis (in millions, except CASM amounts).

For additional information related to special items, see Note 17 to the financial statements included in Part II, Item 8 of this report.

30