United Airlines 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

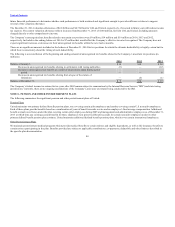

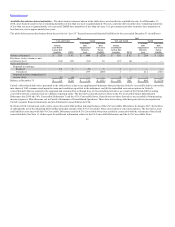

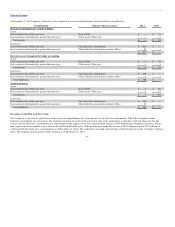

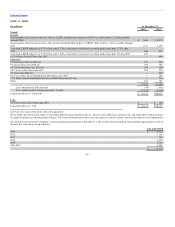

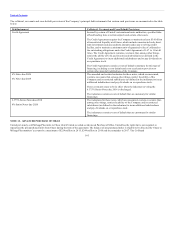

Derivative instruments and investments presented in the tables above have the same fair value as their carrying value. The table below presents the carrying

values and estimated fair values of financial instruments not presented in the tables above as of December 31 (in millions):

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3

UAL debt $ 11,434 $ 12,386 $ — $ 8,568 $ 3,818 $ 11,539 $ 12,695 $ — $ 8,829 $ 3,866

United debt 11,433 12,386 — 8,568 3,818 11,388 12,249 — 8,383 3,866

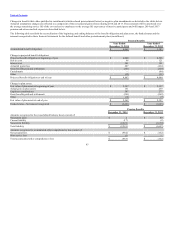

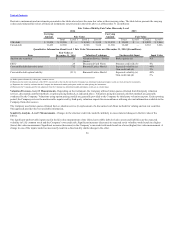

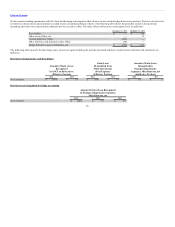

Auction rate securities

$ 26

Valuation Service / Broker

Quotes

Broker quotes (a)

NA

EETC 28 Discounted Cash Flows Structure credit risk (b) 4%

Convertible debt derivative asset

712

Binomial Lattice Model

Expected volatility (c)

Own credit risk (d)

40%

5%

Convertible debt option liability

(511)

Binomial Lattice Model

Expected volatility (c)

Own credit risk (d)

40%

5%

(a) Broker quotes obtained by a third-party valuation service.

(b) Represents the credit risk premium of the EETC structure above the risk-free rate that the Company has determined market participants would use when pricing the instruments.

(c) Represents the volatility estimate that the Company has determined market participants would use when pricing the instruments.

(d) Represents the Company-specific risk adjustment that the Company has determined market participants would use as a model input.

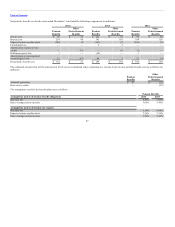

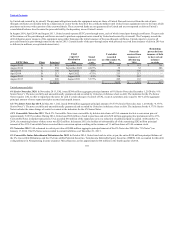

- Depending on the instrument, the Company utilizes broker quotes obtained from third-party valuation

services, discounted cash flow methods, or option pricing methods, as indicated above. Valuations using discounted cash flow methods are generally

conducted by the Company. Valuations using option pricing models are generally provided to the Company by third-party valuation experts. Each reporting

period, the Company reviews the unobservable inputs used by third-party valuation experts for reasonableness utilizing relevant information available to the

Company from other sources.

The Company uses broker quotes obtained from a valuation service (in replacement of a discounted cash flows method) for valuing auction rate securities.

This approach provides the best available information.

- Changes in the structure credit risk would be unlikely to cause material changes in the fair value of the

EETCs.

The significant unobservable inputs used in the fair value measurement of the United convertible debt derivative assets and liabilities are the expected

volatility in UAL common stock and the Company’s own credit risk. Significant increases (decreases) in expected stock volatility would result in a higher

(lower) fair value measurement. Significant increases (decreases) in the Company’s own credit risk would result in a lower (higher) fair value measurement. A

change in one of the inputs would not necessarily result in a directionally similar change in the other.

94