US Airways 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

refinancing of the relevant aircraft. The trusts were also structured to provide for certain credit enhancements, such as liquidity facilities

to cover certain interest payments, that reduce the risks to the purchasers of the trust certificates and, as a result, reduce the cost of aircraft

financing to US Airways.

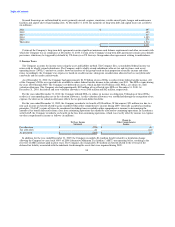

Each trust covered a set amount of aircraft scheduled to be delivered or refinanced within a specific period of time. At the time of each

covered aircraft financing, the relevant trust used the funds in escrow to purchase equipment notes relating to the financed aircraft. The

equipment notes were issued, at US Airways' election in connection with a mortgage financing of the aircraft or by a separate owner trust

in connection with a leveraged lease financing of the aircraft. In the case of a leveraged lease financing, the owner trust then leased the

aircraft to US Airways. In both cases, the equipment notes are secured by a security interest in the aircraft. The pass through trust

certificates are not direct obligations of, nor are they guaranteed by, the Company or US Airways. However, in the case of mortgage

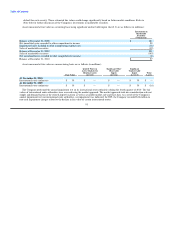

financings, the equipment notes issued to the trusts are direct obligations of US Airways. As of December 31, 2010, $809 million

associated with these mortgage financings is reflected as debt in the accompanying consolidated balance sheet.

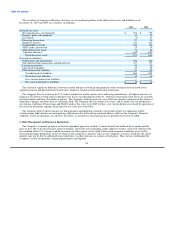

With respect to leveraged leases, US Airways evaluated whether the leases had characteristics of a variable interest entity. US Airways

concluded the leasing entities met the criteria for variable interest entities. US Airways generally is not the primary beneficiary of the

leasing entities if the lease terms are consistent with market terms at the inception of the lease and do not include a residual value

guarantee, fixed-price purchase option or similar feature that obligates US Airways to absorb decreases in value or entitles US Airways to

participate in increases in the value of the aircraft. US Airways does not provide residual value guarantees to the bondholders or equity

participants in the trusts. Each lease does have a fixed price purchase option that allows US Airways to purchase the aircraft near the end

of the lease term. However, the option price approximates an estimate of the aircraft's fair value at the option date. Under this feature, US

Airways does not participate in any increases in the value of the aircraft. US Airways concluded it was not the primary beneficiary under

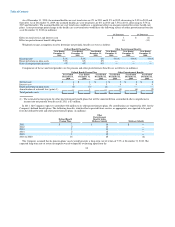

these arrangements. Therefore, US Airways accounts for its EETC leveraged lease financings as operating leases. US Airways' total

future obligations under these leveraged lease financings are $2.96 billion as of December 31, 2010, which are included in the future

minimum lease payments table in (b) above.

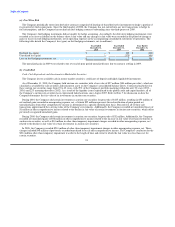

(d) Regional Jet Capacity Purchase Agreements

US Airways has entered into capacity purchase agreements with certain regional jet operators. The capacity purchase agreements

provide that all revenues, including passenger, mail and freight revenues, go to US Airways. In return, US Airways agrees to pay

predetermined fees to these airlines for operating an agreed-upon number of aircraft, without regard to the number of passengers on

board. In addition, these agreements provide that certain variable costs, such as airport landing fees and passenger liability insurance, will

be reimbursed 100% by US Airways. US Airways controls marketing, scheduling, ticketing, pricing and seat inventories. The regional jet

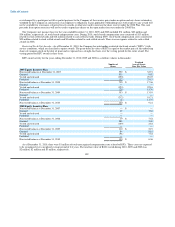

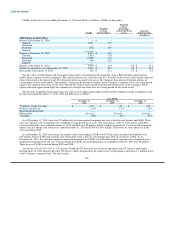

capacity purchase agreements have expirations from 2014 to 2020. The future minimum noncancellable commitments under the regional

jet capacity purchase agreements are $1 billion in 2011, $1.01 billion in 2012, $1.01 billion in 2013, $1.02 billion in 2014, $898 million

in 2015 and $1.38 billion thereafter.

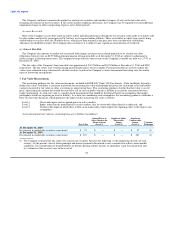

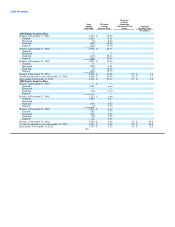

In January 2010, Mesa Air Group, Inc. and certain of its subsidiaries, including Mesa Airlines, Inc., filed voluntary petitions for relief

under Chapter 11 of the U.S. Bankruptcy Code. At December 31, 2010, Mesa operated 51 aircraft for the Company's Express passenger

operations, representing over $500 million in annual passenger revenues in 2010. In November 2010, the Company signed an agreement

for an extension of 39 months on average from the current scheduled expiration of June 30, 2012, for the operation of 38 CRJ900 aircraft

by Mesa under the companies' codeshare and revenue sharing agreement, which agreement was approved by the U.S. Bankruptcy Court.

The remaining 13 aircraft were not extended. On January 20, 2011, the U.S. Bankruptcy Court approved the bankruptcy plan of Mesa Air

Group, Inc., who is expected to emerge from bankruptcy on or about February 28, 2011.

(e) Legal Proceedings

On September 12, 2004, US Airways Group and its domestic subsidiaries (collectively, the "Reorganized Debtors") filed voluntary

petitions for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Virginia,

Alexandria Division (Case Nos. 04-13819-SSM through

98