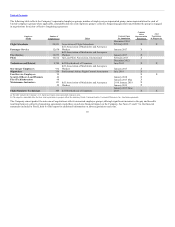

United Airlines 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

carriers permitted to operate on such routes, the capacity of the carriers providing services on such routes, the airports at which carriers may operate

international flights, or the number of carriers allowed access to particular airports. Any further limitations, additions or modifications to such arrangements,

regulations or policies could have a material adverse effect on the Company’s financial position and results of operations. Additionally, a change in law,

regulation or policy for any of the Company’s international routes, such as open skies, could have a material adverse impact on the Company’s financial

position and results of operations and could result in the impairment of material amounts of related tangible and intangible assets. In addition, competition

from revenue-sharing joint ventures and other alliance arrangements by and among other airlines could impair the value of the Company’s business and

assets on the open skies routes. The Company’s plans to enter into or expand U.S. antitrust immunized alliances and joint ventures on various international

routes are subject to receipt of approvals from applicable U.S. federal authorities and obtaining other applicable foreign government clearances or satisfying

the necessary applicable regulatory requirements. There can be no assurance that such approvals and clearances will be granted or will continue in effect

upon further regulatory review or that changes in regulatory requirements or standards can be satisfied.

Many aspects of the Company’s operations are also subject to increasingly stringent federal, state, local and international laws protecting the environment.

Future environmental regulatory developments, such as climate change regulations in the United States and abroad could adversely affect operations and

increase operating costs in the airline industry. There are certain climate change laws and regulations that have already gone into effect and that apply to the

Company, including the EU ETS, the State of California’s greenhouse gas cap and trade regulations, environmental taxes for certain international flights,

limited greenhouse gas reporting requirements and land-use planning laws which could apply to airports and could affect airlines in certain circumstances. In

addition, there is the potential for additional regulatory actions in regard to the emission of greenhouse gases by the aviation industry. The precise nature of

future requirements and their applicability to the Company are difficult to predict, but the financial impact to the Company and the aviation industry would

likely be adverse and could be significant.

In 2015, the U.S. Congress will begin consideration of legislation to reauthorize the FAA, which encompasses all significant aviation tax and policy related

issues. As with previous reauthorization legislation, the U.S. Congress may consider a range of policy changes that could impact the Company’s operations

and costs.

See Part I, Item 1, Business—Industry Regulation, of this report for additional information on government regulation impacting the Company.

The airline industry is highly competitive and susceptible to price discounting and changes in capacity, which could have a material adverse effect on the

Company.

The U.S. airline industry is characterized by substantial price competition including from low-cost carriers. The significant market presence of low-cost

carriers, which engage in substantial price discounting, has diminished the ability of large network carriers to achieve sustained profitability on domestic and

international routes.

Airlines also compete for market share by increasing or decreasing their capacity, including route systems and the number of markets served. Several of the

Company’s domestic and international competitors have increased their international capacity by including service to some destinations that the Company

currently serves, causing overlap in destinations served and therefore increasing competition for those destinations. In addition, the Company and certain of

its competitors have implemented significant capacity reductions in recent years in response to high and volatile fuel prices and stagnant global economic

growth. Further, certain of the Company’s competitors may not reduce capacity or may increase capacity, impacting the expected benefit to the Company

from capacity reductions. This increased competition in both domestic and international markets may have a material adverse effect on the Company’s results

of operations, financial condition or liquidity.

18