United Airlines 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

x

¨

001-06033

Delaware

36-2675207

001-10323

Delaware

74-2099724

United Continental Holdings, Inc. Common Stock, $0.01 par value New York Stock Exchange

United Airlines, Inc. None None

United Continental Holdings, Inc. None

United Airlines, Inc. None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

United Continental Holdings, Inc. Yes ¨ No x

United Airlines, Inc. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

United Continental Holdings, Inc. ¨

United Airlines, Inc. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer”

and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

United Continental

Holdings, Inc. Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

United Airlines, Inc. Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

United Continental Holdings, Inc. Yes ¨ No x

United Airlines, Inc. Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of United Continental Holdings, Inc. was $15,303,043,375 as of June 30, 2014. There is no market for United Airlines, Inc. common stock.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of February 10, 2015.

United Continental Holdings, Inc. 384,226,369 shares of common stock ($0.01 par value)

United Airlines, Inc. 1,000 (100% owned by United Continental Holdings, Inc.)

This combined Form 10-K is separately filed by United Continental Holdings, Inc. and United Airlines, Inc.

United Airlines, Inc. meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this form with the reduced disclosure format allowed under that General Instruction.

Information required by Items 10, 11, 12 and 13 of Part III of this Form 10-K are incorporated by reference for United Continental Holdings, Inc. from its definitive proxy statement for its 2015 Annual Meeting

of Stockholders.

Table of contents

-

Page 1

... non-affiliates of United Continental Holdings, Inc. was $15,303,043,375 as of June 30, 2014. There is no market for United Airlines, Inc. common stock. Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of February 10, 2015. United Continental Holdings... -

Page 2

... Market Risk Financial Statements and Supplementary Data Combined Notes to Consolidated Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance... -

Page 3

... the surviving corporation. Continental's name was subsequently changed to United Airlines, Inc. As UAL consolidates United for financial statement purposes, disclosures that relate to activities of United also apply to UAL, unless otherwise noted. United's operating revenues and operating expenses... -

Page 4

... brand name of another carrier); coordination of reservations, ticketing, passenger check-in, baggage handling, airport lounge access and flight schedules, and other resource-sharing activities that include joint sales and marketing. United is a member of Star Alliance, a global integrated airline... -

Page 5

...by purchasing the goods and services of our network of non-airline partners, such as credit card issuers, retail merchants, hotels and car rental companies. Members can redeem mileage credits for free (other than taxes and government imposed fees), discounted or upgraded travel and non-travel awards... -

Page 6

... used financial hedge instruments based on aircraft fuel or closely related commodities including diesel fuel and crude oil. Third-Party Business. United generates third-party business revenue that includes fuel sales, catering, ground handling, maintenance services and frequent flyer award non-air... -

Page 7

... series of rules to enhance airline passenger protections have required U.S. air carriers to adopt contingency plans and procedures for tarmac delays exceeding three hours for domestic flights and four hours for international flights and to charge the same baggage fee throughout a passenger's entire... -

Page 8

... flights (including Germany's departure ticket tax), greenhouse gas reporting requirements, and the State of California's greenhouse gas cap and trade regulations (that impact United's San Francisco maintenance center). In addition, there are land-use planning laws that could apply to airport... -

Page 9

...circumstances, the operation of aircraft fueling facilities, which primarily involve airport sites. Future costs associated with these activities are currently not expected to have a material adverse effect on the Company's business. Employees As of December 31, 2014, UAL, including its subsidiaries... -

Page 10

...and Aerospace Workers Air Line Pilots Association, International Int'l Brotherhood of Teamsters Int'l Association of Machinists and Aerospace Workers Professional Airline Flight Control Association December 2014/ February 2016 January 2017 January 2017 February 2017 December 2012/ June 2013 January... -

Page 11

... sade in this report. High and/or volatile fuel prices or significant disruptions in the supply of aircraft fuel could have a material adverse impact on the Company's strategic plans, operating results, financial position and liquidity. Aircraft fuel is critical to the Company's operations and has... -

Page 12

..., revenue management systems, accounting systems, telecommunication systems and commercial websites, including www.united.com. United's website and other automated systems must be able to accommodate a high volume of traffic, maintain secure information and deliver important flight and schedule... -

Page 13

... issues and data security. The Company is subject to increasing legislative and regulatory and customer focus on privacy issues and data security. A number of the Company's commercial partners, including credit card companies, have imposed data security standards that the Company must meet and these... -

Page 14

... of customer service call centers, distribution and sale of airline seat inventory, provision of information technology infrastructure and services, transmitting or uploading of data, provision of aircraft maintenance and repairs, provision of various utilities and performance of aircraft fueling... -

Page 15

...to timely pay its debts or comply with certain operating and financial covenants under its financing and credit card processing agreements or with other material provisions of its contractual obligations. These covenants require the Company or United, as applicable, to maintain minimum liquidity and... -

Page 16

... adverse effects on the Company. Laws, regulations, taxes and airport rates and charges, both domestically and internationally, have been proposed from time to time that could significantly increase the cost of airline operations or reduce airline revenue. The Company cannot provide any assurance... -

Page 17

...might limit the number of flights and/or increase costs of operations at certain times or throughout the day. The FAA may limit the Company's airport access by limiting the number of departure and arrival slots at high density traffic airports, which could affect the Company's ownership and transfer... -

Page 18

...which carriers may operate international flights, or the number of carriers allowed access to particular airports. Any further limitations, additions or modifications to such arrangements, regulations or policies could have a material adverse effect on the Company's financial position and results of... -

Page 19

... of Contents UAL's obligations for funding United's defined benefit pension plans are affected by factors beyond UAL's control. The Company maintains two primary defined benefit pension plans, one covering certain pilot employees and another covering certain U.S. non-pilot employees. The timing... -

Page 20

... 31, 2014, UAL reported consolidated federal net operating loss ("NOL") carryforwards of approximately $9.6 billion. The Company's ability to use its NOL carryforwards may be limited if it experiences an "ownership change" as defined in Section 382 ("Section 382") of the Internal Revenue Code of... -

Page 21

... the value of a corporation's stock immediately before the ownership change by the applicable long-term tax-exempt rate. Any unused annual limitation may, subject to certain limits, be carried over to later years, and the limitation may under certain circumstances be increased by built-in gains... -

Page 22

... in certain circumstances, common stock. The number of shares issued could be significant and such an issuance could cause significant dilution to the interests of its existing stockholders. In addition, if UAL elects to pay the repurchase price in cash, its liquidity could be adversely affected. In... -

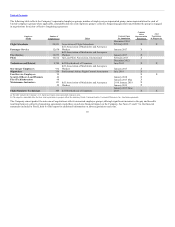

Page 23

...of Contents ITEM 2. Fleet PROPERTIES. Including aircraft operating by United's regional carriers, United operated 1,257 aircraft as of December 31, 2014, the detail of which is presented in the tables below: Tircraft Type Mainline: 747-400 777-200ER 777-200 787-9 787-8 767-400ER 767-300ER 757-300... -

Page 24

... aircraft, 11 Embraer E175 aircraft and two used Boeing 737-700 aircraft. See Notes 11 and 15 to the financial statements included in Part II, Item 8 of this report for additional information. In 2014, the Company began a multi-year initiative to reduce its reliance on 50 seat regional jets operated... -

Page 25

...Company to cover environmental remediation costs for this site. On January 13, 2014, United received an offer of settlement from the Bay Area Air Quality Management District for three Notices of Violation ("NOVs") issued in 2012 and 2013 to United's San Francisco maintenance center (the "Maintenance... -

Page 26

... PURCHTSES OF EQUITY SECURITIES. UAL's common stock is listed on the New York Stock Exchange ("NYSE") under the symbol "UAL." The following table sets forth the ranges of high and low sales prices per share of UAL common stock during the last two fiscal years, as reported by the NYSE: UTL 2014 High... -

Page 27

...the Company in October 2014. The aggregate number of shares repurchased by UAL under the ASR Program is based on the volume-weighted average price per share of UAL's common stock during the calculation periods determined pursuant to each agreement, less a discount. (c) UAL made open market purchases... -

Page 28

... excluding special revenue item and operating and nonoperating special charges, net (a) Basic earnings (loss) per share Diluted earnings (loss) per share Balance Sheet Data at December 31: Unrestricted cash, cash equivalents and short-term investments Total assets Debt and capital lease obligations... -

Page 29

... passenger revenue received for each revenue passenger mile flown. (f) Average stage length equals the average distance a flight travels weighted for size of aircraft. (g) The average number of hours per day that an aircraft flown in revenue service is operated (from gate departure to gate arrival... -

Page 30

...The Company believes that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management's performance excluding the effects of a significant cost item over which management has limited influence. Fuel hedge operating non-cash mark-to-market... -

Page 31

... ERJ 135 aircraft Impairment of assets Labor agreement costs (Gains) losses on sale of assets and other special (gains) losses, net Special operating expense Operating non-cash MTM loss Loss on extinguishment of debt and other, net Income tax benefit Total special revenue item and operating and... -

Page 32

... Year ended December 31, 2014 Mainline CTSM Operating expense Special charges Third-party business expenses Aircraft fuel and related taxes Profit sharing Operating expense excluding above items ASMs - mainline CASM (cents) CASM, excluding special CASM, excluding special CASM, excluding special... -

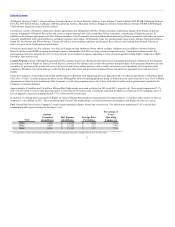

Page 33

...million shares of UAL common stock. UAL ended the year with $5.7 billion in unrestricted liquidity, which consisted of unrestricted cash, cash equivalents, short-term investments and available capacity under the revolving credit facility of the Company's Credit Agreement. 2014 Operational Highlights... -

Page 34

... prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. Labor. As of December 31, 2014, United had approximately 80% of employees represented by unions. During 2014, United's maintenance instructor, load planner, fleet technical instructor, security officer... -

Page 35

... to 2013. The 2014 average fare increase was due in part to a strong domestic demand environment and a number of new long-haul routes that generated higher fares than the system average. Also in 2014, the Company improved its revenue management demand forecast process related to close-in bookings... -

Page 36

... NM (4.0) (1.1) Tverage price per gallon % 2014 2013 Change $ 2.97 $3.13 (5.1) (0.02) - NM 2.99 3.13 (4.5) (0.04) $ 3.03 0.01 $3.12 NM (2.9) Total aircraft fuel purchase cost excluding fuel hedge impacts Hedge gains (losses) reported in fuel expense Fuel expense as reported Cash received (paid) on... -

Page 37

... 2014 as compared to 2013 primarily due to aircraft lease expirations and terminations of several Boeing 757200 aircraft leases resulting from the Company's purchase of the leased aircraft. The table below presents integration-related costs and special items incurred by the Company during the years... -

Page 38

...2012, which was primarily due to the sale of aircraft fuel of approximately $400 million to a third party. Other operating revenue also increased due to additional revenue from non-airline partners under our MileagePlus loyalty program, passenger ticket change fees and sales of airport lounge access... -

Page 39

... and related costs increased $680 million, or 8.6%, in 2013 as compared to 2012. The increase was due to higher pay rates driven by new collective bargaining agreements, profit sharing and other incentive programs, as well as increased pension and retirement plan costs. Landing fees and other... -

Page 40

... Aircraft maintenance materials and outside repairs increased $61 million, or 3.5%, in 2013 as compared to 2012 primarily due to increased volume and scope of airframe heavy checks, mainly on the Boeing 747 and Boeing 757 fleet types, partially offset by a reduction in engine maintenance volumes... -

Page 41

... long-term debt and capital lease obligations and future commitments for capital expenditures, including the acquisition of aircraft and related spare engines. The following is a discussion of the Company's sources and uses of cash from 2012 through 2014. Cash Flows from Operating Activities 2014... -

Page 42

... financial statements included in Part II, Item 8 of this report for additional information on financing activities not affecting cash related to net property and equipment acquired through issuance of debt. United borrowed a $500 million term loan under the Credit Agreement. Debt and Capital Lease... -

Page 43

... by United under a loan agreement between United and the Authority. The 2012 Bonds are recorded by the Company as unsecured long-term debt. For additional information regarding these matters, see Notes 3, 11, 13, 14 and 16 to the financial statements included in Part II, Item 8 of this report. 43 -

Page 44

...the Company has funded the acquisition of aircraft through outright purchase, by issuing debt, by entering into capital or operating leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports to ensure access to terminal, cargo, maintenance and... -

Page 45

...our current year assumptions regarding United's pension plans. Represents contractual commitments for firm order aircraft and spare engines only and noncancelable commitments to purchase goods and services, primarily information technology support. See Note 15 to the financial statements included in... -

Page 46

... statements. Frequent Flyer Accounting. The Company's MileagePlus program is designed to increase customer loyalty. Program participants earn miles by flying on United and certain other participating airlines. Program participants can also earn miles through purchases from other non-airline partners... -

Page 47

... sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and non-travel awards. The Company... -

Page 48

... pension plans for eligible employees and retirees. The most critical assumptions impacting our defined benefit pension plan obligations and expenses are the weighted average discount rate and the expected long-term rate of return on the plan assets. United's pension plans' under-funded status... -

Page 49

...expected long-term rate of return on plan assets by 50 basis points (from 7.36% to 6.86%) would increase estimated 2015 pension expense by approximately $13 million. Future pension obligations for United's plans were discounted using a weighted average rate of 4.20% at December 31, 2014. The Company... -

Page 50

... in assumed health care trend rates would decrease the Company's total service and interest cost for the year ended December 31, 2014 by $11 million. A one percentage point decrease in the weighted average discount rate would increase the Company's postretirement benefit liability by approximately... -

Page 51

... global economic conditions have on customer travel patterns; excessive taxation and the inability to offset future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit market conditions, crude oil prices, costs of aircraft fuel... -

Page 52

...operations, results of operations, financial position and liquidity. To protect against increases in the prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. The Company generally uses financial hedge instruments including fixed price swaps, purchased call... -

Page 53

... in market conditions. The following table summarizes information related to the Company's cost of fuel and hedging (in millions, except percentages): Fuel Costs In 2014, fuel cost as a percent of total operating expenses (a) Impact of $1 increase in price per barrel of aircraft fuel on annual fuel... -

Page 54

... derivative instruments for nonrisk management purposes. At December 31, 2014, the Company had forward contracts and collars outstanding to hedge 60% of its projected European eurodenominated net cash inflows, primarily from passenger ticket sales, through the end of 2015. The result of a uniform... -

Page 55

... PUBLIC TCCOUNTING FIRM The Board of Directors and Stockholders United Continental Holdings, Inc. We have audited the accompanying consolidated balance sheets of United Continental Holdings, Inc. (the "Company") as of December 31, 2014 and 2013, and the related statements of consolidated operations... -

Page 56

... PUBLIC TCCOUNTING FIRM The Board of Directors and Stockholder of United Airlines, Inc. We have audited the accompanying consolidated balance sheets of United Airlines, Inc. (the "Company") as of December 31, 2014 and 2013, and the related statements of consolidated operations, comprehensive... -

Page 57

..., except per share amounts) 2014 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other rent Aircraft maintenance materials and... -

Page 58

... millions) 2014 $ 1,132 (1,171) (510) (6) (1,687) (555) Year Ended December 31, 2013 $ 571 1,626 21 7 1,654 2,225 2012 (723) (730) 90 11 (629) (1,352) Net income (loss) Other comprehensive income (loss), net change related to: Employee benefit plans Fuel derivative financial instruments Investments... -

Page 59

..., except shares) TSSETS Current assets: Cash and cash equivalents Short-term investments Total unrestricted cash, cash equivalents and short-term investments Restricted cash Receivables, less allowance for doubtful accounts (2014-$22; 2013-$13) Fuel hedge collateral deposits Aircraft fuel, spare... -

Page 60

... shares) LITBILITIES TND STOCKHOLDERS' EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt Current maturities of capital leases Fuel derivative instruments Other Tt December 31, 2014 2013... -

Page 61

... fuel hedge collateral Unrealized (gain) loss on fuel derivatives and change in related pending settlements Increase in advance ticket sales Increase (decrease) in accounts payable (Increase) decrease in receivables Decrease in frequent flyer deferred revenue and advanced purchase of miles Increase... -

Page 62

... of stock options Other Balance at December 31, 2013 Net income Other comprehensive loss Convertible debt redemptions Repurchase of convertible debt Share-based compensation Proceeds from exercise of stock options Repurchases of common stock Other Balance at December 31, 2014 Treasury Stock $ (31... -

Page 63

...193 37,028 1,259 2014 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other rent Aircraft maintenance materials and outside repairs... -

Page 64

... millions) 2014 $ 1,114 (1,171) (510) (6) - (1,687) $ (573) Year Ended December 31, 2013 $ 654 1,626 21 8 6 1,661 $2,315 2012 $ (661) (730) 90 12 - (628) $(1,289) Net income (loss) Other comprehensive income (loss), net change related to: Employee benefit plans Fuel derivative financial instruments... -

Page 65

... shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments Total unrestricted cash, cash equivalents and short-term investments Restricted cash Receivables, less allowance for doubtful accounts (2014-$22; 2013-$13) Fuel hedge collateral deposits Aircraft fuel... -

Page 66

...TND STOCKHOLDER'S EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt Current maturities of capital leases Fuel derivative instruments Payables to related parties Other 2014 $ 3,701 2,058... -

Page 67

... fuel hedge collateral Unrealized (gain) loss on fuel derivatives and change in related pending settlements Increase in advance ticket sales Increase (decrease) in accounts payable (Increase) decrease in receivables Decrease in frequent flyer deferred revenue and advanced purchase of miles Increase... -

Page 68

... of related party receivables to equity Balance at December 31, 2013 Net income Other comprehensive loss Convertible debt redemption Dividend and other capital distributions to UAL Share-based compensation UAL contribution related to stock plans Other Balance at December 31, 2014 Common Stock... -

Page 69

... the surviving corporation. Continental's name was subsequently changed to United Airlines, Inc. As UAL consolidates United for financial statement purposes, disclosures that relate to activities of United also apply to UAL, unless otherwise noted. United's operating revenues and operating expenses... -

Page 70

... sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and non-travel awards. The Company... -

Page 71

... marketing-related deliverable services component of the sale. (b) This amount represents the increase to frequent flyer deferred revenue during the period. (c) This amount represents the net increase (decrease) in the advance purchase of miles obligation due to cash payments for the sale of miles... -

Page 72

...-term or long-term in the consolidated balance sheets based on the expected timing of return of the assets to the Company. Airline industry practice includes classification of restricted cash flows as either investing cash flows or operating cash flows. Cash flows related to restricted cash activity... -

Page 73

...-line basis over the related lease term. Regional Capacity Purchase-Payments made to regional carriers under CPAs are reported in Regional capacity purchase in our consolidated statements of operations. As of December 31, 2014, United had 281 call options to purchase regional jet aircraft being... -

Page 74

..., maintenance services and frequent flyer award non-air redemptions, and third-party business revenue is recorded in Other operating revenue. The Company also incurs third-party business expenses, such as maintenance, ground handling and catering services for third parties, fuel sales and non-air... -

Page 75

...this report for additional information related to impairment of intangible assets. NOTE 3 - COMMON STOCKHOLDERS' EQUITY TND PREFERRED SECURITIES During 2014, United used $62 million of cash to purchase and retire $28 million aggregate principal amount of United's 4.5% Convertible Notes due 2015 (the... -

Page 76

... additional information related to exercises of rights under the 4.5% Notes. On July 24, 2014, UAL announced a $1 billion share repurchase program, which was authorized by UAL's Board of Directors. UAL may repurchase shares through the open market, privately negotiated transactions, block trades, or... -

Page 77

...report for additional information related to the ASR Program, open market share repurchases, open market purchases of the Company's convertible debt and exchange of shares for redemption of convertible debt. NOTE 5 - SHTRE-BTSED COMPENSTTION PLTNS UAL maintains several share-based compensation plans... -

Page 78

...the closing stock price on the grant date). The Company accounts for the RSUs as liability awards. The following table provides information related to UAL's share-based compensation plan cost for the years ended December 31 (in millions): 2014 Compensation cost: (a) RSUs Restricted stock Other Total... -

Page 79

... RSUs and restricted stock vested in 2014, 2013 and 2012 was $97 million, $22 million and $27 million, respectively. The fair value of the restricted stock awards was primarily based upon the UAL common stock price on the date of grant. These awards are accounted for as equity awards. The fair value... -

Page 80

... TOCI to Income Year Ended December 31, 2014 2013 2012 Tffected Line Item in the Statement Where Net Income is Presented Derivatives designated as cash flow hedges Fuel contracts-reclassifications of (gains) losses into earnings (c) Amortization of pension and post-retirement items Amortization of... -

Page 81

... periodic pension and other postretirement costs (see Note 8 of this report for additional information). NOTE 7 - INCOME TTXES The significant components of the income tax expense (benefit) are as follows (in millions): 2014 Current Deferred UTL $(17) 13 $ (4) United $ (17) 13 $ (4) 2013 Current... -

Page 82

... - 234 (5) $ (1) 2012 $(230) (7) 7 12 19 (15) - 223 (5) $ 4 United Income tax provision at statutory rate State income taxes, net of federal income tax Foreign income taxes Nondeductible employee meals Nondeductible interest expense Derivative market adjustment State rate change Valuation allowance... -

Page 83

... compute, record and pay UAL for their own tax liability as if they were separate companies filing separate returns. In determining their own tax liabilities, United and each of its subsidiaries take into account all tax credits or benefits generated and utilized as separate companies and they are... -

Page 84

... tax benefits relating from a lapse of the statute of limitations Balance at December 31, 2014 $ 14 (5) - - $ 9 2013 $ 19 - - (5) $ 14 2012 $ 24 (12) 8 (1) $ 19 The Company's federal income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service ("IRS... -

Page 85

... and plan assets, the funded status and the amounts recognized in these financial statements for the defined benefit and other postretirement plans (in millions): Pension Benefits Year Ended Year Ended December 31, 2014 December 31, 2013 $ 4,068 $ 3,383 Accumulated benefit obligation: Change in... -

Page 86

... 31, 2014 December 31, 2013 Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost Plan participants' contributions Actuarial (gain) loss Federal subsidy Plan amendments Curtailments Gross benefits paid Benefit obligation at end of year Change in plan assets... -

Page 87

... assumptions used for the benefit plans were as follows: Tssumptions used to determine benefit obligations Discount rate Rate of compensation increase Tssumptions used to determine net expense Discount rate Expected return on plan assets Rate of compensation increase 87 Pension Benefits 2014 2013... -

Page 88

... plans. A 1% change in the assumed health care trend rate for the Company would have the following additional effects (in millions): Effect on total service and interest cost for the year ended December 31, 2014 Effect on postretirement benefit obligation at December 31, 2014 1% Increase... -

Page 89

... tables present information about United's pension and other postretirement plan assets at December 31 (in millions): 2014 Pension Plan Assets: Equity securities funds Fixed-income securities Alternatives Insurance contract Other investments Total Other Postretirement Benefit Plan Assets: Deposit... -

Page 90

...return on plan assets: Sold during the year Held at year end Purchases, sales, issuances and settlements (net) Balance at end of year 2014 $ 293 7 6 6 $ 312 2013 $ 256 15 7 15 $ 293 Funding requirements for tax-qualified defined benefit pension plans are determined by government regulations. United... -

Page 91

... Plan reported $368 million in employers' contributions for the year ended December 31, 2013. For 2013, the Company's contributions to the IAM Plan represented more than 5% of total contributions to the IAM Plan. Pension Fund EIN/ Pension Plan Number Pension Protection Act Zone Status (2014 and 2013... -

Page 92

...'s financial statements as of December 31 (in millions): Total Cash and cash equivalents Short-term investments: Asset-backed securities Corporate debt Certificates of deposit placed through an account registry service ("CDARS") U.S. government and agency notes Auction rate securities Other fixed... -

Page 93

...Liability UTL and United Student Loan-Related Tuction Rate Securities 2013 United Convertible Convertible Debt Debt Supplemental Conversion Derivative Option Tsset Liability EETC EETC Balance at January 1 Purchases, (sales), issuances and settlements (net) Gains and (losses): Reported in earnings... -

Page 94

... by the Company. Valuations using option pricing models are generally provided to the Company by third-party valuation experts. Each reporting period, the Company reviews the unobservable inputs used by third-party valuation experts for reasonableness utilizing relevant information available to the... -

Page 95

...) for 2015 and 2016, respectively, with commonly used financial hedge instruments based on aircraft fuel or crude oil. As of December 31, 2014, the Company had fuel hedges expiring through March 2016. The Company does not enter into derivative instruments for non-risk management purposes. As... -

Page 96

... for hedge accounting, the purpose of these economic hedges is to mitigate the adverse financial impact of potential increases in the price of fuel. Currently, the only such economic hedges in the Company's hedging portfolio are three-way collars (a collar with a higher strike sold call option... -

Page 97

...when the price of the underlying commodity increases. The Company posted $577 million of collateral with fuel derivative counterparties as of December 31, 2014. The collateral is recorded as Fuel hedge collateral deposits on the Company's balance sheet. The Company did not post or hold collateral as... -

Page 98

... classification in the financial statements (in millions): Derivatives designated as cash flow hedges Tmount of Gain (Loss) Recognized in TOCI on Derivatives (Effective Portion) 2014 2013 Gain (Loss) Reclassified from TOCI into Income (Fuel Expense) (Effective Portion) 2014 2013 Tmount of Gain... -

Page 99

...) United: Secured Notes payable, fixed interest rates of 1.42% to 12.00% (weighted average rate of 5.86% as of December 31, 2014), payable through 2026 Notes payable, floating interest rates of the London Interbank Offered Rate ("LIBOR") plus 0.20% to 5.46%, payable through 2026 Term loan, LIBOR... -

Page 100

...December 31, 2014, UAL and United were in compliance with their respective debt covenants. Continued compliance depends on many factors, some of which are beyond the Company's control, including the overall industry revenue environment and the level of fuel costs. United secured debt 2013 Credit and... -

Page 101

... and recorded by United on its balance sheet as debt. The indenture for the 6% Senior Notes requires UAL to offer to repurchase the notes for cash if certain changes of control of UAL occur at a purchase price equal to 101% of the aggregate principal amount of notes repurchased plus accrued and... -

Page 102

... UAL carrying value on those dates. In addition, UAL's contractual commitment to provide common stock to satisfy United's obligation upon conversion of the debt is an embedded call option on UAL common stock that was also required to be separated and accounted for as though it were a free... -

Page 103

... of Miles. United has the right, but is not required, to repurchase the pre-purchased miles from Chase during the term of the agreement. The balance of pre-purchased miles is eligible to be allocated by Chase to MileagePlus members' accounts by a maximum of $224 million in 2015, $249 million in 2016... -

Page 104

...aircraft, airport passenger terminal space, aircraft hangars and related maintenance facilities, cargo terminals, other airport facilities, other commercial real estate, office and computer equipment and vehicles. At December 31, 2014, United's scheduled future minimum lease payments under operating... -

Page 105

... 31, 2014, 2013 and 2012, respectively. In connection with UAL Corporation's and United Air Lines, Inc.'s fresh-start reporting requirements upon their exit from Chapter 11 bankruptcy protection in 2006 and the Company's acquisition accounting adjustments related to the Company's merger transaction... -

Page 106

... brand. As of December 31, 2014, SkyWest is operating 19 of these aircraft and expects to bring into service the remaining 21 aircraft in 2015. In April 2013, United agreed to purchase 30 Embraer E175 aircraft. In August 2013, United entered into a CPA with Mesa Air Group, Inc. and Mesa Airlines... -

Page 107

... in increases in the value of the aircraft. This is the case for many of our operating leases; however, leases of approximately 60 mainline jet aircraft contain a fixed-price purchase option that allow United to purchase the aircraft at predetermined prices on specified dates during the lease term... -

Page 108

... revenue bonds and interest thereon. These bonds, issued by various airport municipalities, are payable solely from rentals paid under long-term agreements with the respective governing bodies. The leasing arrangements associated with $1.5 billion of these obligations are accounted for as operating... -

Page 109

...'s employees were represented by various U.S. labor organizations as of December 31, 2014. During 2014, United's maintenance instructor, load planner, fleet technical instructor, security officer and dispatcher work groups ratified new joint labor agreements. We are in the process of negotiating... -

Page 110

... capitalized) Income taxes Non-cash transactions: Net property and equipment acquired through issuance of debt Airport construction financing Exchanges of certain 4.5% Notes and 6% Convertible Senior Notes for common stock Transfer of UAL subsidiaries to United 2013 Cash paid (refunded) during the... -

Page 111

...: Loss on extinguishment of debt and other, net Income tax benefit Total operating and nonoperating special charges, net of income taxes 2014 The Company recorded $141 million of severance and benefit costs related primarily to a voluntary early-out program for its flight attendants. More than 2,500... -

Page 112

... of the related non-cash debt discounts recorded due to purchase accounting during the Company's merger transaction in 2010. 2013 The Company offered a voluntary retirement program for its fleet service, passenger service, storekeeper and pilot work groups. Approximately 1,200 employees volunteered... -

Page 113

... planned to be used for significantly shorter periods, as well as relocation for employees and severance primarily associated with administrative headcount reductions. On December 31, 2012, UAL and United Air Lines, Inc. entered into an agreement with the Pension Benefit Guaranty Corporation... -

Page 114

..., the Company's chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics. The Company's chief operating decision maker makes resource allocation decisions to maximize the Company's consolidated financial results. Managing the Company as... -

Page 115

... DTTT (UNTUDITED) UTL (In millions, except per share amounts) 2014 Operating revenue Income (loss) from operations Net income (loss) Basic earnings (loss) per share Diluted earnings (loss) per share 2013 Operating revenue Income (loss) from operations Net income (loss) Basic earnings (loss) per... -

Page 116

... charges Nonoperating: Loss on extinguishment of debt and other, net Income tax benefit Total operating and nonoperating special charges, net of income taxes 2013 Special charges (income): Severance and benefit costs Integration-related costs Labor agreement costs Impairment of assets (Gains) losses... -

Page 117

...The management of UAL and United, including the Chief Executive Officer and Chief Financial Officer, performed an evaluation to conclude with reasonable assurance that UAL's and United's disclosure controls and procedures were designed and operating effectively to report the information each company... -

Page 118

... Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2014 of the Company and our report dated February 20, 2015 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP Chicago, Illinois February 20, 2015... -

Page 119

... of United Continental Holdings, Inc. Chicago, Illinois The management of United Continental Holdings, Inc. ("UAL") is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f). Our internal control over... -

Page 120

... to September 2010, Mr. Bonds served as Senior Vice President Human Resources and Labor Relations of Continental. Mr. Bonds joined Continental in 1995. James E. Compton. Age 59. Mr. Compton has been Vice Chairman and Chief Revenue Officer of UAL and United since December 2012. From October 2010 to... -

Page 121

...and Controller of Continental. Mr. Kenny joined Continental in 1997. John D. Rainey. Age 44. Mr. Rainey has been Executive Vice President and Chief Financial Officer of UAL and United since April 2012. From October 2010 to April 2012, Mr. Rainey served as Senior Vice President Financial Planning and... -

Page 122

... of services and fees incurred year-to-date and a list of newly pre-approved services since its last regularly scheduled meeting. The Audit Committee has considered whether the 2014 and 2013 non-audit services provided by Ernst & Young LLP, the Company's independent registered public accounting firm... -

Page 123

...reviews, and accounting and financial reporting consultations and research work necessary to comply with generally accepted auditing standards. AUDIT RELATED FEES In 2014, fees for audit related services consisted of an assessment of certain information technology security related controls. TAX FEES... -

Page 124

... undersigned, thereunto duly authorized. UNITED CONTINENTAL HOLDINGS, INC. UNITED AIRLINES, INC. (Registrants) By: /s/ John D. Rainey John D. Rainey Executive Vice President and Chief Financial Officer Date: February 20, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this... -

Page 125

... Vice President and Chief Financial Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Director /s/ Chris Kenny Chris Kenny /s/ James E. Compton James E. Compton /s/ Gregory L. Hart Gregory L. Hart Date: February 20, 2015 Director 125 -

Page 126

Table of Contents Schedule II Valuation and Qualifying Tccounts For the Years Ended December 31, 2014, 2013 and 2012 (In millions) Description Tllowance for doubtful accounts - UTL and United: 2014 2013 2012 Obsolescence allowance-spare parts - UTL and United: 2014 2013 2012 Valuation allowance for... -

Page 127

... filed May 4, 2010, Commission file number 1-6033, and incorporated herein by reference) Agreement and Plan of Merger, dated as of March 28, 2013, by and between Continental Airlines, Inc. and United Air Lines, Inc. (filed as Exhibit 2.1 to UAL's Form 8-K filed April 3, 2013, Commission file number... -

Page 128

..., dated as of May 7, 2013, among United Continental Holdings, Inc., United Airlines, Inc. and The Bank of New York Mellon Trust Company, N.A., as Trustee, providing for the issuance of 6.375% Senior Notes due 2018 (filed as Exhibit 4.2 to UAL's Form 8-K filed on May 10, 2013, Commission file number... -

Page 129

..., 2009, Commission file number 1-10323, and incorporated herein by reference) Description of Benefits for Officers of United Continental Holdings, Inc., United Air Lines, Inc., and Continental Airlines, Inc. (filed as Exhibit 10.24 to UAL's Form 10-K for the year ended December 31, 2011, Commission... -

Page 130

... 31, 2012, Commission file number 1-6033, and incorporated herein by reference) United Continental Holdings, Inc. Incentive Plan 2010, as amended and restated February 17, 2011 (previously named the Continental Airlines, Inc. Incentive Plan 2010) (filed as Annex B to UAL's Definitive Proxy Statement... -

Page 131

... Share Unit Award Notice pursuant to the United Continental Holdings, Inc. 2006 Director Equity Incentive Plan (filed as Exhibit 10.9 to UAL's Form 10-Q for the quarter ended June 30, 2014, Commission file number 1-6033, and incorporated herein by reference) (for awards granted on or after June 2011... -

Page 132

... 10.2(a) to Continental's Form 10-K for the year ended December 31, 2009, Commission file number 1-10323, and incorporated herein by reference) United Air Lines, Inc. Management Cash Direct & Cash Match Program (amended and restated effective January 1, 2014) (filed as Exhibit 10.64 to UAL's Form 10... -

Page 133

... United UAL United UAL United UAL United UAL United Letter Agreement No. 3 to the Airbus A350-900XWB Purchase Agreement, dated March 5, 2010, by and among Airbus S.A.S and United Air Lines. Inc. (filed as Exhibit 10.30 to UAL's Form 10-Q for the quarter ended March 31, 2010, Commission file number... -

Page 134

...United UAL United UAL United UAL United UAL United UAL United Amendment No. 1 to the Airbus A350-900XWB Purchase Agreement, dated June 25, 2010, by and among Airbus S.A.S and United Air Lines, Inc. (filed as Exhibit 10.6 to UAL's Form 10-Q for the quarter ended June 30, 2010, Commission file number... -

Page 135

... United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 2 to Purchase Agreement No. 1951, dated March 5, 1997 (filed as Exhibit 10.3 to Continental's Form 10-Q for the quarter ended March 31, 1997, Commission file number... -

Page 136

... UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 13 to Purchase Agreement No. 1951, dated October 13, 1999 (filed as Exhibit 10.25(n) to Continental's Form 10-K for the year ended December 31, 1999, Commission file number... -

Page 137

... United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 24, including side letters, to Purchase Agreement No. 1951, dated August 31, 2001 (filed as Exhibit 10.11 to Continental's Form 10-Q for the quarter ended September 30, 2001, Commission file number... -

Page 138

... United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 35 to Purchase Agreement No. 1951, dated June 30, 2005 (filed as Exhibit 10.4 to Continental's Form 10-Q for the quarter ended June 30, 2005, Commission file number... -

Page 139

...UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 47 to Purchase Agreement No. 1951, dated October 30, 2008 (filed as Exhibit 10.21(av) to Continental's Form 10-K for the year ended December 31, 2008, Commission file number... -

Page 140

... 30, 2013, Commission file number 1-6033, and incorporated herein by reference) Aircraft General Terms Agreement, dated October 10, 1997, by and among Continental and Boeing (filed as Exhibit 10.15 to Continental's Form 10-K for the year ended December 31, 1997, Commission File Number 1-10323... -

Page 141

...Exhibit 10.1 to Continental's Form 10-Q for the quarter ended June 30, 2003, Commission file number 1-10323, and incorporated herein by reference) Purchase Agreement No. PA-03784, dated July 12, 2012, between The Boeing Company and United Air Lines, Inc. (filed as Exhibit 10.1 to UAL's Form 10-Q for... -

Page 142

..., 2012, among Boeing, United Continental Holdings, Inc., United Air Lines, Inc., and Continental Airlines, Inc. (filed as Exhibit 10.4 to UAL's Form 10-Q for the quarter ended September 30, 2012, Commission file number 1-6033, and incorporated herein by reference) Purchase Agreement No. 3860, dated... -

Page 143

...and Subsidiary Companies Computation of Ratio of Earnings to Fixed Charges List of Subsidiaries 21 UAL United List of United Continental Holdings, Inc. and United Airlines, Inc. Subsidiaries Consents of Experts and Counsel 23.1 23.2 UAL United Consent of Independent Registered Public Accounting Firm... -

Page 144

Table of Contents * †^ Previously filed. Indicates management contract or compensatory plan or arrangement. Pursuant to Item 601(b)(10), United and Continental are permitted to omit certain compensation-related exhibits from this report and therefore only UAL is identified as the registrant for ... -

Page 145

... HOLDINGS, INC. PROFIT SHARING PLAN (2014) WHEREAS, United Continental Holdings, Inc. (the "Company") sponsors the United Continental Holdings, Inc. Profit Sharing Plan (the "Plan"); WHEREAS, Section III of the Plan sets forth the profit sharing calculation for certain employee groups of the Company... -

Page 146

... Representatives Storekeeper Employees Maintenance Instructors Emergency Procedure Instructors Fleet Technical Instructors Security Officers Individual sCO or sUA Collective Bargaining Agreements Central Load Planners Flight Attendants Food Service Personnel Simulator Technicians Technicians Non... -

Page 147

IN WITNESS WHEREOF, the Company has caused this amendment to be executed on its behalf this 5th day of February, 2015. UNITED CONTINENTAL HOLDINGS, INC. /s/ Michael P. Bonds Michael P. Bonds Executive cice President, Human Resources and Labor Relations 3 -

Page 148

... in the United Club (or any successor program). Frequent Flyer Status. Each non-employee director and the non-employee director's spouse or qualified domestic partner receives 1K Global Services Status. Lifetime Benefits. A non-employee director who (i) served as a member of the Board on October... -

Page 149

...gross-up protection from the Company. Charitable Tickets. Each non-employee director receives up to 10 round-trip tickets annually to donate to qualified charities. Charitable Contribution Matching Program. The Company will provide matching cash payments to nonprofit organizations to which an active... -

Page 150

... earnings to fixed charges (a) Amortization of debt discounts includes amortization of fresh-start valuation discounts. (b) Imputed interest applied to rent expense. (c) Earnings were inadequate to cover fixed charges by $:56 million in 2012. 2014 $1,128 1,648 12 1 (52) (1) $2,:36 2013 $ 539 1,629... -

Page 151

... earnings to fixed charges (a) Amortization of debt discounts includes amortization of fresh-start valuation discounts. (b) Imputed interest applied to rent expense. (c) Earnings were inadequate to cover fixed charges by $689 million in 2012. 2014 $1,110 1,655 12 1 (52) (1) $2,725 2013 $ 637 1,627... -

Page 152

... Airlines Purchasing Services LLC** • Continental Express, Inc. • Covia LLC** • Mileage Plus Holuings, LLC • MPH I, Inc. • Mileage Plus Marketing, Inc. • Mileage Plus, Inc. • Presiuents Club of Guam, Inc. • Uniteu Aviation Fuels Corporation • Uniteu Vacations, Inc. • UAL Benefits... -

Page 153

...-131434), of our reports dated February 20, 2015, with respect to the consolidated financial statements and schedule of United Continental Holdings, Inc. and the effectiveness of internal control over financial reporting of United Continental Holdings, Inc., included in this Annual Report (Form 10... -

Page 154

... No. 333-181014) of our report dated February 20, 2015, with respect to the consolidated financial statements and schedule of United Airlines, Inc., included in this Annual Report (Form 10-K) of United Airlines, Inc. for the year ended December 31, 2014. /s/ Ernst & Young LLP Chicago, IL February 20... -

Page 155

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Jeffery A. Smisek Jeffery A. Smisek Chairman, President and Chief Executive Officer Date: February 20, 2015 -

Page 156

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ John D. Rainey John D. Rainey Executive Vice President and Chief Financial Officer Date: February 20, 2015 -

Page 157

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Jeffery A. Smisek Jeffery A. Smisek Chairman, President and Chief Executive Officer Date: February 20, 2015 -

Page 158

...of the Principal Financial Officer Pursuant to 15 U.S.C. 78m(a) or 78o(d) (Section 302 of the Sarbanes-Oxley Act of 2002) I, John D. Rainey, certify that: (1) (2) I have reviewed this annual report on Form 10-K for the period ended December 31, 2014 of United Airlines, Inc. (the "Company"); Based on... -

Page 159

... Exchange Act of 1934, as amended; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of United Continental Holdings, Inc. Date: February 20, 2015 /s/ Jeffery A. Smisek Jeffery A. Smisek Chairman, President... -

Page 160

... the Securities Exchange Act of 1934, as amended; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of United Airlines, Inc. Date: February 20, 2015 /s/ Jeffery A. Smisek Jeffery A. Smisek Chairman, President and... -

Page 161