US Airways 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

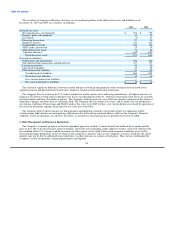

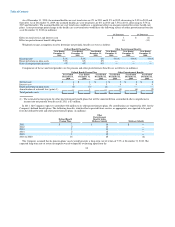

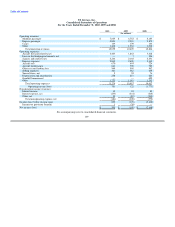

10. Other Comprehensive Income (Loss)

The Company's other comprehensive income (loss) consisted of the following (in millions):

Year Ended December 31,

2010 2009 2008

Net income (loss) $ 502 $ (205) $ (2,215)

Recognition of net realized gains on sale of available-for-sale securities (52) — —

Net unrealized gains (losses) on available-for-sale securities, net of tax expense of $21 million in 2009 (1) 35 —

Recognition of previous unrealized losses now deemed other-than-temporary — — 48

Pension and other postretirement benefits (23) (10) 7

Total comprehensive income (loss) $ 426 $ (180) $ (2,160)

The components of accumulated other comprehensive income were as follows (in millions):

December 31, December 31,

2010 2009

Pension and other postretirement benefits $ 32 $ 55

Available-for-sale securities (18) 35

Accumulated other comprehensive income $ 14 $ 90

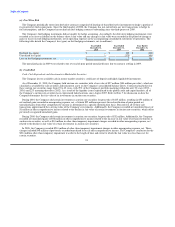

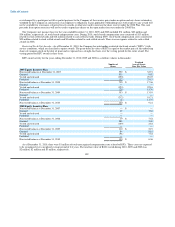

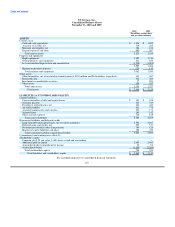

11. Supplemental Cash Flow Information

Supplemental disclosure of cash flow information and non-cash investing and financing activities are as follows (in millions):

Year Ended December 31,

2010 2009 2008

Non-cash transactions:

Note payables issued for aircraft purchases $ 118 $ 333 $ —

Interest payable converted to debt 40 40 7

Net unrealized loss (gain) on available-for-sale securities 1 (58) —

Prepayment applied to equipment purchase deposits (38) — —

Deposit applied to principal repayment on debt (31) — —

Debt extinguished from sale of aircraft — (251) —

Maintenance payable converted to debt — 8 33

Cash transactions:

Interest paid, net of amounts capitalized 225 195 216

Income taxes paid 1 — 1

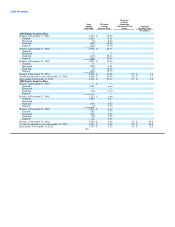

12. Related Party Transactions

Richard A. Bartlett, a member of the Company's board of directors until June 2008, is a greater than 10% owner of Air Wisconsin. US

Airways and Air Wisconsin have a regional jet services agreement. Mr. Bartlett became a member of the board of directors pursuant to

certain stockholder agreements, which by their terms expired in June 2008.

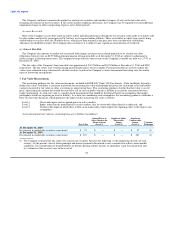

13. Operating Segments and Related Disclosures

The Company is managed as a single business unit that provides air transportation for passengers and cargo. This allows it to benefit

from an integrated revenue pricing and route network that includes US Airways, Piedmont, PSA and third-party carriers that fly under

capacity purchase or prorate agreements as part of the Company's Express operations. The flight equipment of all these carriers is

combined to form one fleet that is deployed through a single route scheduling system. When making resource allocation decisions, the

chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no weight

to the financial

100